Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Dec, 2022

By Zoe Sagalow

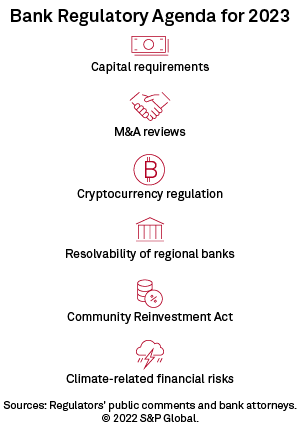

Banking regulators are expected to focus on capital requirements and resolvability for regional banks among other key topics in 2023.

The Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency will also be paying attention to stablecoins and other types of cryptocurrency, climate-related financial risks, new rules related to the Community Reinvestment Act, and a revamp of M&A review procedures, industry observers say.

|

"The banking regulators have a very full plate for 2023," Margaret Tahyar, partner and co-head of Davis Polk & Wardwell LLP's financial institutions practice, said in an interview.

The three regulators are figuring out how to balance the needs of business and the public, Derek Tang, economist at Monetary Policy Analytics, said in an interview.

"They want the banking system to be strong, to be well-capitalized [and] to be able to raise capital," Tang said. "At the same time, they don't want there to be a risk to the public, and especially not to the taxpayer, if these firms need to be resolved with public help."

The Federal Reserve's vice chair for supervision, Michael Barr, said in September that he would address capital requirements this fall, but the highly anticipated details are yet to be seen. Barr said he will take "a holistic view" of the supplementary leverage ratio, countercyclical capital buffer, stress testing and the Basel III endgame.

The Basel Committee on Bank Supervision is an international body that has been working on capital requirements, set to be implemented Jan. 1, 2023. These standards will eventually apply to U.S. banks, regulators said.

Resolvability of regional banks

In October, the FDIC Board approved the publication of a notice of proposed rulemaking to request comment on whether another layer of capacity to absorb losses could "improve optionality in resolving a large banking organization."

The Federal Reserve issued a similar proposal on Oct. 14, in conjunction with its approval of U.S. Bancorp's acquisition of MUFG Union Bank NA. The notice seeks input on extending rules for single point of entry and total loss-absorbing capital to large regional banks, which would require them to hold tens of billions of dollars in long-term debt, in addition to existing capital requirements.

The Fed considered some resolvability issues in its approval of the merger application for U.S. Bancorp and MUFG Union Bank NA, which was unusual, Chip MacDonald, managing director of MacDonald & Partners LLP, said in an interview.

For smaller banks, fewer issues will be raised related to resolvability because those organizations are smaller and less complex, MacDonald said.

The Fed is seeking comments until Jan. 23, 2023, an extended deadline from when the proposal was announced.

"This represents another example of how regulatory requirements for global systemically important bank holding companies trickle down to smaller institutions," John Geiringer, a partner in the Financial Institutions Group at Barack Ferrazzano Kirschbaum & Nagelberg LLP, said in an email.

The Fed said Sept. 30 that it anticipates issuing guidance related to further developing resolution plans, also known as living wills. The guidance would apply to banking organizations in categories II and III, which generally means those that have more than $250 billion in total assets yet are not global systemically important banks.

Cryptocurrency, other fintech companies

Banks are looking for rules from the agencies related to stablecoin and other cryptocurrency transactions, which have not been regulated as much as traditional financial services. FTX Trading Ltd.'s bankruptcy and the related fallout for the crypto industry is likely to make regulators more cautious.

Stablecoins are intended to be different from other crypto in that their values are pegged to other assets, such as commodities or the U.S. dollar.

"The stablecoin in particular is an urgent risk because it could impinge on the public's trust in the dollar system in general, even though of course it's not issued by the state, but it does sort of leverage public trust," Tang said. "The government has a responsibility to make sure that the public's trust is not eroded because of that."

There is a question, he added, of who the right regulator for the currencies might be, and whether the Fed, the FDIC or others might take the lead.

Anthony Balloon, partner at Alston & Bird LLP advising clients on M&A, said the developments involving FTX and other macro events could affect bank M&A.

"I don't know that it will have a direct effect, but I think nobody wants to be the regulator who missed an issue in a transaction," Balloon said. "It's just another headwind in the dealmaking environment from a regulator's perspective that's going to push them toward caution rather than swift approval."

Climate-related financial risks

Another of Barr's priorities is assessing climate-related financial risks. The Fed plans to launch a pilot in 2023 to conduct micro-prudential scenario analyses, but "it won't have direct capital or supervisory implications," Barr said in September. The pilot will include six large banks — Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley and Wells Fargo & Co.

"Banks have actually been quite keen to participate in it because the risks are there, quite evidently, but of course Republicans are kind of seizing on it as potential overreach," Tang said.

Barr is "going to tread very carefully to make sure that it's not crossing any red lines that lawmakers have not already set out," Tang said. "So the regulators' attitudes have been if there needs to be kind of more activism there, then it might require a change in the law. But if there's no change in the law, then we'll just kind of color within the lines."

The FDIC proposed principles in March related to climate risk for banks with more than $100 billion in total assets and has not issued a final version.

Tahyar sees U.S. banking regulators "taking it slowly, thoughtfully and carefully," adding, "Banks may be doing a whole bunch of this already in their risk governance."

Community Reinvestment Act rulemaking

The Office of the Comptroller of the Currency, FDIC and Fed jointly proposed rules related to the CRA and have received comments but have not yet finalized the proposal. The rules, which were unveiled in May, would expand both the reach and scope of evaluations on whether banks are providing enough financial services to low- and moderate-income communities under the 1977 law.

That area has gained importance in the merger review process and will continue to be an important factor in CRA ratings in 2023, advisers said.

Regulatory leadership

The FDIC will have two new board members, making a full slate. Martin Gruenberg will be chair after having been in that role on an acting basis, Travis Hill will be vice chair and Jonathan McKernan will be a board member. Hill and McKernan are Republicans. The Federal Deposit Insurance Act requires that no more than three board members can be part of the same political party.