S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jul, 2021

By Chris Rogers

The back-to-school shopping season provides an annual opportunity for retailers of products ranging from apparel to school supplies and laptop computers to bolster their sales. The situation in 2020 was complicated by at-home schooling resulting from pandemic-related restrictions, while the midyear return to in-person schooling and increased use of summer school — including in New York City, according to The Economist — may remove some of the "bump" in shipments.

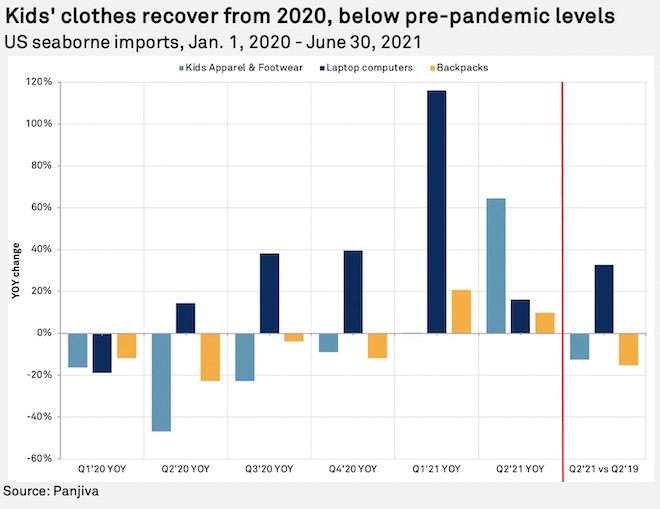

Panjiva's data indicates that there has been a marked recovery in imports of back-to-school products compared with 2020, though shipments are well below 2019 levels. U.S. seaborne imports of kids' shoes and apparel increased 64.4% year over year in the second quarter of 2021 but are still 12.6% below the same period of 2019. Similarly, imports of backpacks improved 9.8% year over year but are 15.2% down compared with 2019 levels.

The outlier has been imports of laptop computers, which rose 16.1% year over year and by 32.8% (including data for seaborne imports only for June) compared with the same period of 2019 as a result of the increased work- and school-at-home trend. The increase in laptop computers may also reflect pent-up replacement demand as well as the debottlenecking of supply chains in the face of reduced semiconductor availability, as discussed in Panjiva's research of June 17.

Importers of kids' apparel and footwear also had to deal with logistics challenges and may have faced decisions to airfreight data or radically shift their seaborne shipping strategies in order to avoid issues such as port congestion on the U.S. West Coast.

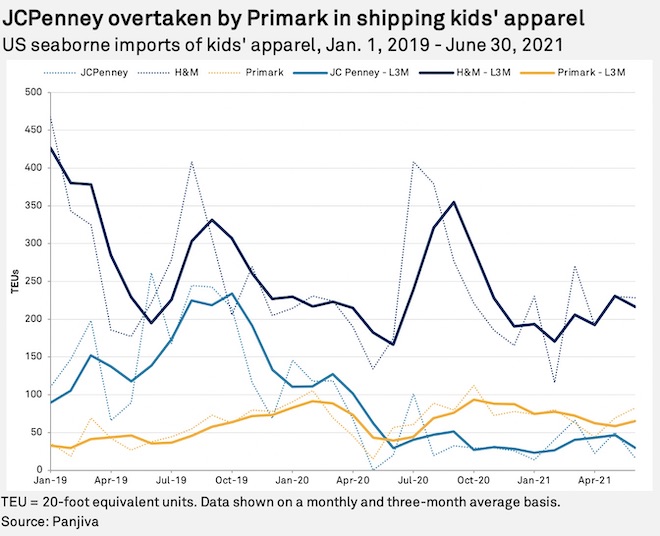

There is also a shift in buying patterns to be accounted for. Imports linked to traditional retailers — particularly department stores — have declined, as shown by shipments associated with J. C. Penney Corp. Inc., which fell 78.6% in the second quarter of 2021 compared with the second quarter of 2019.

By contrast, imports linked to budget store chain Primark Ltd. and fast-fashion retailer H & M Hennes & Mauritz AB (publ) increased 82.4% and 11.1%, respectively, over the same period. There is also evidence of a shift to sports brands. Imports linked to Nike Inc. were up 362.2%, although a designation of products as being specifically for children may have driven part of that surge.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.