S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Jan, 2022

By Anthony Barich

Battery material stocks skyrocketed in 2021, tripling and even quintupling company share prices, while precious metals companies tanked, according to an S&P Global Market Intelligence analysis.

Battery metal companies benefited from a jump in lithium prices: Chinese battery-grade lithium carbonate price more than quadrupled in 2021, according to Market Intelligence Research, and eight companies in the study's list of 15 were heavily involved in lithium.

"The hot money was chasing lithium" amid surging electric vehicle demand as "institutional money deserted the gold sector" beset with some disappointing production outcomes and high costs, Alto Capital investment manager Tony Locantro said in an interview.

Australia-listed Liontown Resources Ltd. led the lithium charge with a 388.2% hike in share price for the year. The company announced plans in November 2021 to raise up to A$490 million to develop its Kathleen Valley lithium-tantalum project in Western Australia.

Fellow Australian lithium developer AVZ Minerals Ltd.'s share price rose 355.9% in 2021. The company secured US$240 million of investment in September 2021 from a subsidiary of Chinese lithium-ion battery maker Contemporary Amperex Technology Co. Ltd. for the Manono lithium-tin project in the Democratic Republic of Congo.

Pilbara Minerals Ltd., another Australian company, recorded a 267.8% increase in share price, including a record high in September 2021 upon accepting a bid for its second spodumene concentrate digital auction at a price that was double the previous rally. Spodumene is a lithium-containing mineral.

Chinese lithium chemicals players also featured prominently in 2021, including Tibet Mineral Development Co. Ltd., up 309.3%, and Sinomine Resource Group Co. Ltd., up 165.8%.

Rare earths producers also made gains, notably China Northern Rare Earth (Group) High-Tech Co.Ltd. and Australia's Lynas Rare Earths Ltd., which booked share price increases of 249.9% and 155.5%, respectively.

The top-performing stock in the study was Filo Mining Corp., with its share price leaping 561.7%. The Canadian company focuses on copper, which is not considered a battery metal but has been in high demand due to global energy transition efforts. It had a market capitalization of at least US$1 billion in 2021 and daily trading volume averaging 100,000 shares on the back of positive drill results at its Filo del Sol copper-gold silver deposit in Argentina.

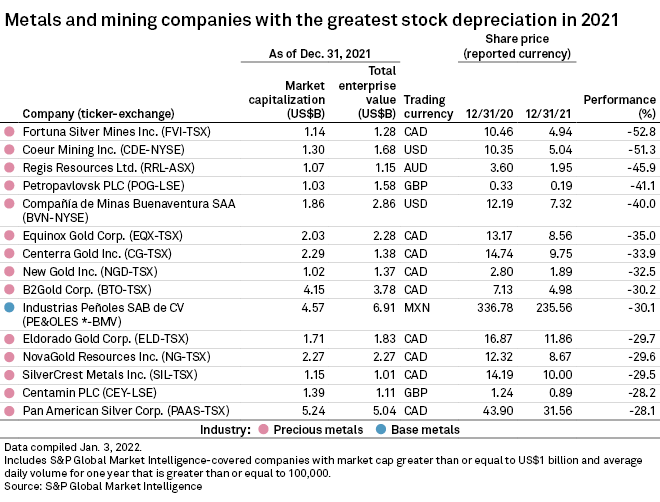

Precious metals miners dominated the list of 15 worst-performing metals and mining companies in 2021, led by Fortuna Silver Mines Inc.'s 52.8% depreciation amid concerns about the future of its Mexican San Jose silver mine. Coeur Mining Inc. followed with a 51.3% drop in share price, having swung to a net loss in the third quarter of 2021 from profit in the prior-year period.

Regis Resources Ltd.'s share price fell 45.9% after its fiscal 2021 net profit decreased 27%, with higher revenue from gold sales offset by increased mining costs. Meanwhile, FTSE 250 gold miner Petropavlovsk PLC depreciated 41.1% amid tension with its largest shareholder Uzhuralzoloto OJSC.