Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Dec, 2022

By Yizhu Wang and Thomas Mason

The cryptocurrency ecosystem has proven to be a volatile funding source for banks servicing digital asset customers on a large scale.

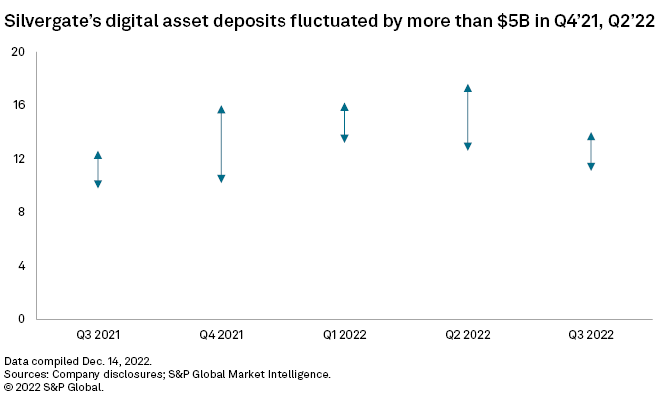

Twice in the last year Silvergate Capital Corp.'s digital asset deposits have fluctuated by more than $5 billion in a given quarter thanks in part to bitcoin reaching a peak and the collapse of the stablecoin pair Luna and TerraUSD. Metropolitan Bank Holding Corp. saw its cryptocurrency-related deposits drop nearly 40% sequentially in the third quarter.

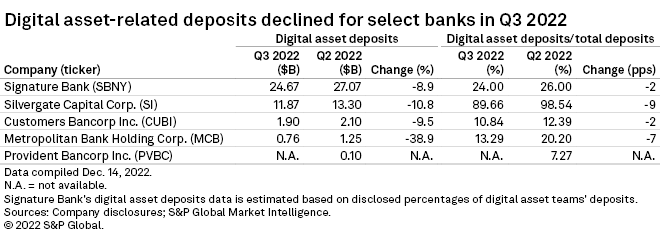

Other banks that report that data also saw significant declines in deposits tied to cryptocurrency clients in the third quarter. Two of the largest cryptocurrency banks by deposit size, Signature Bank and Silvergate, reported quarter-over-quarter drops of 8.9% and 10.8%, respectively. Customers Bancorp Inc. saw a 9.5% sequential decline in the third quarter.

The fluctuation is expected to continue, given the volatility in the asset class stemming from the FTX Trading Ltd. fallout.

Strategy assessment

The interest in the space grew as banks sought to capture the deposits that were flowing into the digital asset ecosystem and out of depositories. Several experimented with loans using cryptocurrency or cryptocurrency mining equipment as collateral. As of October, the Federal Deposit Insurance Corp. was aware of about 80 financial institutions under its supervision that expressed interest in cryptocurrency-related activities, and about 24 of them were actively engaged.

Now, concerns have escalated as the market capitalization of cryptocurrency fell to about $811 billion as of Dec. 20 from nearly $3 trillion in November 2021.

Provident Bancorp Inc. is typically among the small group of banks that reports cryptocurrency-related deposits, but it has not filed a third-quarter Form 10-Q as it is "evaluating the actual level of losses" written to distressed cryptocurrency miners, according to a Form 8-K filing.

Metropolitan also felt some impact from the industry's turmoil. About 70% of its $485.9 million third-quarter decline in cryptocurrency-related deposits resulted from the bankruptcy of customer Voyager Digital Ltd. in July. The bank is pivoting away from providing banking for digital asset customers and has not onboarded any since 2019.

Bigger players are also changing their strategies. Signature Bank, which is estimated to have $24.67 billion of deposits tied to customers in digital assets as of Sept. 30, said it would cut cryptocurrency-related deposits to between $8 billion and $10 billion by the first quarter of 2023.

In the third quarter, Silvergate reduced the percentage of noninterest bearing deposits, which was driven by the Silvergate Exchange Network catering to digital asset customers, by issuing brokered certificates of deposit, according to a Form 10-Q filing.

All is not lost

Several banks have made progress in blockchain-enabled payments to generate fee income, notably Signet by Signature Bank and the Silvergate Exchange Network by Silvergate. These networks cater to the payment needs of cryptocurrency companies and aim to make it easier to convert between digital assets and fiat currency.

The developer of Signet, Tassat Group Inc., has been introducing the technology to more banks for commercial payments unrelated to cryptocurrency, including Customers Bancorp Inc., Western Alliance Bank and Cogent Bancorp Inc.

Another blockchain-enabled payment network is the USDF Consortium formed by nine bank members, fintech investor JAM FINTOP and blockchain developer Figure Technologies Inc.