Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Mar, 2022

| President Joe Biden (right), seen here delivering a speech next to Vice President Kamala Harris on May 13, released his highly anticipated executive order providing guidance for future regulation of digital assets on March 9. |

Federal regulators will likely see President Biden's executive order on digital assets as more of a symbolic gesture than a call to action, policy analysts said.

"The banking agencies have been working on crypto for a long time," said Ian Katz, managing director at bank consultancy firm Capital Alpha Partners LLP. "While the order has some message-giving importance, this probably doesn't change the workflow in any significant way. Everyone knows this has been happening."

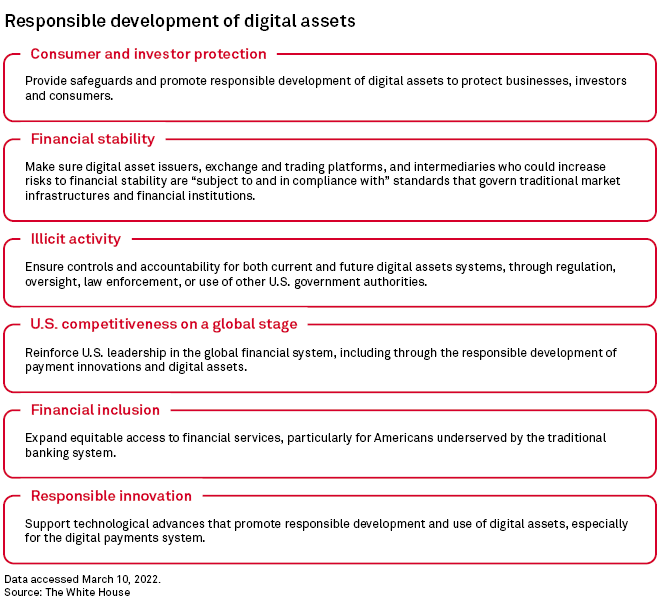

Biden issued the executive order, on "ensuring responsible development of digital assets," March 9. The order calls for a collaborative effort across regulatory agencies, with the Treasury Department leading the way. A major focus of the order calls on agencies to protect U.S. consumers, investors, and businesses, while ensuring U.S. and global fiscal stability.

Digital asset issues are increasingly significant as the cryptocurrency market is seeing explosive growth. The total market value of all crypto-assets surpassed $2 trillion as of September 2021 — a tenfold increase since early 2020, according to the International Monetary Fund.

The executive order mainly calls for reports by federal banking agencies and other regulators on the implications of the development and adoption of digital assets, and changes in financial market and payment system infrastructures.

But many agencies have already started work on these issues. For example, the Federal Reserve, Federal Deposit Insurance Corp., and the Office of the Comptroller of the Currency announced in November 2021 a joint "policy sprint" on crypto-assets that focused on developing a commonly understood vocabulary regarding the use of crypto-assets by banking organizations; identifying and assessing key risks; analyzing the applicability of existing regulations and guidance; and identifying areas that may need additional clarification.

Also in November 2021, the OCC, the President's Working Group on Financial Markets, and the FDIC issued a stablecoin report urging Congress to pass legislation that addresses risks to crypto users and guards against runs.

Additionally, the Fed released a discussion paper in January looking into the benefits and risks of a central bank digital currency, or CBDC. The Fed analysis suggested that the best version of a CBDC would be privacy-protected, intermediated, widely transferable and identity-verified.

During a press briefing on the executive order, senior administration officials acknowledged that work on the issue is ongoing, but they said the order helps unite those efforts.

"There's been work done by Treasury, there's been work done by financial regulators, but really pulling together the questions around consumer and investor protection, financial stability, and systemic and disparate risk … bringing that together and then, with a common approach, laying out a coordinated path is really the game changer here," one of the officials said.

Issues with the EO

The sweeping breadth of the order could place a burden on the work already underway, according to Daniel Stipano, a partner at law firm Davis Polk and a former top attorney at the OCC.

"There's only so much you can do at once," he said.

And the sheer number of agencies involved, with their varying missions and agendas, along with potential changes in Congress and at the White House, ensure that "the impact of all of this seems pretty far off and pretty uncertain," Stipano said.

The executive order dedicates a section to the research and development of a CBDC, the contents of which the American Bankers Association found distressing.

"We are concerned that [the order] clearly directs federal agencies to begin pursuing a central bank digital currency even before determining if a U.S. CBDC is actually ‘in the national interest' as the order also requires," the ABA said in a statement. "We believe the Federal Reserve's ongoing CBDC review is the right venue for this discussion."

Crypto industry, market watchdog approved

From the perspective of the cryptocurrency industry, the administrative action brings digital assets to the forefront in a way that could benefit its efforts to establish digital assets as a fundamental element of the financial industry.

"The White House's directive to coordinate oversight is further proof that the crypto ecosystem is now a vital and inseparable part of the [U.S.] economy," according to a statement from the Blockchain Association.

And Better Markets, which advocates on behalf of consumer protection and financial stability, said Biden's executive order was needed to help ensure the safety and soundness of the industry.

Digital assets "must be carefully weighed and balanced against consumer protection and financial stability concerns," according to President and CEO Dennis Kelleher. "That's what President Biden's executive order … promises and why we welcome it."

Ultimately, the symbolic nature of the missive should not be overlooked, as it provides "the highest kind of recognition you can get," according to Carleton Goss, counsel at Hunton Andrews Kurth LLP and a former attorney with the OCC.

"The president is saying digital assets are important, that's validation at the highest level," he said.

11 Mar, 2022

| President Joe Biden (right), seen here delivering a speech next to Vice President Kamala Harris on May 13, released his highly anticipated executive order providing guidance for future regulation of digital assets on March 9. |

Federal regulators will likely see President Biden's executive order on digital assets as more of a symbolic gesture than a call to action, policy analysts said.

"The banking agencies have been working on crypto for a long time," said Ian Katz, managing director at bank consultancy firm Capital Alpha Partners LLP. "While the order has some message-giving importance, this probably doesn't change the workflow in any significant way. Everyone knows this has been happening."

Biden issued the executive order, on "ensuring responsible development of digital assets," March 9. The order calls for a collaborative effort across regulatory agencies, with the Treasury Department leading the way. A major focus of the order calls on agencies to protect U.S. consumers, investors, and businesses, while ensuring U.S. and global fiscal stability.

Digital asset issues are increasingly significant as the cryptocurrency market is seeing explosive growth. The total market value of all crypto-assets surpassed $2 trillion as of September 2021 — a tenfold increase since early 2020, according to the International Monetary Fund.

The executive order mainly calls for reports by federal banking agencies and other regulators on the implications of the development and adoption of digital assets, and changes in financial market and payment system infrastructures.

But many agencies have already started work on these issues. For example, the Federal Reserve, Federal Deposit Insurance Corp., and the Office of the Comptroller of the Currency announced in November 2021 a joint "policy sprint" on crypto-assets that focused on developing a commonly understood vocabulary regarding the use of crypto-assets by banking organizations; identifying and assessing key risks; analyzing the applicability of existing regulations and guidance; and identifying areas that may need additional clarification.

Also in November 2021, the OCC, the President's Working Group on Financial Markets, and the FDIC issued a stablecoin report urging Congress to pass legislation that addresses risks to crypto users and guards against runs.

Additionally, the Fed released a discussion paper in January looking into the benefits and risks of a central bank digital currency, or CBDC. The Fed analysis suggested that the best version of a CBDC would be privacy-protected, intermediated, widely transferable and identity-verified.

During a press briefing on the executive order, senior administration officials acknowledged that work on the issue is ongoing, but they said the order helps unite those efforts.

"There's been work done by Treasury, there's been work done by financial regulators, but really pulling together the questions around consumer and investor protection, financial stability, and systemic and disparate risk … bringing that together and then, with a common approach, laying out a coordinated path is really the game changer here," one of the officials said.

Issues with the EO

The sweeping breadth of the order could place a burden on the work already underway, according to Daniel Stipano, a partner at law firm Davis Polk and a former top attorney at the OCC.

"There's only so much you can do at once," he said.

And the sheer number of agencies involved, with their varying missions and agendas, along with potential changes in Congress and at the White House, ensure that "the impact of all of this seems pretty far off and pretty uncertain," Stipano said.

The executive order dedicates a section to the research and development of a CBDC, the contents of which the American Bankers Association found distressing.

"We are concerned that [the order] clearly directs federal agencies to begin pursuing a central bank digital currency even before determining if a U.S. CBDC is actually ‘in the national interest' as the order also requires," the ABA said in a statement. "We believe the Federal Reserve's ongoing CBDC review is the right venue for this discussion."

Crypto industry, market watchdog approved

From the perspective of the cryptocurrency industry, the administrative action brings digital assets to the forefront in a way that could benefit its efforts to establish digital assets as a fundamental element of the financial industry.

"The White House's directive to coordinate oversight is further proof that the crypto ecosystem is now a vital and inseparable part of the [U.S.] economy," according to a statement from the Blockchain Association.

And Better Markets, which advocates on behalf of consumer protection and financial stability, said Biden's executive order was needed to help ensure the safety and soundness of the industry.

Digital assets "must be carefully weighed and balanced against consumer protection and financial stability concerns," according to President and CEO Dennis Kelleher. "That's what President Biden's executive order … promises and why we welcome it."

Ultimately, the symbolic nature of the missive should not be overlooked, as it provides "the highest kind of recognition you can get," according to Carleton Goss, counsel at Hunton Andrews Kurth LLP and a former attorney with the OCC.

"The president is saying digital assets are important, that's validation at the highest level," he said.