S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jul, 2023

By Alison Bennett and Xylex Mangulabnan

US banks with large commercial real estate loan concentrations must work to proactively mitigate any potential problems or run the risk of regulatory intervention.

As concerns over commercial real estate (CRE) grow and those portfolios face headwinds, regulators have made it clear they are paying extra attention to banks with outsized concentrations and will not shy away from taking action against institutions that present risk. Those actions could include regulatory rating downgrades and increased capital retention requirements, experts told S&P Global Market Intelligence. Banks should take steps now to mitigate risk in order to avoid such actions, they said.

"The fact that [regulators are] calling this out now just heightens the need for banks to really assess how they're mitigating for those risks effectively, and not creating other problems," Peter Dugas, who heads the Center of Regulatory Intelligence at financial consulting firm Capco, said in an interview.

Although CRE loan scrutiny has always been a consistent focus for the agencies, "the pendulum is swinging more towards activism," said Carleton Goss, counsel with law firm Hunton Andrews Kurth.

"What you're seeing is regulators saying, 'I'm not going to follow an excessively lengthy and procedural approach when I see a problem. I'm going to use the powers that I have,'" Goss said.

CRE concentrations

Banks have tightened underwriting standards on CRE loans in recent months as cautious investors looked for weakness in lenders' balance sheets following the recent bank failures.

While some real estate industry borrowers, in property types including industrial and multifamily, remain relatively stable, others have suffered in recent years. In particular, occupancy in office properties has not recovered from the COVID-19 pandemic and the rise of work from home, while labor-related expenses for health care property operators remain high in a tight job market.

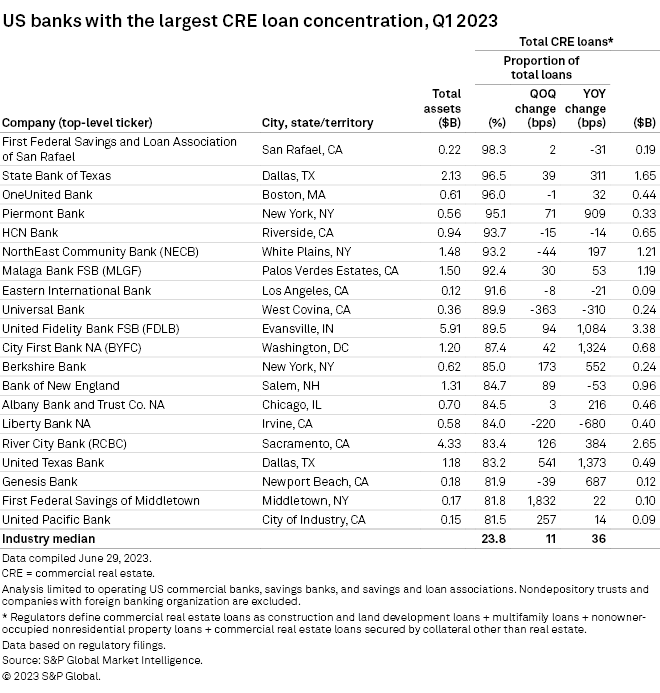

In the first quarter, CRE loans made up a median of 23.8% of US banks' total loans. Generally, the nation's largest banks carried lower concentrations than smaller banks.

Among the 20 US banks with the largest CRE loan concentration at March 31, all had assets below $6 billion. First Federal Savings and Loan Association of San Rafael topped the list, with CRE loans making up 98.3% of its total loans, and another seven community banks had more than 90% of their total loans concentrated in CRE, according to an analysis by Market Intelligence.

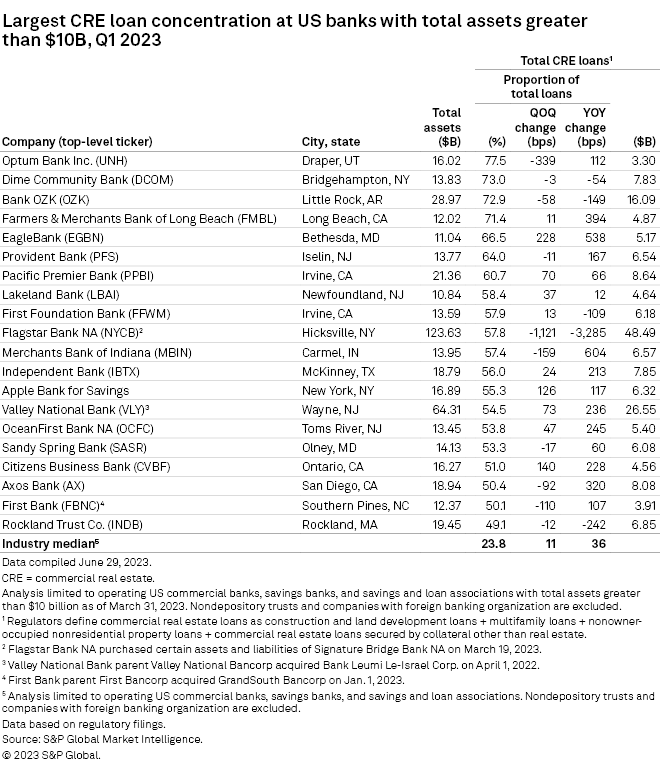

When narrowing the analysis to banks with more than $10 billion in assets, CRE concentrations for the top 20 banks declined but were still elevated from the industry median. Optum Bank Inc. topped the list with 77.5% of its total loans in CRE. All but one bank on the list had at least half of its total loans concentrated in CRE.

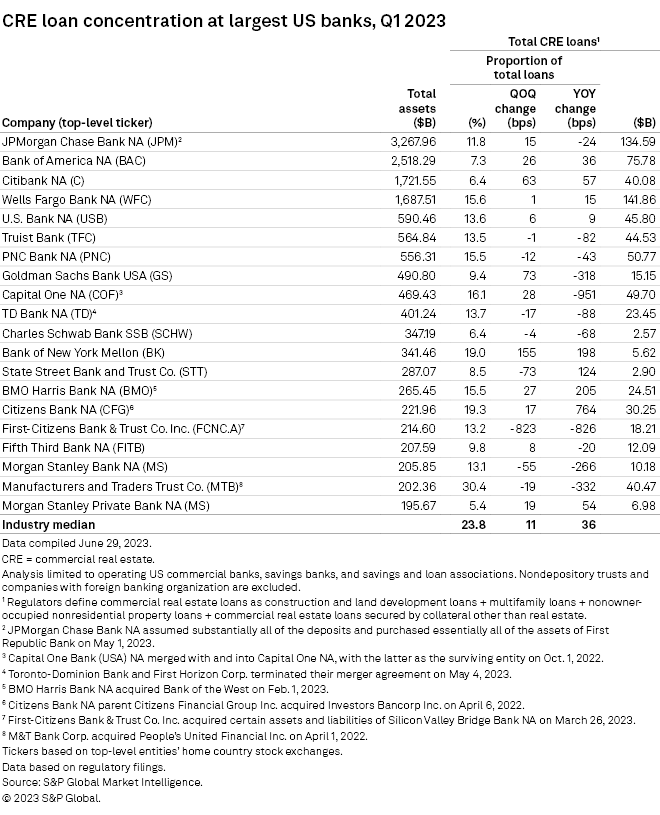

Among the 20 largest US banks, M&T Bank Corp. subsidiary Manufacturers and Traders Trust Co. had the highest CRE loan concentration, with the segment taking up 30.4% of its total loans. Every other bank on the list reported concentrations below 20%.

Regulatory action

Regulators have made it clear in recent months that CRE portfolios are a focus, particularly among banks with large concentrations.

"We have a long-standing expectation, this is interagency, that CRE-concentrated banks should look at their own performance in a downturn. And so we're scrutinizing that very vigorously," Todd Vermilyea, senior associate director of the Fed Board of Governors Division of Banking Supervision and Regulation, said June 16.

Martin Gruenberg, chairman of the Federal Deposit Insurance Corp., said at the release of the FDIC's most recent Quarterly Banking Profile that CRE would be a significant focus for his agency, calling it "a matter of ongoing attention in our supervision work."

Speaking at S&P Global Market Intelligence's Community Bankers Conference in May, an FDIC examiner cautioned that the agency will take a hard look at internal risk assessments, reserves and capital positions for banks with high CRE concentrations.

However, the intensity of regulators' scrutiny depends on a number of factors.

For example, states that encourage flexible return-to-work policies or have a lot of technology and other companies that make it easier for employees to work from home pose more risk, Capco's Dugas said.

"When it comes to CRE, it's really going to be a regional issue," Dugas said. "When you look at banks that are operating in states like Florida and Texas and some areas within the South ... they're in much better shape than states like California or New York or Illinois."

Moreover, office is seen as a higher risk than other property types.

"Not all commercial real estate is the same. A high-rise office building in a big city is different than an owner-occupied mom-and-pop business on Main Street," said James Stevens, co-leader of the financial services industry group at Troutman Pepper.

Wherever supervisors see "very significant risk concentrations that aren't being handled properly," they will take swift action, according to Goss of Hunton Andrews Kurth. Such consequences include ratings downgrades and supervisory agreements, he said. They could also require banks to raise additional capital, Goss said.

To prepare for the enhanced scrutiny, banks should work now to proactively address any risk before it is identified by regulators, bank advisers said.

Financial institutions should be asking themselves, "'Do I have concentrations of any of these [risky] kinds of properties, or any risks geographically by asset class? Is there anything at my bank that could be an issue, and if there is, what should I be doing to mitigate that?'" said Matthew Bisanz, partner with Mayer Brown's financial services regulatory and enforcement practice.

Banks can mitigate risk with interest rate hedges or by slowing their lending, Bisanz said. Those are actions "that a banking regulator might press a bank to do based on a concern that exposure to a portion of the CRE market is too large," Bisanz said.