Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Dec, 2021

An outsized rally by the biggest technology stocks could be hiding ongoing weakness from the Nasdaq Composite Index and other broad indices' smaller constituents.

The Nasdaq is up about 17% since the start of 2021, but the gains have been particularly top-heavy, with the largest stocks by market cap, the so-called mega-cap stocks, rallying at a far greater pace than relatively smaller stocks.

"It's like having the generals lead the military into battle without the troops behind them," said Paul Schatz, president of investment management firm Heritage Capital.

If you take out Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc. and Tesla Inc., the tech-heavy index's largest stocks by market cap, the Nasdaq is up less than 10% on the year.

"One of the key problems about the equity markets today is that the 5 to 7 largest names are an outsized portion of the market," said Michael O'Rourke, chief market strategist with JonesTrading. "While the few are strong they mask the underlying and broadening weakness in the stock market."

O'Rourke said mega-cap tech stocks have been an "outsized" portion of the market, worsening market breadth, a measure of how many stocks are participating in an index's move up or down. Market breadth now may be more extreme than it was at the height of the 2000 dot-com bubble when Microsoft, Cisco Systems Inc., Intel Corp., Oracle Corp. and WorldCom Inc. dominated the equity market, O'Rourke said.

The issue has impacted investors who may believe they have the safety of investment diversification in index funds but are really reliant on gains of the largest stocks, O'Rourke said.

Breadth is relatively better in the S&P 500, which has advanced about 21% on the year, compared to 17% without the index's five-largest stocks.

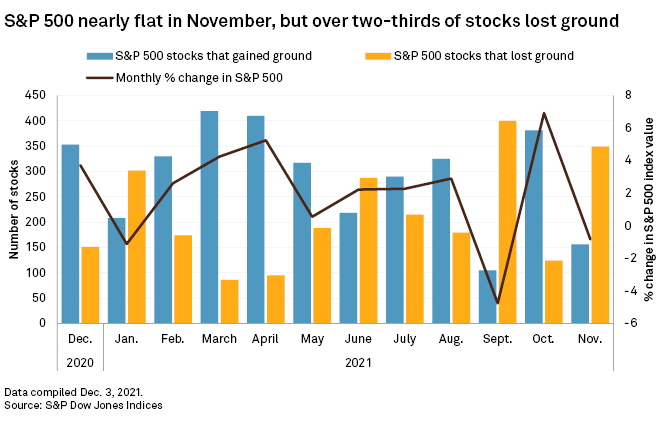

Still, while the S&P 500 was relatively flat in November, 349 stocks lost ground on the month, compared to 156 that gained, according to S&P Dow Jones Indices. In September, when the S&P 500 lost about 4.8%, 400 stocks lost ground, while just 105 gained.

The S&P 500 is roughly 4% off its 52-week best, but few stocks are at their highest levels in the past year. Just 32 of the index's 505 stocks are at or better than their 52-week high, according to Savita Subramanian, an equity and quant strategist with BofA Securities.

"Bad breadth usually hurts stock pickers: the fewer the stocks ahead, the lower the chance of picking a winner," Subramanian wrote in a Dec. 2 note.

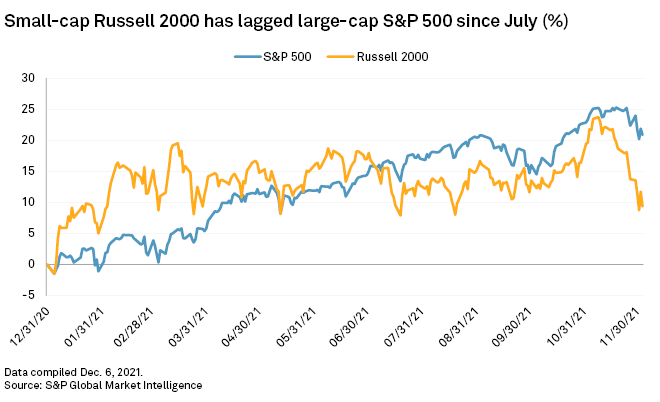

Larger cap stocks have consistently beaten smaller-cap stocks for months. The large-cap S&P 500 is up about 21% in 2021, compared to about 9% for the smaller cap Russell 2000.

"The Russell 2000 has been underperforming all year," said Peter Cecchini, director of research and head of macro strategy at Axonic Capital.

Large-cap companies, which have more pricing power than their smaller competitors, are better able to deal with the ongoing rise in inflation, Cecchini said. "The vast majority of companies can't pass costs through as readily," he said.

Schatz, of Heritage Capital, said it is unclear just how long this top-heavy market may last. During the dot-com bubble it lasted nearly two years.

"It's like valuation," Schatz said. "You know it's in the danger zone, but the timing isn't certain."