S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 May, 2023

By Jake Mooney and Xylex Mangulabnan

Banks' rising caution about commercial real estate loans will increase stress on borrowers and could pressure policymakers to intervene.

Investors have increased their scrutiny in recent weeks of loans tied to commercial real estate (CRE) properties, especially office buildings, as they probe bank balance sheets for weakness following the failures of Silicon Valley Bank and Signature Bank. Banks, in turn, have tightened underwriting. Analysts say the trend is likely to continue and could produce ripple effects that span years.

Banks began tightening CRE lending standards in the first quarter of 2022, with a net 61% reporting stricter CRE lending standards as of the 2023 first quarter, according to senior loan officer surveys, BofA Securities analysts said in an April 3 note. That trend, combined with the potential for more regulation and less commercial mortgage-backed securities availability, is likely to slow lending by small and midsize banks, the analysts added.

Concerns are most acute around office properties, in which occupancy rates still have not recovered from widespread shifts to work-from-home during the COVID-19 pandemic. Fitch Ratings said in an April 27 note that it expects "a degree of permanent valuation impairment" for weaker office properties, arguing that lower demand for office space stemming from pandemic-era shifts "bears some likeness to a secular decline in physical space requirements for lower quality retail formats" after the rise of e-commerce.

Office vacancy rates in New York City, San Francisco and Atlanta stand at 20% and higher, well above pre-pandemic norms, and landlords are offering rent concessions that amount to steep discounts, Jefferies analysts said in an April 13 note.

If a combination of higher interest rates, tighter underwriting standards and negative sentiment leaves property owners unable to refinance the approximately $1.5 trillion in CRE debt set to mature by the end of 2025, "it is always fair to assume that Washington will step in if a crisis is either deep enough or wide enough," BTIG analyst Isaac Boltansky wrote in an April 22 note.

Though there is general reluctance within the federal government to intervene on behalf of the CRE industry, possible actions in such a crisis could begin with bank regulators encouraging financial institutions to work out CRE loans through regulatory guidance and could escalate to emergency lending by the Federal Reserve, Boltansky wrote.

Small banks' greater role

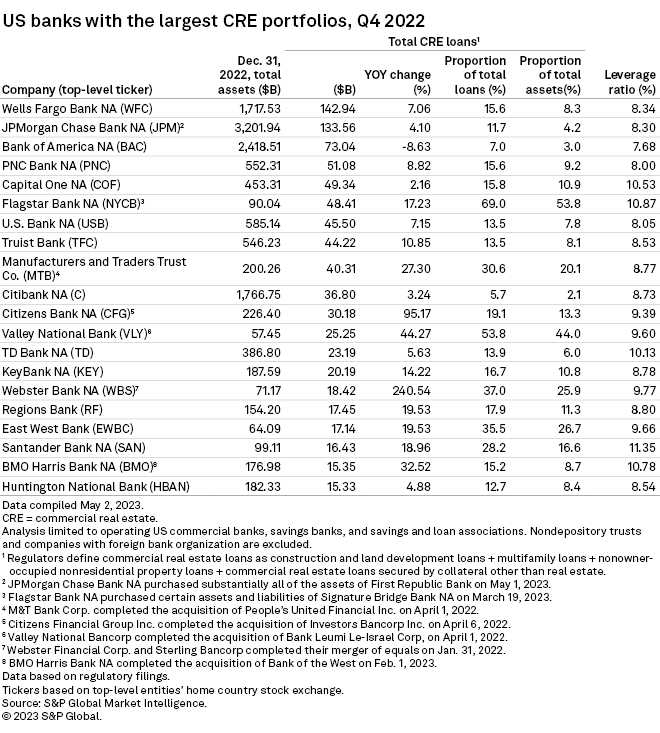

Banks account for about half of all CRE debt outstanding, and CRE loans at US banks now total $2.8 trillion, or 23% of banks' total loans — the highest level since the Global Financial Crisis, the BofA Securities analysts wrote.

Of that total, the 25 largest banks account for roughly 30% of bank CRE loans, with smaller banks carrying the rest. Over the last decade, banks outside the top 25 in asset size contributed 82% of CRE loan growth, and CRE loans now make up 44% of total loans at banks outside the top 25, compared to only 13% among the 25 largest banks, the analysts added.

Office loans represent about 18% of CRE loans, or 4% of total loans, within BofA Securities' coverage universe.

Some analysts cautioned against excessive pessimism. The Jefferies analysts noted that there have been "very few issues" in banks' office books and said office leases tend to be long-duration, giving lenders time to work through potential risks.

Hovde Group analysts, in a March 31 note, said capitalization rates on CRE properties remain low, signaling valuations that "should result in manageable diminishment of equity," but added that within the office sector, "clearly there are 'have and have nots' from a macro and individual credit perspective," with "class B" properties suffering more.

In first-quarter earnings calls, Wells Fargo & Co. executives said they are stress testing their real estate book to see where potential problems might arise, and executives at Bank OZK, another major CRE lender, said they expect higher-end office properties to withstand a general slowdown in fundamentals.

Market shake-up

The BofA analysts described construction financing as "basically nonexistent" for new projects in the current environment, and the Hovde analysts, quoting a JLL Capital Markets adviser, said appetite for construction loans among banks is "nil, resulting in nonbanks getting 'overpaid' on related deals."

In an investor conference call on March 22, shortly after the Silicon Valley Bank and Signature Bank failures, Colliers Mortgage President and Mortgage Bankers Association Chairman Matthew Rocco said banks newly cautious about CRE will look to sell loan portfolios to opportunistic investors.

The Federal Deposit Insurance Corp. expects to market Signature Bank's approximately $60 billion loans portfolio, primarily composed of CRE and commercial loans, over the summer.

For new loans, "you should expect a pretty big pullback" from banks, Rocco told real estate investors during the call. Unlike in the Global Financial Crisis, there are regulations now in place, including the current expected credit loss methodology, that will push banks to move troubled assets off their books quickly, he added.

"Don't look to lenders to kick the can, candidly, which did benefit us after the [Global Financial Crisis]," Rocco said. "But this time they won't have that luxury."

"Banks are going to be very selective," he added. "They're going to have to deal with rapidly changing market conditions and asset valuations, increased regulatory scrutiny and what that means to their portfolio and where they want to invest. Banks will carefully examine tall trees in their portfolio ... and that's going to be uncomfortable for folks, but it's necessary and it must occur."