Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Sep, 2022

| PG&E's Elkhorn battery storage station sits next to a natural gas-fired power plant on California's Monterey Bay. |

The world's largest concentration of grid-connected lithium-ion batteries helped California ride through its most acute energy emergency since widespread rolling blackouts hit the Golden State in August 2020.

"I would say that in general, the battery storage fleet performance has been outstanding," California ISO President and CEO Elliot Mainzer said Sept. 8 during an unprecedented heat wave that has driven California's demand for electricity to new heights.

Along with coordinated consumer actions to reduce energy use, battery storage has emerged as one of the most essential new clean energy tools for meeting California's growing demand for electricity into the evening, just as the state's vast solar power resources fade offline and natural gas-fired generation fills the grid. This was the biggest test yet for the electrochemical alternative and likely just a glimpse of what is to come for a state with ambitions to completely neutralize the carbon emissions in its power portfolio before midcentury.

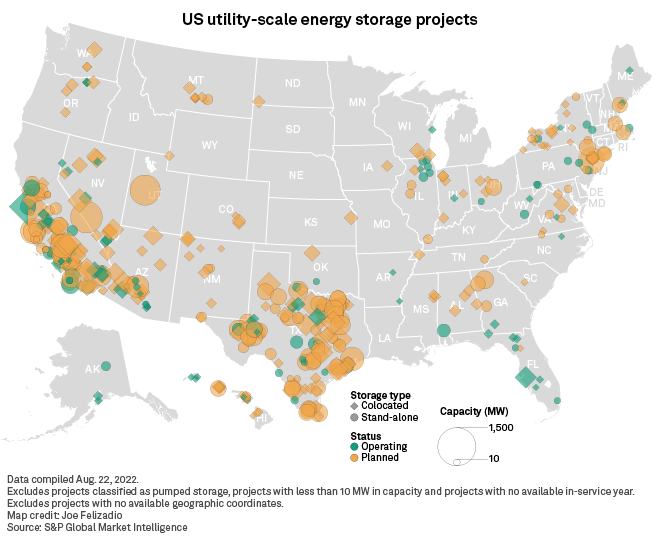

Heading into the heat wave, the large-scale battery fleet, which has largely offset the need for new gas peakers in recent years, featured nearly 4,000 MW of power capacity at stand-alone energy storage stations and battery-equipped solar farms, according to S&P Global Market Intelligence data. Most are designed to charge and discharge up to four hours of electricity. In addition, California entered August with roughly 884 MW of small-scale battery capacity operating at about 77,000 homes and businesses, according to state data.

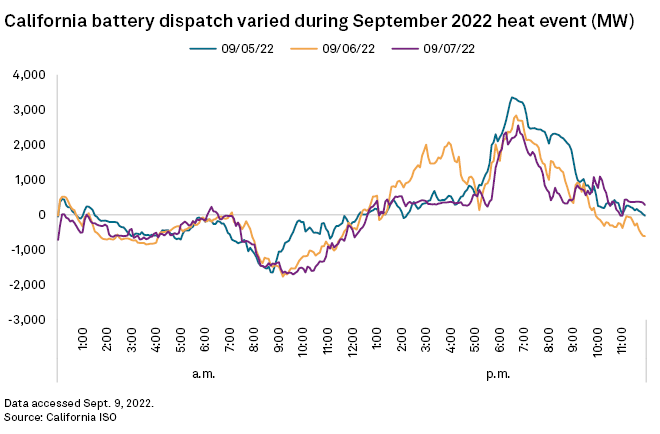

Two years ago, just before Mainzer took the helm at CAISO, the grid operator could not even muster 200 MW of battery discharge on back-to-back days of rotating outages. This time around, with battery output hitting nearly 3,400 MW at one point during the capacity crunch, a full-blown crisis was avoided.

But optimizing California's fast-proliferating batteries to support the grid at its moments of greatest need is a work in progress, Mainzer acknowledged during a Sept. 8 media briefing.

"We are constantly looking at the battery performance, looking at the structure of our energy market, looking at the price signals, the pricing structure, and I think we're learning a lot about how that's working," Mainzer said. "I'm sure we'll have some lessons learned coming out of this, and we'll continue to evolve our structures, but generally, performance has been outstanding."

Lessons to learn

At times, California's battery peakers pushed power into the market before the period of greatest risk in the evening. On Sept. 6, for instance, batteries released more than 2,000 MW in the mid- to late afternoon, when solar generation was still high, before crashing to 135 MW at 5:10 p.m. and then rebounding to 2,839 MW by 6:40 p.m., grid operator data shows.

That performance caused concern among some energy storage industry representatives over whether California has the right market rules in place to support grid reliability.

"The dispatch of batteries in markets like CAISO is driven by price signals," said Jason Burwen, vice president for energy storage at the American Clean Power Association, an industry trade group. "When batteries discharged early afternoon on Tuesday, they were doing so because CAISO's market showed prices at their maximum — which is administratively capped — several hours prior to net peak."

That stood in contrast to other days during the emergency when the grid operator directed battery operators to reserve more capacity for the most at-risk peak hours. "This goes to show how critical it is for grid operators and regulators to update market rules and processes to effectively utilize newer energy storage resources for reliability," Burwen said.

Pacific Gas and Electric Co., or PG&E, which has added more than 1,100 MW of owned and contracted utility-scale energy storage resources since August 2020, plans to analyze the data more closely "to see what lessons can be learned from operations during the course of the heat wave that can be leveraged for future high load events," Paul Doherty, a spokesperson for the PG&E Corp. subsidiary, said in an email.

Overall, the past week reinforces that battery energy storage now plays "an integral role in enhancing overall grid reliability, addressing local capacity requirements, and providing energy and ancillary services to the CAISO-controlled grid," Doherty said.

Small batteries, big ambitions

The assets have been activated throughout the heat wave, discharging up to about 24 MW at times. Tesla has invited approximately 25,000 PG&E customers to join.

"Virtual power plants are an essential part of California's clean energy future and a valuable resource for supporting grid reliability," Doherty said.

Sunrun Inc., the nation's largest home solar and battery installer, believes that as well. The company has dispatched 18,000 residential battery systems daily in California over the course of the heat wave. From Sept. 1 to Sept. 6, those batteries delivered nearly 500 MWh of peak energy needs, according to Nick Smallwood, Sunrun's senior vice president of product and strategic development.

Those systems, installed primarily to provide backup power, can dispatch energy into the grid at higher peak rates and take advantage of the state's emergency load reduction program, which offers limited compensation to customers for sharing capacity with the broader power system.

But Sunrun sees bigger things ahead for California's expanding base of small-scale batteries.

"It's not being fully utilized, and we're still here, and we're going to grow, and these assets don't go away," Smallwood said. "I think there's absolutely the opportunity to provide the full kind of value [for] these batteries, particularly when networked together, to provide meaningful and very valuable services to the grid."

Sunnova Energy International Inc. is pursuing a different model. In a recent filing to the California Public Utilities Commission, the company asked for approval to own and operate solar-powered, battery-backed microgrids at new master-planned residential communities of 500 to nearly 2,000 new homes as a "micro-utility" to compete against PG&E and other big investor-owned utilities.

"That's a way that we can essentially create our own more reliable, cheaper utility system," Sunnova President and CEO John Berger said in an interview. "And it's a way for consumers to fight back at the monopolies that really are entrenched."

Such community microgrids would be designed to fully disconnect from the primary grid or remain connected and serve as "shock absorbers" by providing voltage support, frequency regulation and other services to CAISO or adjacent utilities, according to the filing.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.