S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Oct, 2021

By Zoe Sagalow and Zuhaib Gull

Rising deal activity and a rocky political environment have produced a logjam of large bank deals awaiting Federal Reserve approval — and a clearing is not yet in sight.

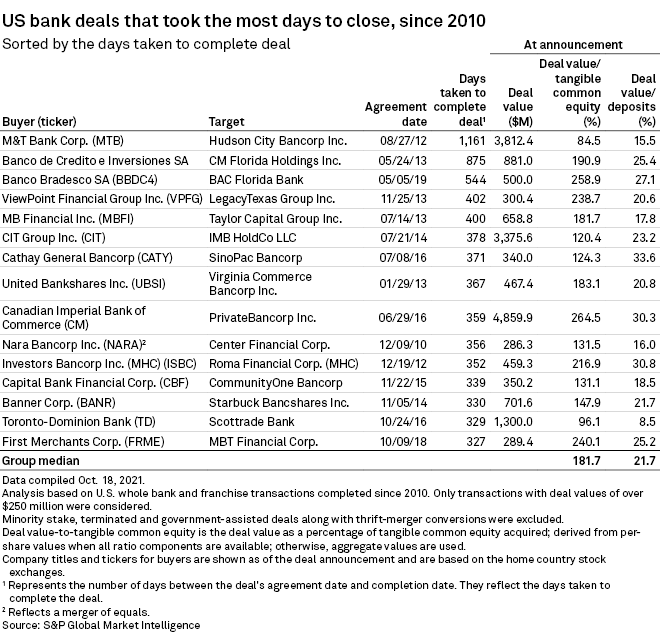

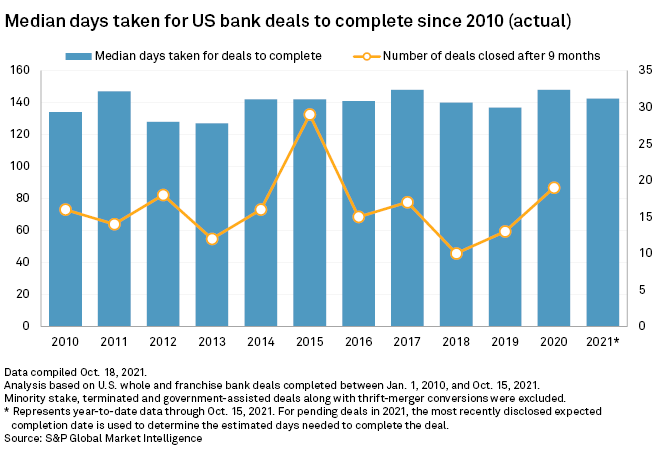

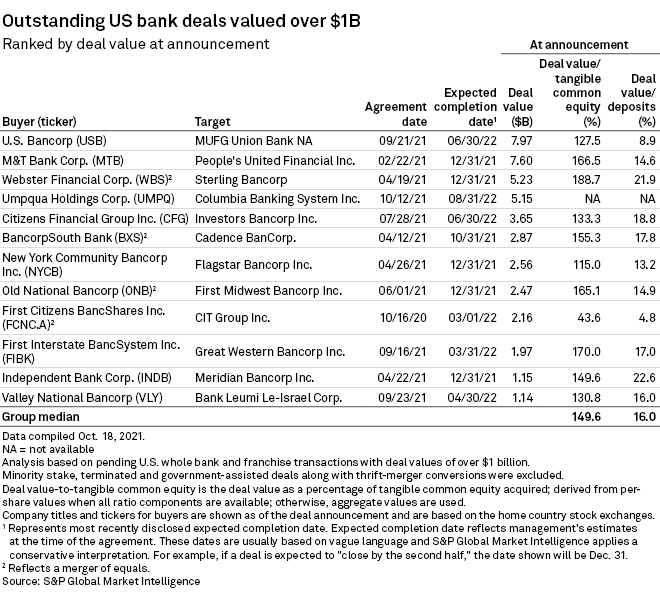

While the median time to close for completed deals has not yet moved up significantly, there are 12 pending bank deals with values of more than $1 billion at announcement. Several of those deals have been outstanding for some time, with executives reporting a lack of clarity on when regulatory approval would come.

Lawyers and bankers have attributed the slowdown to the increase in deal activity, President Joe Biden's July 9 executive order to reconsider regulatory approvals and uncertainty in Fed leadership. Randal Quarles' term as vice chair of supervision ended on Oct. 13, and it is not clear whether Jerome Powell will be renominated as chair. Further, the Fed is dealing with the fallout of an ethics scandal over insider trading, which led to the retirement of two presidents at regional banks and new rules restricting trading activity.

"Washington can be a bit of a black hole at times, but there are a lot of political winds blowing and issues," said John Gorman, partner at Luse Gorman PC. Gorman added that the influx of large deals need to be approved by the Federal Reserve Board of Governors, rather than a regional Reserve Bank under delegated authority.

Waiting is the hardest part

A merger of equals between First Citizens BancShares Inc. and CIT Group Inc. has been waiting the longest, among the pending deals, with an announcement date of Oct. 16, 2020. Leaders at First Citizens said they have provided all information requested by regulators and that deal approval sits at the Fed. S&P Global Market Intelligence reported last week that an anonymous letter writer alleged antitrust violations in the deal.

Executives behind Umpqua Holdings Corp.'s $5.15 billion deal, announced Oct. 12, with Columbia Banking System Inc. expect to face a lengthy approval process from regulators.

"There's a backlog right now at the Fed on approvals of this nature," said Columbia CEO Clint Stein. "So we expect that it will be a longer approval process than what we just went through with our Bank of Commerce Holdings approval that went very quickly. And that's why we're anticipating a mid-2022 close for this."

|

Several executives reported during earnings season that they were waiting on the Fed. Webster Financial Corp. executives said the bank lacks a "clear line of sight to timing" as they seek Fed approval for their $5.23 billion deal with Sterling Bancorp. And Old National Bancorp executives similarly said they are stuck "in the queue" looking for approval from the Fed on its $2.47 billion deal with First Midwest Bancorp Inc. Another deal that is a bit smaller — WSFS Financial Corp.'s $989.9 million tie-up with Bryn Mawr Bank Corp. — is also stuck waiting on approval from the Fed, WSFS management reported during their earnings call.

On the other hand, executives at Independent Bank Corp. reported that their $1.15 billion deal with Meridian Bancorp Inc. had received approval from federal regulators but had not yet secured sign-off at the state level.

Uncertain times

The causes of the delay are unclear, said Edward Mills, a managing director and Washington policy analyst at Raymond James & Associates Inc. He has been receiving questions from investors, who are also unsure.

Possible reasons include political issues, effects of Powell's potential renomination and the expiration of Quarles' term as vice chairman for supervision, he said.

"I don't think they would say because of all that, things are slowing down, but I think that's contributing to it," Gorman added. Gorman said he anticipates deals, especially larger ones, will take about six to nine months to be completed — longer than the four to six months they typically take.

Pending deals are "highly likely" to be approved, though the time frame is unclear, Mills also said.

"The worry that's out there is: Are the delays telling us something we don't know, such as one or more of these deals could surprise us and not get approved?" Mills said.

Gorman also said that President Joe Biden's executive order from earlier this year might be pushing some bankers to pursue deals before any potential changes to the review process, creating a bottleneck of deals seeking approval. Biden's order called on the attorney general to review the process of bank merger approvals, in consultation with banking regulators.

The upcoming holiday season and a busy schedule for the Fed could further contribute to delays, said John Geiringer, partner at Barack Ferrazzano Kirschbaum & Nagelberg LLP.

"We tell our clients to assume that December is a dead month for any applications at the Federal Reserve Board because of the [Federal Open Market Committee] meeting and everyone's holiday schedule," Geiringer said in an interview.

With a full pipeline and the catalysts for bank mergers — low growth, rising fintech costs, time-intensive regulations — only intensifying, bankers appear likely to be waiting on the Fed into 2022.