Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Aug, 2022

Raiffeisen Bank International AG is still weighing up the options for its Russian business and has not yet set a deadline for a final decision, CEO Johann Strobl said.

Austria's second-largest lender has the highest exposure to Russia among European banks and is one of the few still undecided on plans for its operations there. Many of the European banks with Russia exposure have announced plans to wind down their businesses in the country, including the second- and third-most exposed banks after RBI, France's Société Générale SA and Italy's UniCredit SpA.

"We are committed to finding a timely solution, but at the same time, we need to be extremely diligent. I cannot make any statements today on the timeline [for a decision]," Strobl said during an Aug. 2 second-quarter earnings call.

The CEO noted, however, that even in the worst-case scenario of RBI having to de-consolidate its Russian business without any contribution, the estimated impact on group common equity Tier 1 ratio would be small at 5 basis points thanks to accrued dividends and other capital levers the bank can pull. "In essence, the Russian activities are, to a large extent, ring-fenced," Strobl said.

RBI booked a 13.4% CET1 ratio in the first half of the year, after deducting 30 basis points for dividend accruals, the CEO said. The bank will review its dividend policy at the end of the year, but for now, payouts remain suspended due to uncertainties related to the war in Ukraine, he said.

Its operations in Russia were a key driver behind the RBI's strong second-quarter earnings, boosting the group's net interest income, or NII, and net fee and commission income, or NFCI, in particular. RBI's shares were 6.7% higher, at €12.80, in afternoon trading.

Strong performance

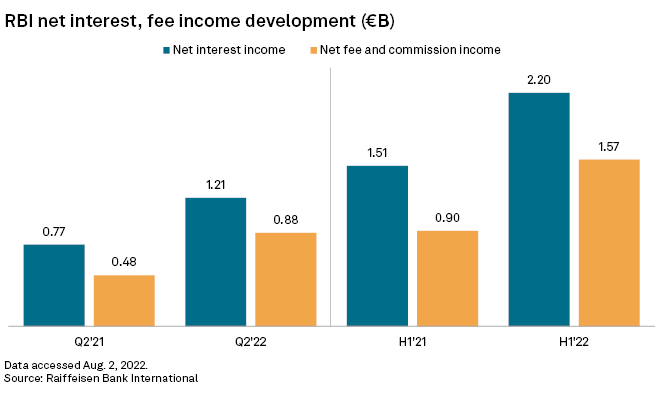

NII rose 57% year over year to €1.21 billion in the second quarter, driven mainly by significantly higher deposits in Russia as well as foreign exchange effects related to the appreciation of the Russian ruble. NFCI, which surged 82% to €882 million, was boosted by the strong foreign exchange business in Russia.

"We have seen an unusually high contribution from Russia and an unprecedented appreciation of the ruble against the euro," Strobl said. Even without the Russian business, he said, there was "impressive improvement" in second-quarter NII and NFCI.

Excluding the impact of business in Russia and Belarus, second-quarter NII grew 30% and NFCI rose 12% year over year, Strobl said.

First-half NII rose 46% year over year to €2.20 billion due to strong customer loan growth and rising interest rates. NFCI grew 73.3% to €1.57 billion driven by high client activity in the group's foreign currency business, primarily in the spot foreign exchange business in Russia, RBI said.

"This development was due to both the geopolitical situation and the measures taken by the Russian central bank to restrict foreign exchange," the bank said.

First-half operating income rose 62.8% year over year to €4.15 billion, driven by strong growth of both NII and NFCI. RBI's consolidated profit for the period increased roughly 180% to €1.71 billion, helped by the sale of subsidiary Raiffeisenbank (Bulgaria) EAD to KBC Bank NV earlier this year, which contributed €453 million to group earnings, the bank said.

Russian exposure

Euro-ruble exchange rate changes were the main driver behind the increase in RBI's total exposure to Russia, Ukraine and Belarus to €27.19 billion as of June 30, from €21.53 billion as of Dec. 31, 2021. The group's exposure to Russia increased to €21.92 billion in the first half of 2022, from €16.88 billion at the end of 2021.

"We are focused building up the capital and liquidity buffers and selectively reducing the lending portfolio," Strobl said. Total loans to customers in local currency decreased 22% in the second quarter compared to the first quarter of the year, he said. At the same time, however, the group booked large deposit inflows, "which means that the balance sheet is not shrinking," Strobl said.

RBI's loan-to-deposit ratio in Russia declined to 47% in the second quarter from 66% in the first.

2022 outlook

In 2022, RBI expects to achieve NII of €4.3 billion to €4.7 billion and NFCI of at least €2.7 billion. Excluding Russia and Belarus effects, full-year NII and NFCI are expected to increase by about 20% and 10%, respectively.

RBI expects a full-year provisioning ratio of 100 basis points, after booking a ratio of 86 basis points in the first half of 2022. The bulk of provisions was related to Russia.

The CET1 ratio is expected to be above RBI's target of 13% in 2022.