Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Feb, 2021

By Matt Smith

South Africa's major banks need to improve transparency around their financing of fossil fuel industries, according to industry observers, who describe the current disclosures as "trivial" and "not meaningful."

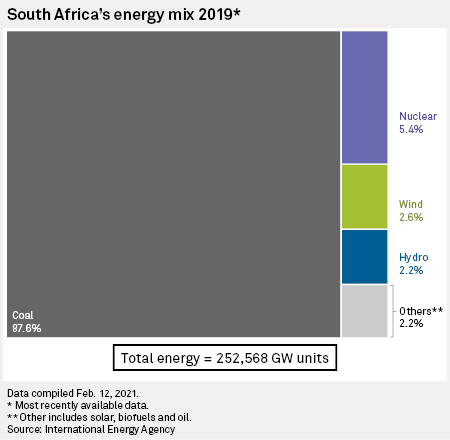

Environmental, social and governance issues were key features of President Cyril Ramaphosa's state of the nation address in the week of Feb. 8, in which he outlined plans for a "just transition to a low-carbon economy and climate-resilient society." South Africa is one of Africa's wealthiest countries but its economy is still heavily reliant on coal, which accounts for 87.6% of its energy, International Energy Agency data shows.

There are no specific legal requirements for responsible investing and financing, though South Africa's responsible investment code urges institutional investors to incorporate ESG into its investment activities.

The top four lenders by assets — Standard Bank Group Ltd., FirstRand Ltd., Absa Group Ltd. and Nedbank Group Ltd. — produce ESG reports and other related documents, but they offer limited insight, said Stuart Theobald, chairman of Intellidex, a financial markets research and consulting firm.

Absa and Nedbank declined to comment, while FirstRand and Standard Bank did not respond to questions from S&P Global Market Intelligence.

"What we want to know is whether [banks are] funding coal miners or natural gas and their exposure to these industries, for example. That would be useful," said Theobald. "Mostly, banks aren't disclosing the stuff we really want know. The catalyst for change largely comes from external sources, particularly European shareholders and funders who are putting pressure on banks to improve ESG disclosure."

Much of banks' ESG disclosure is "trivial verbiage to fill space," said Theobald.

The banking regulator should introduce specific regulations limiting or banning lending to certain sectors, said Happy Khambule, Greenpeace Africa's senior climate and energy campaign manager.

He described banks' pledges to limit their investments in certain sectors such as coal, weapons, and nuclear power as "vague platitudes" in response to growing shareholder activism and greater public awareness of lenders' role in supporting environmentally and socially destructive industries.

"The banks have a big role to play in making sure climate targets are achieved," he said.

'Transparency for transparency's sake'

South Africa's largest bank by assets, Standard Bank, published its first climate-related financial disclosure report in October 2020, which revealed that 4.4% of its loan book value is to the fossil fuel industry and related companies, while 0.8% is to the renewables sector. In comparison, FirstRand's fossil fuel lending accounted for 1.5% of its total loans, with 1.4% of the loan book dedicated to renewables.

The bank's policy for financing coal-fired power stations generally restricts it to lending to plants that produce less than 750 grams of carbon dioxide per kilowatt-hour, although it can lend to more polluting power projects under certain circumstances to low-income countries that include nearly 40 African nations.

|

Medupi, pictured, and Kusile are two new coal-fired power stations in South Africa, a country that generates most of its energy from coal. |

"We have seen some change" in banks' lending practices due to environmental considerations, "but it's not meaningful," said Khambule.

"It's good that transparency is increasing, but it's transparency for transparency's sake. They're all declining resolutions on disclosure or declining to have a moratorium on any new coal-fired power stations or any fossil-fuel-based projects. They don't want to do the actual thing that will give us major change."

ESG rankings

ESG factors were "considered" for 95% of Nedbank's investments up to July 2019, the bank said, while from 2020 ESG factors were considered for all its funds.

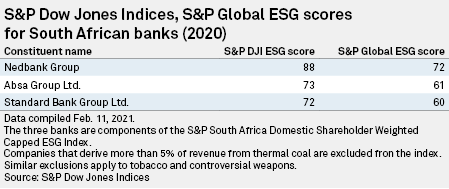

Nedbank has the best ESG score among South African banks, according to both S&P Global and S&P Dow Jones Indices' rankings. Absa stands in second and Standard Bank third. All three lenders are part of the S&P South Africa Domestic Shareholder Weighted Capped ESG Index, which requires companies to meet a range of ESG criteria.

"Banks are changing their lending practices, especially with regards to where they put their capital," said Anashrin Pillay, acting CEO of Risk Insights. "They're looking to incorporate ESG practices into their investment processes in terms of lending to ensure they can show transparency and governance, especially on the society side – community projects, gender, inclusivity etcetera."

A joint study by Risk Insights and Instinctif Partners analyzed the ESG disclosures of South Africa's banks based on their public statements in the 2019 financial year. This ranked Nedbank first, First Rand second, Absa third and Standard Bank fourth. Yet the study, published in December, found that around 84% of disclosures were related to governance, with environmental and social each representing about 8%.