S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Mar, 2021

By Lauren Seay

A growing number of community banks are seeking loan participations as surplus cash and soft loan demand hamper performance.

Tepid loan growth and excess liquidity have weighed on financial institutions' balance sheets, driving down loan-to-deposit ratios and net interest margins. In search of relief, more community banks and credit unions have turned to loan participation programs, industry observers said. Loan participation programs allow financial institutions to pool resources and collectively make larger loans than they would be able to on their own. Community banks and credit unions also see the arrangements as an opportunity to diversify during a time of increased uncertainty surrounding various industries impacted by the COVID-19 pandemic.

"We have definitely seen a pickup really in the last six months," Lori Bettinger, co-president of Alliance Partners LLC and president of BancAlliance, said in an interview. "Banks are looking for loan growth [as they are] awash of liquidity, and participations could be an efficient way to address that."

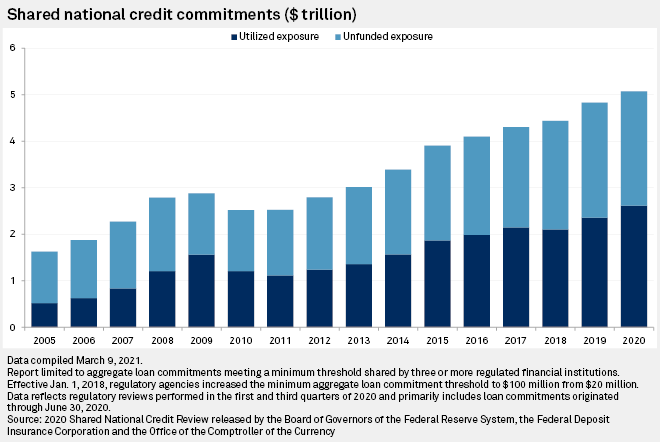

The shared national credit population totaled $5.1 trillion in commitments during the third quarter of 2020, up $242 billion, or 5.0%, from the third quarter of 2019, according to the 2020 Shared National Credit report released by the Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency. The report tracks loans or other commitments that individually exceed $100 million and are shared by three or more regulated financial institutions.

LendKey Technologies Inc.

"When the pandemic hit followed by the recession, we saw a reset to exactly what happened in 2009," Vince Passione, founder and CEO of LendKey, said in an interview. "We're getting close to almost 70% loan-to-deposit ratios, which are very, very low. That's an unhealthy institution. It's an institution that needs to take those deposits and now invest them somewhere."

Since launching the platform, LendKey has found that many community banks and credit unions are participating in loans with nonbank lenders.

"Credit unions [and] community banks, they're all looking for strong performing assets right now," he said.

Alliance Partners was founded shortly after the Great Recession to help banks with exposure to commercial real estate diversify. Much like the 2008 financial crisis, the need to diversify is prominent again as certain industries are under pressure, Bettinger said.

"There's, again, a renewed interest in diversifying your loan portfolio because, again, you have some uncertainty around commercial real estate," she said. "When you have that uncertainty in one of your core asset classes, it just makes you think a little more about ... maybe this is the time to do it given the uncertainty in my core business."

But excess liquidity among sellers has led to a shortage in supply and "pent-up demand" among buyers, according to Mike Dorsett, president of Portfolio Performance LLC, which assists credit unions in the loan participation process.

"It's an absolute sellers' market right now," Dorsett said. "Excess liquidity means the sellers don't need to necessarily sell off some of those loans in the form of participations to continue to fund loans. They have that cash to do that. So the buyers have been impatiently waiting, I would say, for more and more opportunities."

Many U.S. banks tightened their underwriting practices after the COVID-19 pandemic made credit quality a concern across the industry. The amount of SNC commitments with low supervisory ratings jumped year over year, according to the 2020 SNC report. Special mention and classified SNC commitments rose to 12.4% in 2020 from 6.9% in 2019. The increase was largely driven by borrowers in industries affected by COVID-19, according to the report.

"Community banks are definitely very focused on the risk that might be specific to COVID," Bettinger said. "[But] at this point, it's easier to characterize the stronger credits in this environment from the weaker credits in this environment, so I think people feel more comfortable underwriting."