Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Feb, 2021

European banks' exposure to small- and medium-sized businesses constitutes a major challenge when applying a new EU classification system on climate-friendly investments because there is a widespread lack of data, a new report finds.

The report, compiled by the European Banking Federation and United Nations Environment Programme Finance Initiative, studied the system's impact on 26 of Europe's largest banks, testing the framework on lenders' retail and SME lending as well as corporate and investment banking. The report cited a lack of standardized and comparable data as one of the challenges for the banking sector.

The EU sustainable finance action plan, announced in 2018, created a common classification system to define environmentally friendly investments. The so-called taxonomy assesses 67 economic activities, spanning manufacturing to transport, and is designed to steer companies as they adapt their business strategies to climate change, as well as help investment funds judge sectors based on their environmental performance.

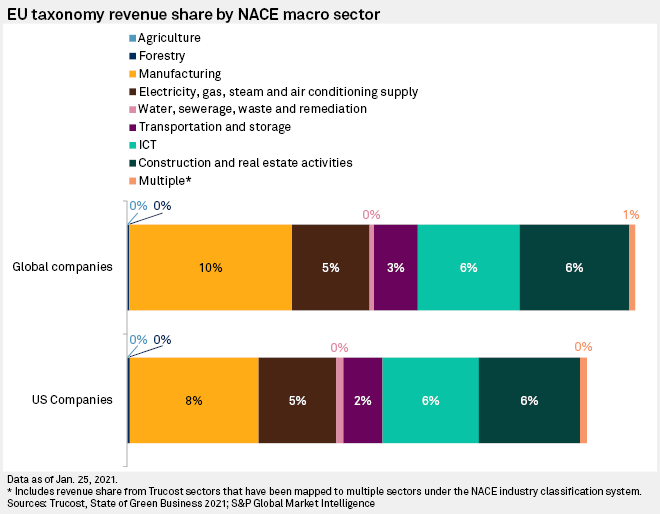

About 73% of revenues generated by the 500 largest U.S. companies and 69% of revenues generated by the 1,200 largest global companies were not aligned with the EU Taxonomy, according to a 2019 analysis by S&P Global Trucost. The manufacturing sector generated the largest percentage of EU Taxonomy-aligned revenues in both the U.S. and globally, followed by the construction and real estate and information and communications sectors.

Bankers say they face a particularly daunting challenge in applying the taxonomy.

"We need to cover, as banks, a wider scope of companies not only listed corporates but also SMEs where practically no data will be available," Antoni Ballabriga, global head of responsible business at one of Spain's largest banks, Banco Bilbao Vizcaya Argentaria SA told a conference to launch the new taxonomy report.

"This wider scope means an increased level of complexity about the stock exposures for banks," he said. "We are not talking about a few thousand of corporate clients, but hundreds of thousands or millions of customers."

SMEs are key

The European economy is heavily dependent on bank financing, and European SMEs use banks for 70% of their financing, compared to 40% in the U.S., according to trade credit insurer Euler Hermes.

More data will become available as banks offer more sustainable products, which would track client sustainability, collect data and in turn boost sustainable finance, Ballabriga said.

Other banks said climate-related certifications from third parties could also help distinguish the greenness of an SME's business.

"For SMEs, issuing a sustainability report is not an option in general and so what they can do is to have certifications on products and services," said Hans Biemans, head of sustainable markets at Dutch bank ING Groep NV.

"If we can rely on such certifications and that kind of data from SMEs, I think you have a very reliable proxy to identify the greenness of SMEs," he said.

There is not sufficient publicly available data on SMES to determine whether they meet the taxonomy criteria, the report said.

"Assessing the alignment of SME business activities against the EU Taxonomy often relies on manual and individual intervention that is inefficient and costly, both for SMEs and banks," the report said. "This will result in an increase in product and transactional costs, while SMEs need to execute transactions rapidly and in a cost-effective way."

Seeking a centralized database

"We are asking that the data, based on some common reporting standards, are reported to a central data register, to which anyone who is interested in the data could actually tap in and get this data in some kind of structured way," Denisa Avermaete, the EBF's senior adviser sustainable finance, said in an interview.

One major obstacle is the fact that national statistics offices and governments use different practices in collecting data, and there needs to be a common approach, Biemans said.

"It is very annoying when companies are approached by all their banks, you know that large companies will have 25 to 30 banks, to get sustainability data and also by the government and statistics office to get even more data that are all very similar," he said.

Karen Degouve, head of sustainable business development at French investment bank Natixis, told the conference the answer to the data challenge would be a European centralized database. Ideally it would contain verified, open sourced data with all the information that banks would need to apply the taxonomy, she said.