Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jan, 2021

By Tom Yeatts

While commercial real estate industry players are still charting a path through the rubble created by the 2020 pandemic, sentiment seems to have turned a corner. Analysts and industry leaders expect a more favorable 2021 with the U.S. presidential election in the rearview and the prospect of a return to business as usual on the horizon.

"The world is still spinning, and in real estate people are still transacting," Daniel Hardwick, vice chair of the real estate group at the law firm Cozen O'Connor, said in an interview. "If you take a look at the Great Recession, there were buying opportunities there. When things were really bad, people were able to find deals and make money. And I think you're going to see the same thing [in 2021] in hotels and retail, even though it's so dark right now and things seem so grim."

Hardwick added, "There will be investment opportunities for whoever has the best and brightest ideas for what to do with [commercial] space, and do it safely. There will be bright days ahead."

In recent notes, real estate investment trust analysts offered total return forecasts for the group in 2021 ranging from 8% to 18%. Those with more modest expectations for the year, like Janney Montgomery Scott's Robert Stevenson, cited the prospect of rising interest rates as a main performance-dampening factor.

"While the group should benefit from a US 10-Year Treasury rate still hovering around 1.0%, the recent rate bias has been upward, and that has rarely been good news historically for REIT stock performance," Stevenson said in a note. He expects dividends to account for roughly half of the anticipated 8% total return from REITs.

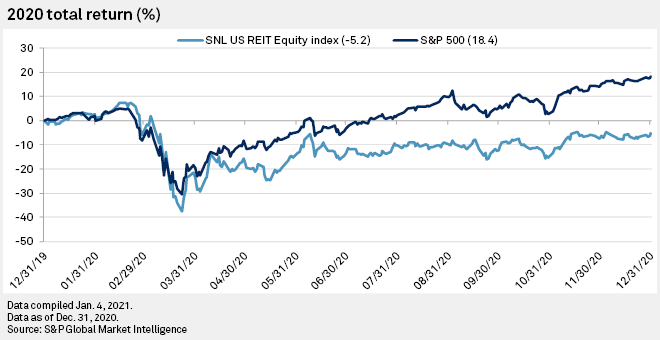

The SNL U.S. REIT equity index logged a negative 5.2% return in 2020 against the S&P 500's 18.4% return, according to S&P Global Market Intelligence data.

Favored segments

BMO Capital Markets' equity REIT analyst team authored one of the more positive outlooks for the year, forecasting an 18% total return and citing expectations for a rebound in hard-hit segments like office, retail and lodging as pent-up demand for shared proximity experience is released on the market. While many REIT analysts remain bullish on the industrial and data center segments, the BMO team cited multifamily as a preferred subsector.

"Unlike the past two years, we believe sector performance will converge as secular growth sectors see continued earnings momentum, while recovery sectors see a bounce back during the year as the market focuses on the trajectory for 2022," the analysts said in a research note.

Baird's equity REIT analysts similarly expect a better showing from REITs in 2021, but they were less sanguine in their outlook, projecting 10% upside, characterized by "volatile but muted" performance. Record low borrowing costs and the roll-out of a coronavirus vaccine will immediately benefit hotels, retail, healthcare and net-lease names, with office REITs lagging. The team named healthcare its "high conviction" segment.

"While we look for volatility in REITs to continue throughout the year, the RMZ will likely finish only moderately higher," the Baird team said.

The recession brought on by the pandemic likely marks the beginning of a new real estate cycle, Matt Werner, managing director and portfolio manager at Chilton Capital, said in an interview at year-end. The dramatic fall-off in new development in 2020 has created ideal conditions for a market reversal, and the trough in commercial occupancy in 2021 will "set the stage" for a five- to 10-year incline in the metric.

"This market downturn was something that we have been anticipating for a while," he said. "Ex-Covid, it didn't seem like this was going to be the end of the cycle, but it [the pandemic] ended up being the catalyst to do it. And it's good because it's shaking out a lot of the development that normally would have compounded [troubles at] the end of the cycle."