Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Aug, 2022

By Yizhu Wang and Umer Khan

Community banks that want to sell banking-as-a-service to financial technology companies may find fewer new opportunities from neobanks but more from another fast-growing corner of fintech known as embedded finance.

The neobank marketplace has fewer new entrants and faces questions about players' profitability, which means that fewer new, scalable partnership opportunities with neobanks will be available for community banks who seek fee income, loan and deposit growth.

But weaker demand from neobanks has not dampened banks' interest in providing banking-as-a-service, and those providers are now turning to partners in embedded finance, industry executives said. Unlike neobanks, embedded finance providers do not resemble a digital version of banks. Instead, such providers blend financial services in nonfinancial experiences such as ride-hailing, pet care or food delivery.

"Neobanks are kind of the bread and butter of this space, but we are definitely seeing a significant increase in what we call embedded finance companies. So companies that aren't neobanks but have depository products built in," said Sheetal Parikh, associate general counsel at Treasury Prime Inc., a technology platform matching banks and fintechs for partnerships.

Buy-now, pay-later services demonstrate how embedded finance applications can work: Consumers do not visit e-commerce websites with the goal of applying for personal loans, but instead encounter financing and payment options designed and provided deliberately in the context of shopping.

Declining neobank entrants

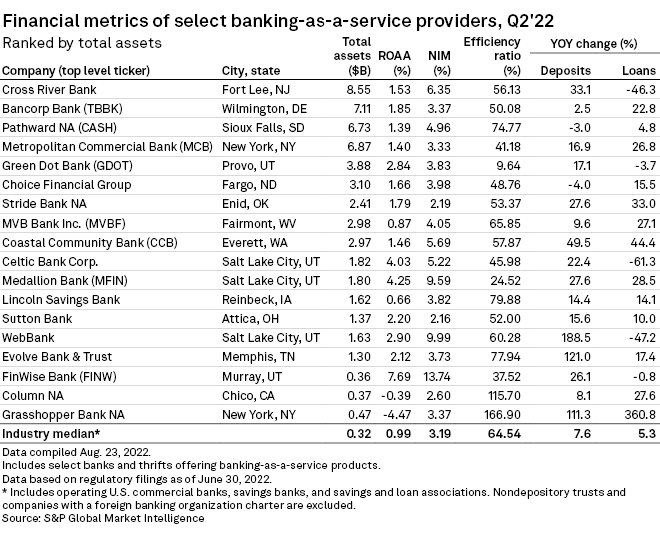

Banks remain highly interested in the robust profitability metrics of the banking-as-a-service model. Most of the banks in banking-as-a-service generated a better return on average assets, net interest margin and efficiency ratio in the second quarter compared to industry medians, according to data compiled by S&P Global Market Intelligence.

But fewer fintechs are looking for bank partners at the moment, based on the current pipeline at Treasury Prime, Parikh said. She added that while banks want to capture loan and deposit growth in the rising interest rate environment, many early-stage and smaller fintechs face operational hurdles with the economy being on the edge of a recession.

The number of new neobanks appears to be declining, indicating fewer neobanks that would need new sponsor banks.

There were 59 new neobanks created in 2021 globally, versus the peak of 94 in 2020, according to a study by consultancy Simon-Kucher & Partners. The firm estimated that among the 85 neobanks in the U.S., less than a handful are breakeven. Several are burning as much as $140 per customer annually, showing an unclear path to profitability.

Moreover, even for a top neobank that handles larger transaction volumes, only one or two sponsor banks are needed to fully function. That leaves little space for other banks to compete to sponsor the top neobanks.

On the bright side for banks, the demand for sponsor banks from fintech neobanks active in the market is steady. Although some neobanks have sought to own a bank charter, that approach is not suitable for all, and partnering with a bank is still the mainstream model, said Christoph Stegmeier, a senior partner in Simon-Kucher's global banking practice.

New ideas emerging

There is no shortage of new market opportunities as fintechs reimagine ways to consume financial services.

Retail, gaming and healthcare are among the industry verticals where merchants ask for banking-as-a-service solutions, such as deposit accounts to buy gaming items, said Maria Prados, head of vertical growth teams at Worldpay, a subsidiary of Fidelity National Information Services Inc.

"It helps a lot of other banks that maybe couldn't reach companies like Tesco or Walmart, to reach them through a fintech or an embedded finance marketplace," Prados said.

Bilt Rewards, a rental rewards and payment platform owned by Kairos HQ, is helping its credit card issuer, Wells Fargo & Co., to reach landlords and property management companies of more than 2 million apartment units across the country. Renters use Bilt's credit card to pay rent, which can improve their credit scores, and they earn points to redeem things like flight tickets. Bilt also works with Evolve Bank & Trust for payment processing and card network Mastercard Inc.

Bilt took four years to build its proprietary landlord network, which became a competitive differentiator to attract the banks to do business with the company, Bilt COO Dan Seder said. For Bilt, sponsor banks' core banking technology and customer services are key criteria for consideration.

"Core technology ties into pricing. Typically, the less layers you have, the cheaper you can offer to clients, to the end user and the fintech," Seder said in an interview.

Regulatory scrutiny increasing

The fast growth of banking-as-a-service has drawn increased regulatory attention recently, especially on depository products structured upon fintech and bank partnerships.

"I think the biggest new thing here is that the regulators are also focusing on deposit-oriented programs, and we're seeing more scrutiny there. I think that's pretty new," said Jonah Crane, partner at advisory and investment firm Klaros Group.

In late April, the Consumer Financial Protection Bureau said it will use its dormant legal authority under the Dodd-Frank Act to supervise nonbank financial companies such as fintechs. In May, the Federal Deposit Insurance Corp. approved a final rule to prohibit misrepresentations about the status of FDIC deposit insurance.

For banks, fintechs' advertising and marketing efforts could pose compliance risks, such as the misuse of the FDIC logo. Banks also need to ensure compliance around anti-money laundering when gathering deposits through fintechs. The viability of the fintech partner could be another concern, since the failure of the fintech may cause damage if the bank relies on those deposits, Crane said.

"This is my personal opinion that we are probably on the precipice of some proposed legislation, that's going to put some guardrails on fintechs that are actually engaging in deposits," Parikh said. "There's been a lot of proposed legislation regulating crypto and I think that banking-as-a-service and fintechs are really next.