S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Mar, 2022

By Umer Khan

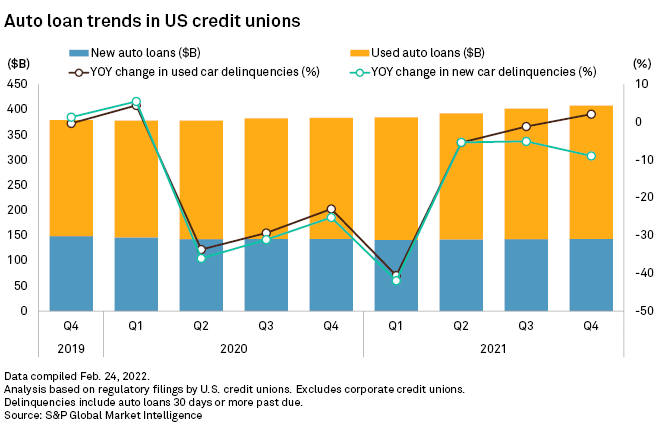

U.S. credit unions grew their auto loan portfolios by more than $6 billion in the fourth quarter of 2021, reporting a total balance of $408.21 billion at the end of the period.

Specifically, new auto loans at credit unions amounted to $143.20 billion at year-end 2021, up from $142.86 billion at the end of the previous quarter, but down from $143.45 billion at the end of 2020, according to S&P Global Market Intelligence data. Meanwhile, used car loans increased 2.2% quarter over quarter and 10.2% year over year to $265.01 billion.

The delinquency rate in new car loans decreased 9 basis points year over year to 1.0% of total new auto loans at the end of 2021. The used car loan delinquency rate decreased 4 basis points to 1.0% of total used auto loans.

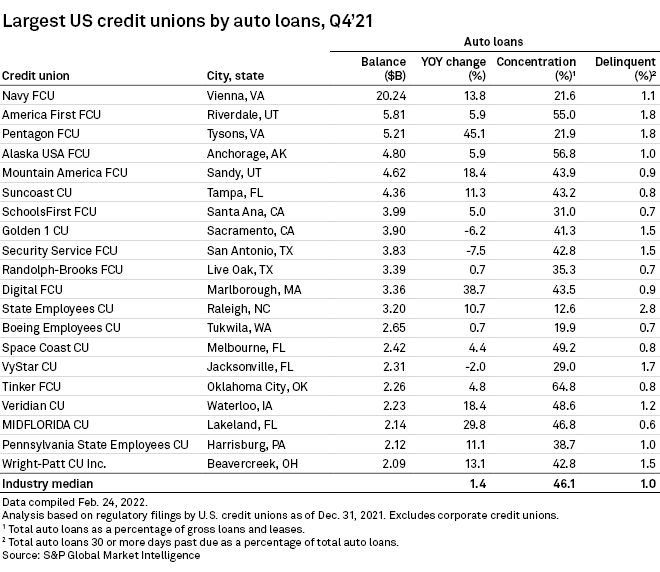

Vienna, Va.-based Navy FCU topped the list of credit unions with the largest auto loan balances at the end of 2021. Auto loans at the credit union totaled $20.24 billion as of Dec. 31, 2021, up 13.8% year over year.

Including Navy FCU, 17 of the 20 largest credit unions by auto loans reported a year-over-year increase in their auto loan balances.

Tysons, Va.-based Pentagon FCU posted the largest year-over-year gain in the group, recording $5.21 billion of auto loans, up 45.1% from the year-end 2020 total. Pentagon FCU was the country's third-largest credit union by auto loans at year-end 2021, up from the ninth spot at the end of 2020.

Raleigh, N.C.-based State Employees CU, meanwhile, reported the highest auto loan delinquency rate among the top 20 credit union auto lenders at the end of 2021. The institution's auto loan delinquency rate rose 12 basis points year over year to 2.8%. Specifically, the used car loan delinquency rate went up 13 basis points year over year to 3.1%, while new car loan delinquency dropped 1 basis point to 1.8%.

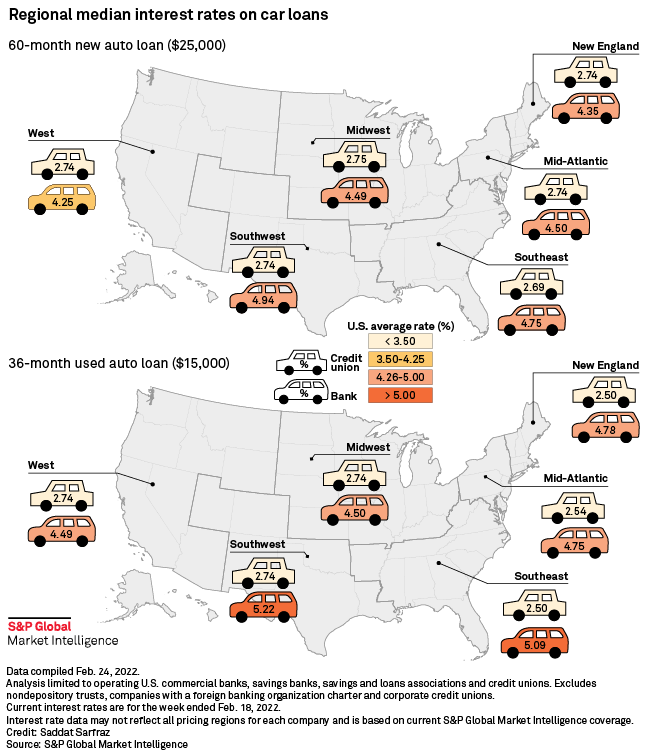

Median interest rates on 60-month new auto loans from banks were higher compared to credit unions. In the Southwest, for instance, the median interest rate on 60-month new car loans issued by banks stood at 4.9%, while those from credit unions had a median interest rate of 2.7%.

Similarly, banks offered higher rates for 36-month used auto loans. The median interest rate on such loans issued by banks in the Southwest was 5.2%, while 36-month used auto loans from credit unions had a median rate of 2.7%.