Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jun, 2023

By Eri Silva and Avery Chen

| Battery-makers and carmakers look to balance safety, cost, life span, energy density and power when picking a battery technology for electric vehicles. Source: Songsak Rohprasit/Moment via Getty Images |

Automakers facing steep metal costs are pushing alternative battery chemistries, but moving from high-performance lithium- and cobalt-based batteries to alternatives comes with trade-offs for consumers, according to battery industry experts.

|

The electric vehicle battery market is dominated by three versions of the lithium-ion battery that differ by their proportion of critical minerals within the cathode — lithium-iron-phosphate (LFP), nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum compositions, according to IHS Markit forecasts.

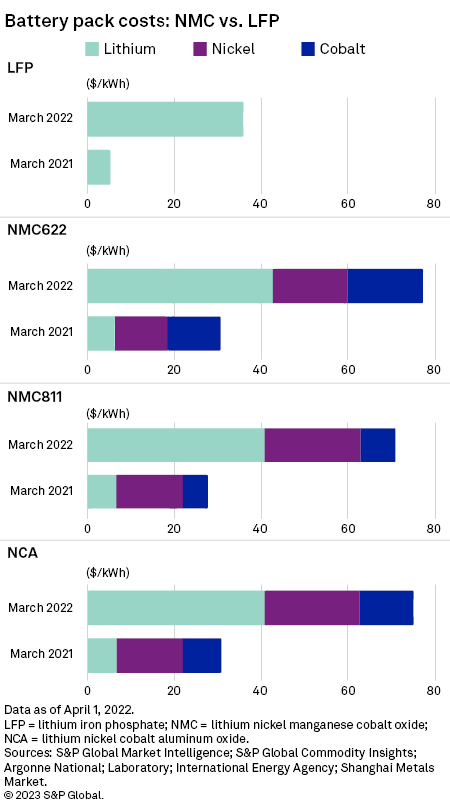

In the short term, battery-makers plan to keep working with these existing chemistries to reduce reliance on critical minerals that are in short supply or heavily concentrated geographically, while looking for new chemistries that could radically change the battery space. Automakers, under pressure from investors focused on environmental, social and governance issues, would like to reduce the use of cobalt that largely comes from regions where miners have been accused of human rights violations and a lack of environmental safeguards. In addition, S&P Global Commodity Insights forecasts lithium and nickel prices will remain well above historical averages despite recent decreases, prompting automakers to try other battery chemistries using materials including sodium and iron.

These types of changes require automakers to weigh the pros and cons of each battery chemistry's performance within their respective markets before investing in retrofitting supply lines.

"Performance is one of the key drivers behind battery chemistry innovation. We all want higher energy densities and longer cycle lives for our batteries and longer ranges for our EVs," Rob Burrell, a senior analyst at Benchmark Mineral Intelligence, told Commodity Insights. "[But] with all these things, there is no such thing as a free lunch. An increase in energy density will often result in unwanted side effects."

Cutting cobalt

Battery-makers will be adopting NMC batteries that strive to reduce cobalt content as much as possible while increasing nickel and manganese, according to industry experts.

"To put it simply, they want to cut costs by using less cobalt while maintaining and increasing energy density," Mo Ke, CEO and chief analyst at RealLi Research, told Commodity Insights.

Mo said the removal of cobalt is an "inevitable trend," but several technological hurdles must be overcome within the next few years to enable the mass production of cobalt-free batteries.

As an alternative, nickel-rich chemistries maintain energy density but reduce the safety of the battery. Nickel-rich versions of the NMC battery, such as series 811, are already being adopted by battery manufacturers and automakers and are expected to comprise 25% of all batteries sold in 2024, according to market forecasts by E Source, a utilities research firm.

"As you go to higher nickel content, [the battery] tends to be more reactive, meaning the battery becomes less safe," Venkat Srinivasan, director of energy storage research center ACCESS at the Argonne National Laboratory, told Commodity Insights.

Cutting nickel

Some automakers might opt to reduce the nickel content as well. Nickel sources, particularly for US and European importers of the metal, have been facing various issues including supply constraints. Some governments have focused on the base metal as part of the tariffs put in place after Russia, a major global nickel producer, invaded Ukraine in early 2022.

For example, the US has hiked tariffs on Russian nickel imports, and the UK is expected to ban such imports altogether. The London Metal Exchange, a key nickel trading institution, also struggled to manage nickel trades shortly after the invasion, sending nickel prices to $100,000 per metric ton in March 2022.

The next battery technology to hit the market within the short to medium term will be versions of LFP and NMC with higher manganese content, experts from E Source, Argonne, Benchmark and IHS Markit all said. Volkswagen AG-backed Gotion High-tech Co.Ltd. launched a high-manganese LFP product in May.

"The energy density in manganese-rich [chemistries] is probably not going to be as good as a high-nickel content material. But what it can give you is supply resiliency and a bit more safety," Srinivasan said. "The cycle life may not be perfect, but that's what we're working on."

Manganese cost $4.52 per dry metric ton unit of ore as of May 25, using Mn 32% Fe 20% Tianjin-SA terms, which is far cheaper than the LME nickel cash price of $21,053.50 per metric ton on the same date, according to S&P Global Market Intelligence data.

"We're seeing people start to turn [supply] lines towards manufacturing [these batteries], and that's when you can really start to tell that, OK, this is likely to be commercialized," said Rory McNulty, a senior research analyst at Benchmark Minerals Intelligence.

In addition, China dominates in manganese refining and that could create bottlenecks for US and EU manufacturers.

Manufacturers outside of China seeking manganese supply might get a boost from a flurry of critical mineral sourcing agreements between countries such as the US and Australia. In addition, the US has developed an accelerated federal permitting process; the first project is South32 Ltd.'s Hermosa development in Arizona, which hosts manganese alongside silver, zinc and lead mineralization.

Iron on

Experts also see the LFP battery taking a larger market share in the US and Europe despite not having the longest range due to its lower energy density. LFP became the dominant chemistry in China after the government halved national PEV subsidies in 2019.

"LFP doesn't use nickel or cobalt, and so that makes the battery overall cheaper. And we know that a battery pack is between 30% and 40% of the entire cost of the electric vehicle," said Tu Le, managing director at Sino Auto Insights.

Benchmark's Burrell said LFP's recent resurgence outside of China is "due to the availability and lower price of its raw materials," which makes the trade-off of lower performance acceptable.

Yet, without the growth of battery supply chains outside China, the US risks increasing its reliance on Chinese refining and manufacturing. Around 95% of the LFP batteries produced in 2022 went into vehicles manufactured in China, according to a report from the International Energy Agency.

"Certain materials are almost exclusively made in China, such as [those used in] LFP, so finding alternatives are key to securing domestic supply outside China," Burrell said.

In the US, consumer sentiment has changed and more buyers are willing to buy vehicles for everyday use instead of prioritizing long range to "make sure that they can drive two states away and go out on trips," said Ben Campbell, lead battery analyst at E Source.

Campbell said several automakers are now reserving NMC cathode technology for their premium line of EVs, and vehicles with LFP batteries will be economy cars.

Tesla Inc. outlined plans in October 2021 to shift all of its standard range cars to LFP batteries; and Ford Motor Co. announced in February that it would produce LFP batteries in a plant in Marshall, Mich.

Sodium on the table

Contemporary Amperex Technology Co. Ltd. (CATL), China's largest power battery-maker, made waves in 2021 when it announced it would be mass-producing sodium-ion batteries in 2023. China-based battery-maker BYD Company Ltd. is also reportedly planning to mass-produce sodium-ion batteries this year.

The technology replaces lithium with sodium, which is far more abundant and cheaper. Also, sodium-ion batteries do not need cobalt or nickel, they perform better in lower temperatures, and they can recharge faster than lithium-ion batteries.

The development is threatening to turn the market on its ear, but performance trade-offs limit reach along with the need for additional testing in EVs.

"It has clear energy density and performance limitations to replace lithium-ion batteries for the mainstream passenger [battery electric vehicles]," said Jay Hwang, a senior analyst at S&P Global Mobility.

However, Jakob Fleischmann, a partner within the Battery Insights team at McKinsey & Company, assured that "we should never underestimate this disruption." Fleischmann pointed to the various segments of the market where the technology could take hold, such as stationary storage with lower energy-density needs and low-performing cars and trucks.

Experts agree it will take time for the technology to mature. E Source does not see the technology making a big impact on the market within the next five years.

"Maybe CATL's AB-type sodium-ion batteries are already installed on EVs and it's in trials but no results have been reported thus far," said Mo of RealLi Research. CATL's AB-type battery packs integrate sodium-ion and lithium-ion cells; the A- and B-grade classification for battery cells represents levels of performance expectations.

"There's a question mark whether the sodium-ion battery will be the next direction of the technology route. And whether sodium-ion batteries will be promising is unknown," Mo said.

For battery anode materials, sodium cost 0.7 Chinese yuan per watt-hour as of late 2022, 22% less than a lithium anode, according to MySteel Global.

CATL and BYD did not respond to request for comment.

As of June 7, US$1 was equivalent to 7.13 Chinese yuan.

IHS Markit is now part of S&P Global.

S&P Global Mobility is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.