S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Mar, 2022

By Jon Rees and Mohammad Abbas Taqi

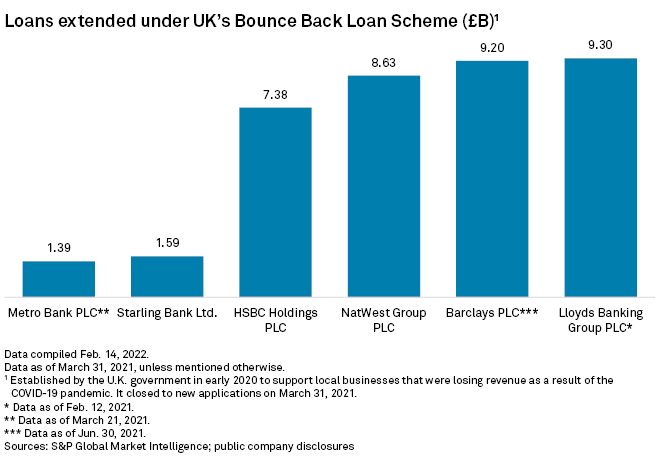

| Lloyds Bank was the biggest issuer of bounce back loans, which are now under scrutiny due to the prospect of major losses as a result of fraud. |

Banks are headed for a legal battle with the U.K. government over the terms of a state-guaranteed COVID-19 recovery loan scheme.

The U.K. government's Department for Business, Energy and Industrial Strategy has estimated that £17.2 billion of such "bounce back" loans will not be repaid, with £4.9 billion of that due to fraud. Lawyers have said legal action could follow if the government believes banks have not acted properly — for instance, by carrying out insufficient checks on borrowers — and refuses to honor the guarantee.

"It could lead to large-scale and serious litigation between the banks and the government," said Rachel Cropper-Mawer, partner at law firm Clyde & Co. and a specialist in fraud and commercial disputes.

Need for speed

About £47 billion was provided to smaller U.K. companies via the Bounce Back Loan Scheme. The loans carried a 100% government guarantee, were self-certified, required no credit checks and offered no interest payments for a year. About a quarter of all businesses in the U.K. took out a loan before the scheme closed in March 2021.

The program was developed and launched within 11 days in April 2020. Lloyds Banking Group PLC, Barclays PLC, NatWest Group and HSBC Holdings PLC were among the top issuers of the loans.

Former U.K. Treasury Minister Lord Agnew, who resigned in January in protest at the government's handling of the scheme, told parliamentarians March 15 that claims from banks "in industrial quantities" are going to reach the Treasury in the next few weeks. Fraudsters have spent money from the scheme on everything from sports cars to gambling to drugs, and banks have little commercial incentive to go after errant borrowers since the loans are state-guaranteed, he said.

Agnew earlier stated in Parliament that oversight of the Bounce Back Loan Scheme by the government and state-owned British Business Bank PLC, which administers it, was "nothing less than woeful." He subsequently called in the Financial Times for payouts under the state-guarantee to be stopped until there was clarity on the work banks are doing to tackle fraud.

Loans could only be provided to businesses that were viable and had been affected by COVID-19, but Cropper-Mawer noted it is unlikely the banks carried out sufficient due diligence on every single loan because they were under considerable pressure from the government to provide businesses with money as quickly as possible.

The contracts covering the guarantee are likely to have been individually negotiated with the banks, Cropper-Mawer said, so each lender could have different terms under which they agreed to process the loans.

While the government is likely to broadly stand by its guarantee to reimburse banks over unpaid COVID-19 loans, it could take action in certain circumstances, said Sam Tate, a partner at law firm RPC who specializes in white-collar crime cases.

"If there were egregious examples of banks, for instance, favoring their own clients and not completing any checks, then I think the government might be forced to act by public opinion," said Tate. "Or, indeed, the regulators might investigate particular areas or conflicts of interest."

'Uncharted waters'

The Bounce Back Loan Scheme was explicitly designed to force banks to disregard their usual caution in the face of pressure from business lobbying groups, said Giles Wilkes, senior fellow at the Institute for Government, a think tank, and previously an adviser to former Prime Minister Theresa May on industrial and economic strategy.

"These are totally uncharted waters. Should the banks have had an in-depth debt management conversation with hundreds and thousands of people who never wanted to take on debt in the first place?" said Wilkes. "That's a tough call if the government is hectoring you [to lend] from the other side."

The scale of the expected losses points to potential tensions between the banks and the government, said Shore Capital analyst Gary Greenwood.

"I think bank executives have been very careful about making sure they recorded all their conversations with the government on this, so I suspect the banks will push back quite hard if the government argues over the guarantee," Greenwood said. "But I'm not surprised if the government is reluctant to pay up given the sums involved."

Payment scrutiny

British Business Bank said the actual amount paid out under the guarantee so far was considerably less than the £1 billion Agnew claimed in Parliament.

"It is not correct that £1 billion has been paid out to lenders under the scheme, but rather this is the value of claims made against the guarantee as at the end [of] December 2021," a spokesperson for the bank said. "The value of claims settled, to the same time period, is much less at around £70 million."

The Department for Business, Energy and Industrial Strategy implemented the COVID-19 support schemes at unprecedented speed to protect millions of jobs and businesses. "Last year we stopped or recovered nearly £2.2 billion in potential fraud from the Bounce Back Loan Scheme," said a spokesperson for the department.

Finance Minister Rishi Sunak told Parliament: "We are going after each and every person we suspect of defrauding the taxpayer." He also said the original estimate of £4.9 billion in fraud in the scheme had been revised down by a third since it was published.

Calling in the debt

A spokesperson for Metro Bank PLC, one of the lenders involved in the scheme, said it adhered to the eligibility requirements of the loan schemes. Banks had to pay close attention to borrowers to ensure they were not incorrectly declined, the spokesperson said.

"For example, a small number of customers may have run a business before the pandemic but changed their incorporation status, for instance, from sole trader to a limited company, therefore existing before the British Business Bank's cut-off date," the spokesperson said.

Metro declined to comment on whether it had made any claims under the government guarantee for COVID-19 loans. Barclays PLC and HSBC Holdings PLC also declined to comment on whether they had made any claims, while Lloyds, NatWest and Starling Bank did not respond to requests for comment.

UK Finance, which represents banks, said lenders could claim on the guarantee at any time after a formal demand for repayment of a loan in default is issued, but no later than 12 months from the date of the formal demand.

"It's a question of whether the government's reputation or the banks' reputation will suffer the most in the public fight over it," said Wilkes.