Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Mar, 2023

By Zoe Sagalow

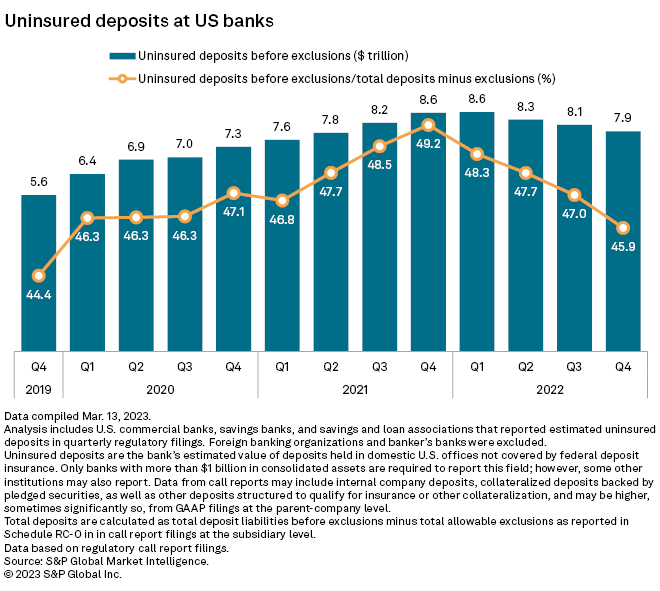

The recent failures of Silicon Valley Bank and Signature Bank, both of which had large amounts of uninsured deposits, have prompted debate about the future of deposit insurance limits.

After the 2008 financial crisis, the Federal Deposit Insurance Corp.'s deposit insurance maximum was raised to $250,000 from $100,000. In the face of this new banking turmoil, largely related to uninsured deposits, questions are swirling about if the limit could rise again. However, such a move would have little to no impact, according to industry experts.

"Unless you make it unlimited, I don't know ... what point you raise it to, to make a difference," said John Gorman, partner at Luse Gorman PC who represents financial institutions on M&A, regulation and other topics.

Instead, the FDIC will likely take a more unusual approach to address uninsured deposit levels at banks by charging banks assessment fees based on their level of uninsured deposits or creating two funds — one for consumers and one for businesses, which tend to hold much more cash in one account.

Raising the limit

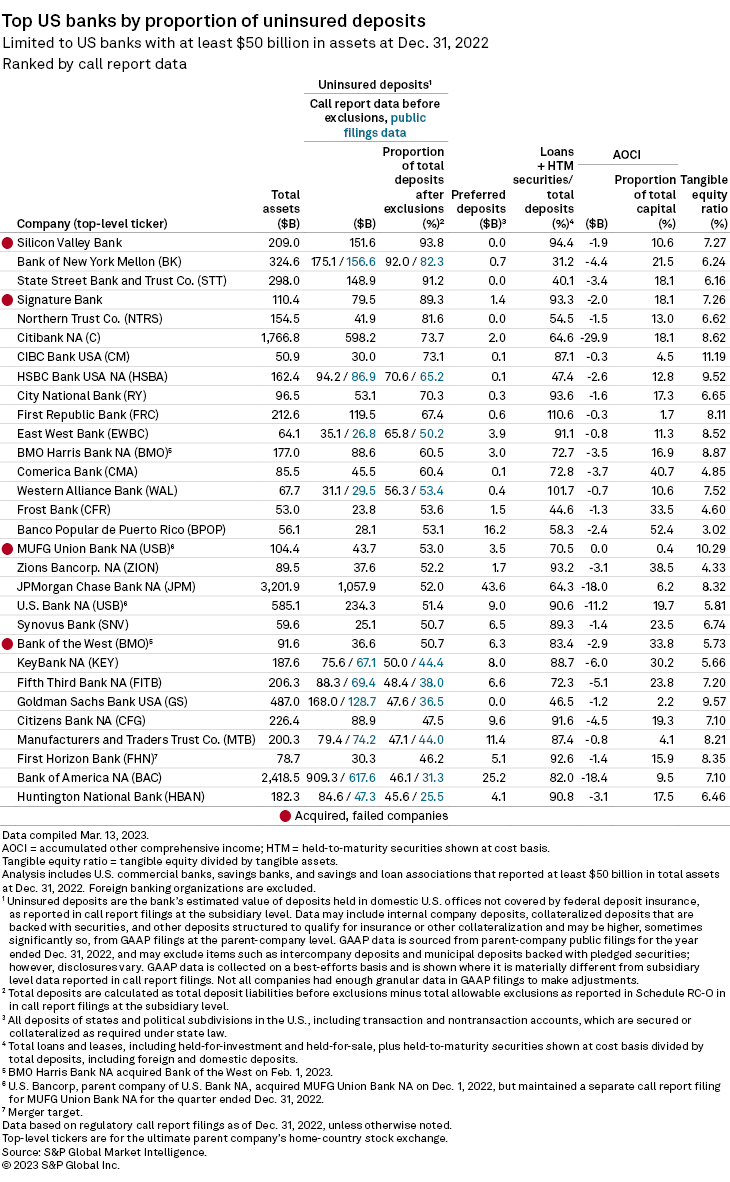

Following the failure of Silicon Valley Bank, where uninsured deposits made up 93.8% of its deposit base, and Signature Bank, which had 89.3% of its deposit base uninsured, regulators used the "systemic risk" exception to cover all deposits, both insured and uninsured, of both institutions.

The rate of uninsured deposits in this analysis is based primarily on bank subsidiary estimates made in regulatory call report filings, and it may include items such as intercompany deposits, collateralized deposits that are backed with securities and other deposits structured to qualify for insurance and can differ from parent company GAAP filings, which may exclude such items.

For some companies, the amount reported in call reports may be significantly higher than what is reported in GAAP filings due to these exclusions.

Now, discussions have ensued about raising the deposit insurance limit from the current $250,000, but such action would do little to help business customers that hold millions in an account.

The $250,000 limit is "a mere pittance for big companies," and they "don't want to have 72 banks" to gain more insurance coverage, said Jim Adkins, managing partner at Artisan Advisors.

While doubling the limit by raising it to $500,000 could "incrementally" help business customers, that would not completely solve the issue, said Gary Tenner, managing director and senior research analyst at D.A. Davidson & Co.

Making deposit insurance unlimited, for at least a period of time, is something some banks are asking for. The Mid-Size Bank Coalition of America urged federal bank regulators to extend insurance for all deposits for the next two years to prevent more bank failures, Bloomberg News reported, citing a letter the group sent to Treasury Secretary Janet Yellen and federal bank regulators.

Such a move "would be great and certainly help stabilize the midsize and smaller banks for a period of time," D.A. Davidson's Tenner said. "And it would buy them time, so to speak, ahead of a more permanent solution to the insurance cap. So that seems to be a way of threading the needle for near-term stability and then providing a runway for more permanent legislative action on it."

But it has the potential to bring more risk than reward, others said.

If all deposits are insured, customers would be less likely to assess the stability of the banks they do business with.

"If you have essentially no risk to the money regardless of where it sits, then you're kind of agnostic as to where the money sits," Joseph Silvia, a member at Dickinson Wright PLLC who advises financial institutions on M&A, regulation and other topics, said in an interview. "And you don't need to examine institutions as carefully or do your diligence as deeply."

Such a move would also allow banks to be more risky in their behavior.

"We've got to give that some thought in terms of, if you just insure everybody, that has an unintended consequence, and it could mean that more risk is taken in the system," Adkins said.

Unique approaches

Instead of raising the deposit insurance maximum, or insuring all deposits, regulators can take unique approaches to address uninsured deposits.

Regulators will probably start charging banks risk assessment premiums based on their levels of uninsured deposits, according to Gorman.

"If the cost of the cleanup to Silicon Valley and Signature Bank is the cost of uninsured deposits, then there should be a relationship between what they're charging for insurance coverage and what's uninsured even," he said.

Some banks "may advocate for something like that to sort of say, 'Those who are incurring this risk ought to be paying for the risk,'" Clifford Stanford, partner at Alston & Bird LLP, said in an interview.

Another idea is separate deposit insurance funds for consumer and business deposits, of which the business deposit fund would have a higher limit, Hernan Hernandez, director of investment banking capital markets for financial institutions at Credit Suisse Group AG and a former FDIC examiner, said in a webinar hosted by Travillian.

To fund those, the FDIC will likely enact "a tiered system of charging banks that have these larger deposits," wherein banks with larger individual deposit balances would need to pay higher deposit premiums, Hernandez said.

Such approaches would be more beneficial rather than raising the limit to $500,000 which is "not going to do much good at all," Hernandez said.