S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Jun, 2021

By Bill Holland and Starr Spencer

The transition to low-carbon and zero-carbon energy in North America has gained momentum among investors and is likely influencing oil and gas companies' access to capital and its cost, a panel of S&P Global Ratings analysts said.

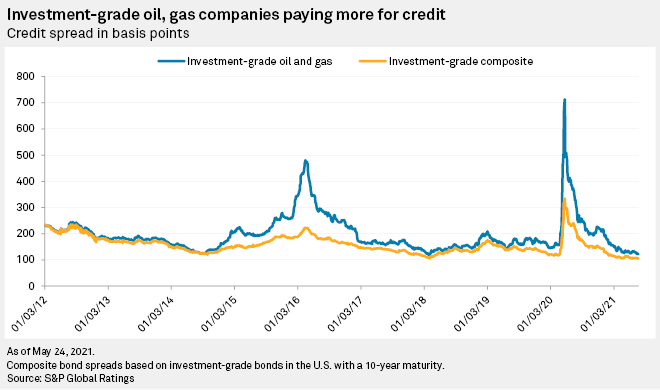

The more carbon that an oil and gas company emits, the more it pays for capital in the bond market, S&P Global Ratings data showed. This is on top of the pressure on energy companies from investment funds going steadily greener.

"Within the North American energy sector, we estimate funding costs were about 75 basis points higher for the most carbon-intensive borrowers compared with those that showed the lowest carbon intensity," S&P Global Ratings Director of Ratings Performance Analytics Evan Gunter said.

Carbon intensity as calculated by Trucost is a company's annual carbon emissions in tonnes for every million dollars of annual revenue.

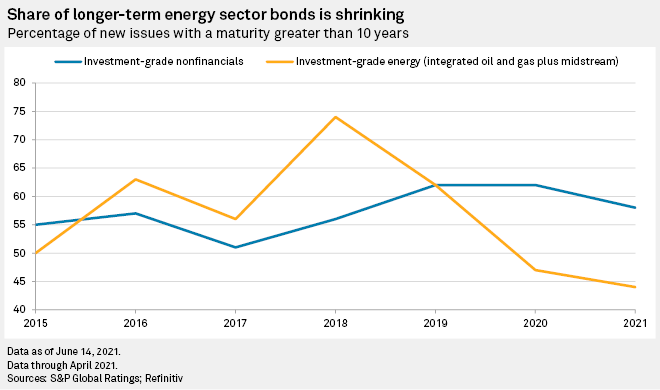

Oil and gas supermajors with lower carbon intensity were able to sell longer-dated debt at lower financing costs than their more carbon-intense peers, Gunter said during an June 16 S&P Global Ratings webinar on the challenges that environment, social and governance issues pose for North American energy companies.

Panelists pointed to recent annual meetings as examples of the focus on ESG among energy companies. Exxon Mobil Corp. shareholders voted in three ESG-friendly board members. Separately, 61% of Chevron Corp.'s shareholders voted to recommend that the company not only reduce production-related emissions, known as Scope 1 and Scope 2 emissions, but also emissions from products sold to consumers, known as Scope 3 emissions.

These two super-majors, along with Royal Dutch Shell PLC, BP PLC and TotalEnergies SE, have pledged support for the goals of the Paris Agreement on climate change and are already targeting emissions reductions. But there are some key differences, S&P Global Ratings Director for U.S. Oil and Gas Carin Dehne-Kiley said.

BP, Shell and Total have net-zero emissions targets at 2050, with more than $2 billion per year on average directed at clean energy projects, Dehne-Kiley said. In contrast, ExxonMobil and Chevron have set no net-zero targets, and they are investing $500 million per year on average on clean energy efforts, she said.

"The Europeans are focusing more on projects that will transform their business models, such as renewable power, while it appears the U.S. majors are focused on projects that are complimenting their existing operations, such as reducing flaring or carbon capture and lowering the carbon intensity of their products, hydrogen and biofuels, while using existing infrastructure," Dehne-Kiley said. "Although we believe it's still early to pick the winners and losers from a credit perspective, it's certainly clear that stakeholders are demanding greater transparency and better-defined strategies for dealing with any transition."

"Midstream is at a crossroads," S&P Global Ratings Senior Director for North American Infrastructure Michael Grande said. "I think what we're going to end up seeing is, because the industry is flush with cash, some of these assets are much more valuable now because you can't really build anything … So, we do expect some consolidation."

The biggest change for midstream operators is the realization that most projections of future volume growth from their oil and gas customers will not come true, although current levels of hydrocarbon use are projected to stay relatively constant, Grande said.

Grande did not think the current environment has signaled any warnings about midstream companies' credit or finances. "I do expect midstream companies to kind of be able to shift to maybe hydrogen and carbon capture, all of those things that we're talking about," Grande said. "But right now, it's very nascent, and it's probably not going to make a significant impact."

Starr Spencer is a reporter with S&P Global Platts. Trucost is part of S&P Global Market Intelligence. S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.