Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Feb, 2023

By Zoe Sagalow and Xylex Mangulabnan

U.S. banks must clear higher hurdles in the merger review process as regulators' focus on Community Reinvestment Act compliance intensifies.

Regulators are taking a harder look at banks' Community Reinvestment Act, or CRA, compliance as community groups increasingly target the industry and the White House directs regulatory agencies to focus on issues such as fair lending. In addition to tougher CRA exams, the increased focus has trickled down to bank merger application review and is one reason why deals are taking longer, advisers and analysts told S&P Global Market Intelligence. Both acquirers and targets need to have a firm grip on CRA for deals to go smoothly, they said.

"The world has changed," Frank Sorrentino, managing director at Stephens Inc., said in an interview. "If you're going to successfully consummate M&A, both companies have to have very solid CRA programs."

Adding steps to dealmaking process

Regulators' focus on CRA has created extra steps in the dealmaking and due diligence process, investment bankers told Market Intelligence.

Now, when evaluating buyers in a selling process, i-bankers are asking for more detailed information on a potential buyer's CRA and Bank Secrecy Act compliance, said Craig Mueller, a managing director and co-head of the financial institutions group at Oak Ridge Financial.

"We will now require and ask them to give us some information as it relates to how they're managing their compliance to CRA, BSA, that type of thing, so that we have an ability to gauge the risk of a buyer not being approved by the regulators," Mueller said in an interview. "We're going to be more hyper-vigilant towards that."

To assure their deals pass regulatory muster, banks should engage with community groups early on and ensure their CRA programs are airtight, according to Sorrentino. Right now, CRA is as important as capital and liquidity in merger applications, he said.

"Part of announcing M&A now is you've got to have a whole separate workstream on reaching out and talking to these protest groups, and it's just another avenue alongside all the financial things that have to happen," Sorrentino said. "It's a key part to getting a deal approved."

Prolonged by protests

The rise of community group protests targeting specific bank mergers is one reason for regulators' increased focus on CRA, experts said.

There have been "significant increases" in adverse comments related to merger applications, which usually lead to investigations and result in longer closing timelines, said Stephanie Kalahurka, partner at Fenimore Kay Harrison LLP, who represents financial institutions on regulatory matters among other topics.

Protests and subsequent regulatory investigations can also lead to nonstandard conditions like the one Stellar Bancorp Inc. received in which the combined company must increase the number of mortgage applications and approvals among African Americans.

Failure to meet nonstandard conditions "may then become examination criticism and the basis for enforcement during future examinations," Kalahurka said.

Proactively addressing CRA and community group issues can help banks large and small avoid deal closing delays, experts said.

"It has certainly been a key driver for why deals ... are taking a long time to get closed," Sorrentino said. "It's not just a size thing. It's not just bigger banks that are getting impacted by it."

Preparing for tougher CRA exams

The increased focus on CRA in reviewing bank merger applications is just one part of regulators' larger focus on CRA compliance in recent years, industry experts said.

Overall, CRA is more important to regulators than it was two or three years ago and "it's more than just a 'check the box' matter — it's sort of an ongoing process," Christopher Marinac, director of research at Janney Montgomery Scott LLC, said in an interview. "It's clear to me for the regulators that this is not going away — as a topic, as a priority, as a task," Marinac added.

Some advisers said CRA exams are tougher than ever before.

"It is something that everybody needs to be thinking about. Just because you were satisfactory last exam and you think you're doing everything the same way, you might not be satisfactory this time," Kalahurka said in an interview.

Regulators might be zeroing in on CRA more due to direction from the Biden administration.

"Banks must be sensitive to the priorities of each administration, and this one is certainly focused on issues surrounding consumer protection and engagement," John Geiringer, a partner in the Financial Institutions Group at Barack Ferrazzano Kirschbaum & Nagelberg LLP, said in an email.

Many banks are preparing for their exams by conducting self-assessments and consulting with advisers and examiners, but the renewed focus on CRA is increasing competition to serve low-income and minority customers, experts said.

"Right now in some markets, it's extremely aggressive competition for a limited number of loans from majority-minority areas or low-income areas because there's a big focus on this," Kalahurka said.

The benefits of scale

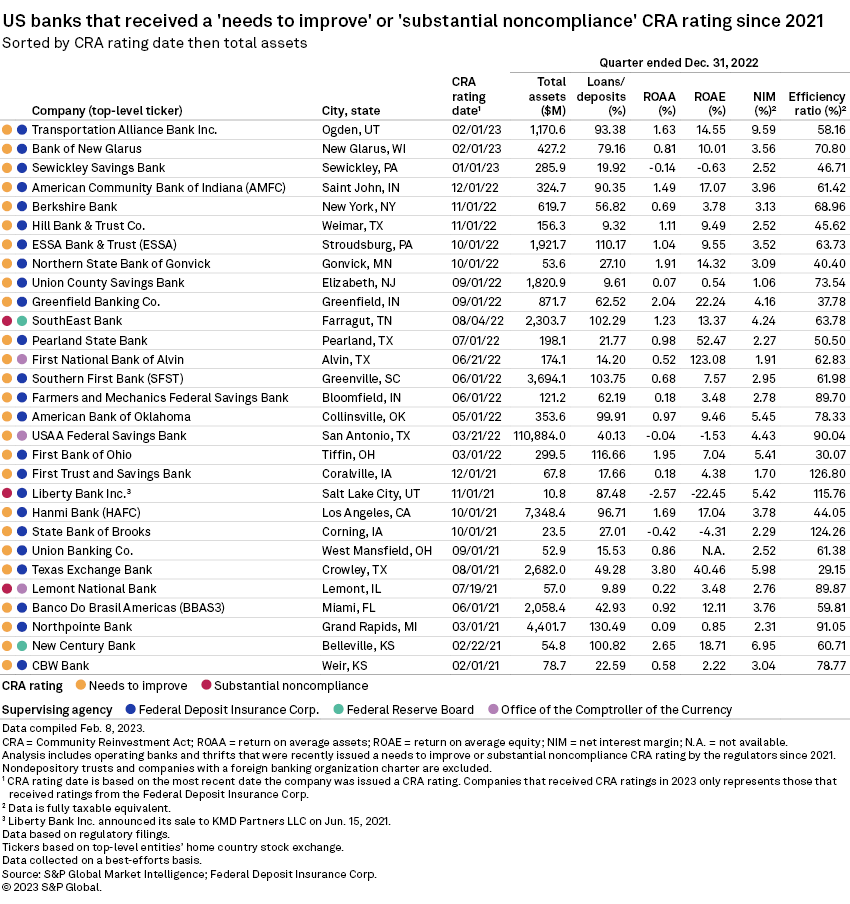

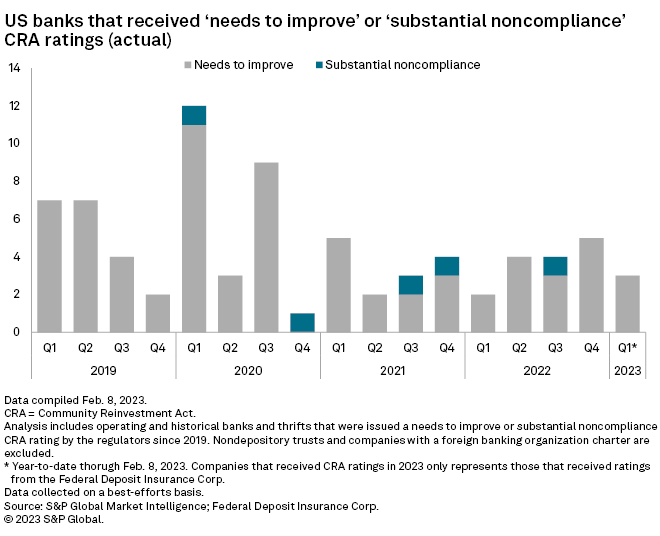

Less than two months into 2023, three banks have received "needs to improve" ratings. In 2022, 14 banks received "needs to improve" ratings, up from 12 the year before but down from 23 in 2020 and 20 banks in 2019.

Some industry experts expect an uptick in "needs to improve" CRA ratings this year. Marinac said he anticipates more banks will receive that rating this year because he does not think CRA is sufficiently high on banks' radars.

Conversely, the number of "outstanding" ratings — the highest CRA mark a bank can receive — has steadily declined in recent years. Last year, 98 banks received that rating, compared to 123 in 2021, 154 in 2020 and 170 in 2019. Consistently each year, most banks receive "satisfactory" ratings.

That trend could be related to the resources — such as time, staff and money — it takes to receive an "outstanding" rating.

"Many banks are comfortable having a 'satisfactory' CRA rating and don't feel compelled to stretch their limited resources to become 'outstanding,'" Geiringer said.

In some cases, it is easier for larger banks to dedicate more resources to CRA compliance, said Riley Adams, chief credit officer at First Resource Bank and a former examiner at the Federal Deposit Insurance Corp.

For community banks, trying to be "outstanding" would mean devoting too many resources to a single area for smaller banks, he said. The Lino Lakes, Minn.-based bank, which had $484.6 million in assets at Dec. 31, 2022, scored a "satisfactory" rating on its most recent CRA exam at the end of last year.