S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jun, 2021

| Corporate efforts to use carbon-free power around the clock are spurring changes in the way electricity is sold, which some say could ultimately transform how power plants like this Enel SpA wind farm in Texas are financed. Source: Enel SpA |

A new race for around-the-clock, carbon-free electricity is forcing Google LLC, one of the biggest corporate buyers of wind and solar power in the U.S., to rethink its investment strategy and is prompting calls to overhaul some of the financial plumbing in the country's power markets.

For years, companies that wanted to cut their emissions have signed power purchase agreements, or PPAs, with developers of renewable energy projects. Buyers of wind and solar power can match some or all of the electricity they draw from the grid with renewables, while developers get guaranteed revenue streams to attract investors.

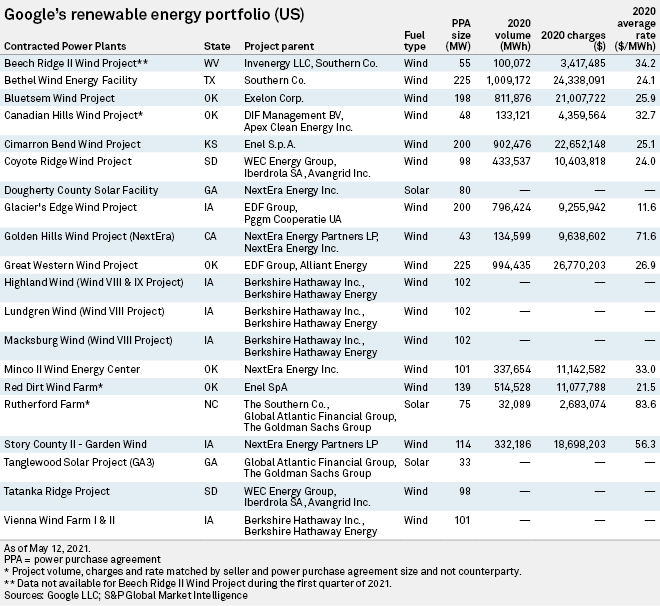

Google, a subsidiary of Alphabet Inc., has been a key player in the market. With 6.2 GW under contract at the end of 2020, the company buys enough renewable energy to match its electricity use each year. However, because the grids where Google operates run on a mix of resources, on an hourly basis, Google uses carbon-free energy only about 61% of the time, according to Mars Hanna, the company's head of sustainability and climate policy.

To make a bigger dent in emissions, Google has said it will try to power its operations with zero-carbon energy 24 hours a day by 2030. It is a massive undertaking that is changing the way Google buys electricity.

"The discrete PPAs were only so scalable," Michael Terrell, Google's director of energy, said in an interview. The question moving forward is, "How do we work with a partner who can help manage that portfolio for us? We need to start thinking much more holistically about how we are sourcing our supply. Before, you were chasing the cheapest renewable energy deal you could find globally."

Under a deal announced May 4, AES Corp. will supply Google's data centers in Virginia with electricity from a mix of renewable energy and energy storage projects, making the data centers 90% carbon-free on an hourly basis.

AES President and CEO Andrés Gluski said the contract with Google "demonstrates that a higher sustainability standard is possible."

"It's not just a question of having overbuilt solar or overbuilt wind," Gluski said on an earnings call May 6. "It's really, how do you manage these different sources of energy, not only to ensure that it's carbon free but to minimize the cost?"

Finding partners

Corporate demand for renewable energy has never been stronger. During the first quarter, companies outside of the energy sector signed PPAs for 3.2 GW of wind and solar power in the U.S., an increase of more than 140% from a year earlier, according to the Renewable Energy Buyers Alliance. However, more companies are joining Google in looking for new ways to buy carbon-free electricity.

"If we really want this to scale to thousands and thousands and thousands of companies, we need to be thinking beyond the PPA," Terrell said.

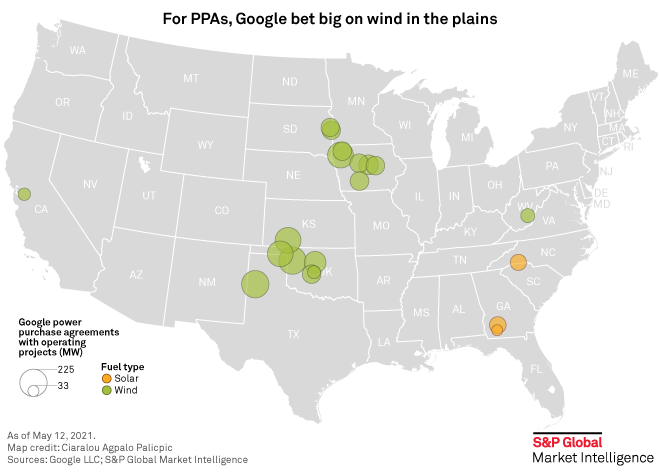

While PPAs have funneled billions of dollars into the renewable energy industry, those investments have tended to accumulate in resource-rich areas, bypassing regions where a new wind or solar plant would have a bigger effect on decarbonization. For example, many of the operating power plants from which Google buys electricity are located in a handful of states in the middle of the country that have long been prime markets for the wind industry.

Now, the practice of buying cheap renewable energy in far-off regions is facing increased scrutiny as more companies focus on what Priya Barua, director of zero-carbon innovation at the Renewable Energy Buyers Alliance, called the "emissions impact" of their investments.

"The conventional power purchase agreement of the previous decade [is] going to be of declining value going forward," said Dallas Burtraw, a senior fellow at Resources for the Future, an independent nonprofit. "We're going to need renewable resources that are 24/7 if we're trying to reach net-zero goals for the electricity sector. ... Some companies may be making investments themselves to help them achieve that goal, but probably they want to stick to their core business, and they want to have somebody else providing that kind of energy certainty."

Late in 2020, Swedish utility Vattenfall AB agreed to match demand at Microsoft Corp.'s three data centers in Sweden with around-the-clock renewable energy. And in April, data manager Iron Mountain Inc. said it was working with RPD Energy, a "green energy marketer," and energy retailer Direct Energy LP to match power demand at more than 60 of its buildings in Pennsylvania and New Jersey with renewable energy on an hourly basis.

Iron Mountain's arrangement could offer a blueprint for companies that want to use more renewable energy but have struggled to sign PPAs, which can be daunting for smaller companies that lack expertise in energy markets, said Kyle Harrison, head of sustainability research at BloombergNEF

"I think a big part of this is working with a retailer who has the capabilities to basically mix and match different renewable generation sources in exactly the way that you want it," Harrison said. "If retailers start to see all this newfound demand for a 24/7, customized clean energy retail contract, that's going to mobilize a lot of financing into clean-energy projects."

'Fundamental change'

Historically, companies have found more freedom to pursue their green-energy strategies in deregulated power markets that are not dominated by monopoly utilities. Now, some utilities are beginning to view the carbon-cutting goals of their corporate customers as an opportunity.

"These companies should have energy suppliers who will just offer them a [carbon-free] product that's part of their supply package for their operations," Terrell said. "There's no reason why utilities can't offer these kinds of contracts."

The Public Utilities Commission of Nevada, for example, recently cleared the way for a deal in which local utility NV Energy Inc. will power a new Google data center in the state with electricity from a portfolio of solar and battery storage projects.

RPD Energy CEO Eric Alam shares Terrell's vision.

"All the market fundamentals, from federal government policy to cultural awareness to [environmental, social and governance]-focused investor influence … are going to do nothing but continue to mount and to drive the need for more flexibility, more choices, more alternatives" for buying carbon-free energy, Alam said.

Ultimately, meeting the changing demands of large electricity buyers will require adjustments to how power projects are financed and how their electricity is sold, Alam said.

For Google to achieve its goal of decarbonizing the world's power systems, a "fundamental change" is needed not just in the PPA model, Terrell said, but also in the broader "market structure."