S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Jan, 2021

By Chris Rogers

President Joe Biden has published an eagerly-awaited "Buy American" Executive Order that starts to set the framework for support for the development of critical U.S. supply chains. From a practical point of view, 97% of U.S. federal contracts already go to U.S. companies, according to the U.S. Chamber of Commerce, with these regulations set to tighten tier-2 supplier rules of origin.

Details will only emerge following the creation of a "Made in America" office in the Office of Management and Budget and with the appointment of a director responsible for implementing the revised policy.

One limitation to delivering a meaningful change to a breadth of industries will be limited by many critical supply chains resting largely in private sector hands. Additionally, there is also the risk of challenges to the new policies under the World Trade Organization's Government Procurement Agreement as well as under United States-Mexico-Canada Agreement, both of which could delay implementation or raise planning uncertainties.

As outlined in Panjiva's research of Jan. 24, there will be tests of the Biden administration's attitudes towards both the WTO in relation to steel and toward USMCA as a result of the Executive Order. On the latter, Canada has already expressed concerns according to Reuters.

No specific targets or product list is provided in terms of domestic content. Instead the Federal Acquisition Regulatory Council will carry out a 180-day process to set new rules.

There is, however, specific reference to steel and in particular "dumped steel, iron, or manufactured goods or the use of injuriously subsidized steel, iron, or manufactured goods." That indicates a preoccupation with infrastructure investments ranging from railways and roads to energy networks and wind turbines.

Panjiva's data shows that U.S. imports of construction rebar, structural steel products, pipes and rail tracks have dropped 29.9% year over year in the 12 months to Nov. 30, 2020. That is likely to be the result of a mixture of the impact of reduced demand during the pandemic as well as the impact of tariffs applied by the Trump administration.

Imports from Canada and Mexico have done better than average with a decline of 6.2% in part reflecting the earlier exemption from section 232 duties applied as part of the USMCA deal negotiations. Shipments from Europe (EU, European Free Trade Association and U.K.) meanwhile declined by just 19.6% and remained the second-largest source of materials after Canada and Mexico.

Imports from Asia have fallen more quickly, with shipments from China down by 37.2% year over year and by 51.7% compared to 2016 as they have also generally faced section 301 duties, too.

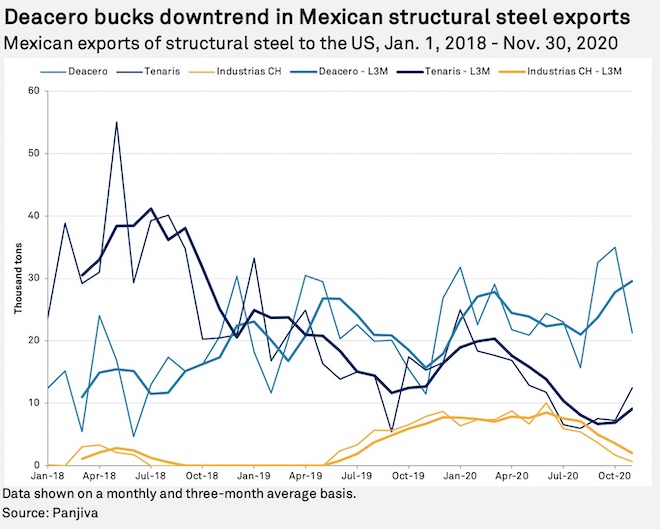

Exporters of infrastructure-type steels to the U.S. may see their access reduced further as a result of the stricter Buy American rules while importers will inevitably face higher costs. Assuming a carve out for Mexico and Canada is not achieved, the largest exporters from Mexico to the U.S. of the structural steels mentioned include Tenaris SA, Deacero SA de CV and Industrias CH S. A. B. de C. V..

Shipments linked to Tenaris, led by shipments of oil/gas pipes, dropped by 28.4% year over year in the three months to Nov. 30, 2020, likely reflecting the broader downturn in the oil and gas industry.

Deacero, meanwhile, which ships a broad range of rebar and other construction steel materials, has experienced a surge in shipments of 88.6% year over year.

By contrast Industrias CH, which also focuses on construction steel, has seen a slide of 70.1% after peaking over the summer. That may reflect a focus on specific projects or asset types.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.