S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Mar, 2023

By Bill Holland

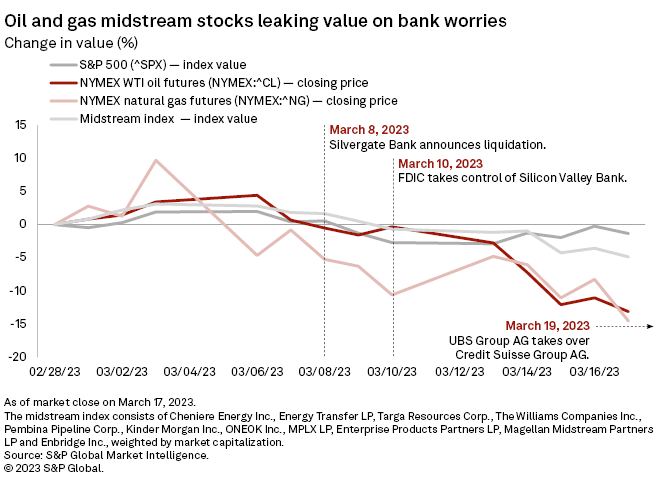

Some investors have exited oil and gas midstream stocks in search of less risky assets after a series of global banking debacles, but two years of capital discipline by processing and pipeline companies have strengthened balance sheets and made the companies less vulnerable to an economic downturn.

Energy industry financial analysts said the real impact of recent bank failures will take some time to affect the oil and gas complex, but in an atmosphere of uncertainty, some investors became wary of oil and gas stocks.

According to S&P Global Market Intelligence data, a basket of 11 large North American midstream operators have lost almost 5% in value since the end of February. Over the same period, the New York Mercantile Exchange West Texas Intermediate crude oil future front month contract dropped 13%, and the NYMEX Henry Hub gas futures contract lost 14.6%.

"The volatility in crude oil prices and the equities roiled energy portfolios last week," Jefferies Group LLC oil and gas analyst Lloyd Byrne told clients March 20. "The consensus on oil's significant decline was the combination of macro positioning, volatility in rates, options expiry, and negative gamma leading to significant unwinds." Gamma is the rate of change in a stock's option price compared to the change in the price of the underlying stock itself. High gamma indicates volatile options pricing.

"The most immediate energy investor concern is around contagion/'ring fencing,' but also tightening of future credit availability/loan growth, loss of consumer confidence and impact on second half 2023 demand," Byrne said. "This will play out over weeks not days, per most investors we spoke to."

On March 19, UBS Group AG announced it agreed to an emergency takeover of Credit Suisse Group AG following tremors in international financial markets after the failures of California's Silicon Valley Bank and other banks.

"Oil prices have plunged despite the China demand boom given banking stress, recession fears, and an exodus of investor flows," the commodities team at Goldman Sachs said. "Historically, after such scarring events, positioning and prices recover only gradually, especially long-dated prices."

But years of strong commodity prices and capital discipline have left the midstream sector with low debt levels and strong cash flows, ready for hard times.

"We talked to most of our companies, and we don't see this having any impact on the midstream's ability to access capital," Rob Thummel, managing director at TortoiseEcofin, a family of energy infrastructure funds, said in a March 17 interview.

The midstream sector and the broader energy sector have changed dramatically in the way they access capital, Thummel said. "The energy sector, including midstream, is much less reliant on the capital markets to really operate their businesses — that's the first thing," Thummel said. "And then number two: None of these companies have much exposure to any of these regional banks that are that are experiencing some difficulties."

According to the corporate credit raters at DBRS Morningstar's energy, utilities and natural resources team, bank troubles and commodity price declines will have minimal impact on midstream credit scores. "Rated issuers in the pipeline sector also have strong liquidity profiles, good access to capital markets, and generate a majority of their revenue from medium- to long-term contracts," DBRS Morningstar said in a March 17 note.

"Riskier and economically sensitive assets such as energy contracts have experienced pricing pressures in recent days as market participants fret over the extent of a US economic slowdown, and they are redirecting money to safer investment havens from riskier assets," DBRS Morningstar said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.