S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Nov, 2021

By Mary Christine Joy

Banks can strengthen existing client relationships and acquire new customers by helping companies understand and implement sustainability standards, especially with regard to corporate finance and treasury functions, according to a report by Coalition Greenwich, an analytics company owned by S&P Global.

Many companies have embraced environmental, social and governance-linked securities, with issuances of green bonds more than doubling year over year in the first nine months of 2021 to $365.2 billion, according to Markets Media data cited in the report.

However, beyond ESG-related financing vehicles such as these, many corporate CFOs and treasurers are unsure what "environmental, social and governance" means for their departments, and banks that move quickly on such issues could build a long-term competitive advantage, Coalition Greenwich said. Banks can help companies figure out how they should apply ESG standards in corporate finance, treasury operations and across their organizations, it said.

"We need our banks for financing mainly, but also advice," a representative of a large industrial company told the analytics firm.

Corporate banking

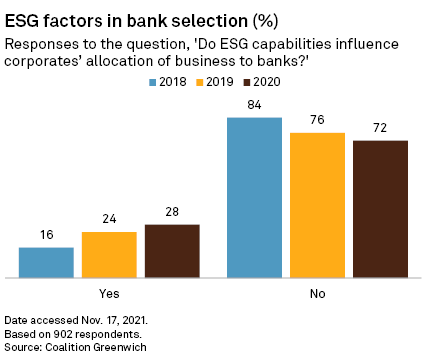

Companies are expected to start taking ESG performance into account soon, if they are not already doing so, when allocating their banking business, Coalition Greenwich said.

Of a group of large corporate companies surveyed, 28% said ESG capabilities influence how they allocate business to banks, with respect to 2020. This is up from 24% in 2019 and 16% in 2018. The share is much higher in certain countries, such as Norway, where the figure is about 50%.

Trade finance

ESG considerations in trade finance have accelerated as a result of the COVID-19 pandemic, according to the report.

"Expertise in sustainable finance" is considered a key criterion when selecting a trade finance provider by 16% of large corporates in Europe with respect to the year 2020, compared to 3% for 2019. The Nordics, Germany and the Netherlands were the top three regions in Europe where respondents cited expertise in sustainable finance as a top consideration.