S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Mar, 2021

By Ranina Sanglap

Australia's "buy-now-pay-later" players may need more regulation to protect customers after the point-of-sale credit industry has grown rapidly in recent years, helped in part by an absence of oversight, experts say.

Companies such as Afterpay Ltd., Zip Co. Ltd. and Brighte Capital Pty. Ltd. have attracted droves of consumers, especially younger buyers on e-commerce platforms, by allowing them to pay for their purchases in installments and not charging them interest. That has also led to criticism of their lending practices, mainly from customers being charged heavy late fees.

Buy-now-pay-later, or BNPL, players have so far avoided regulation as provisions of the Australian National Consumer Credit Protection Act of 2009 do not apply to certain types of loans, including interest-free credit for a short term. The industry adopted a code of conduct for self-regulation from March 1, pledging to safeguard customer interests by making it mandatory for operators to conduct financial checks and ensuring users do not overextend themselves.

"Some level of responsible lending checks will instill confidence in consumers who are skeptical of this type of services," said Yin Yeoh, an analyst at IBISWorld, a market research company.

Australian regulators will consider what is best for consumers while deciding if there is a need for them to intervene. It would be due to a significant number of BNPL customers facing difficulty in repaying their debt, Yeoh said. Stricter regulation of the sector can pose a challenge to the growth of the industry as many consumers view BNPL arrangements as a quick and easy way to access credit, she added.

Unhindered growth

The BNPL industry in Australia has managed to grow unhindered, likely because it is too small to regulate. But the "regulatory clock is ticking" as the U.K. and Singapore have said they will increase their oversight over the BNPL industry, said Grant Halverson, CEO of McLean Roche, a retail banking and payments consulting firm. Even after seven years, Australia and New Zealand have no BNPL laws and no regulation — "it's a Wild West of consumer lending," Halverson said in comments emailed to S&P Global Market Intelligence.

BNPL services in the Asia-Pacific region will more than double in the five years to 2024, growing largely at the expense of credit cards, bank transfers and prepaid cards, Fidelity National Information Services Inc. said in its Global Payments Report 2021. BNPL accounted for 10% of all e-commerce transactions in Australia in 2020, FIS said.

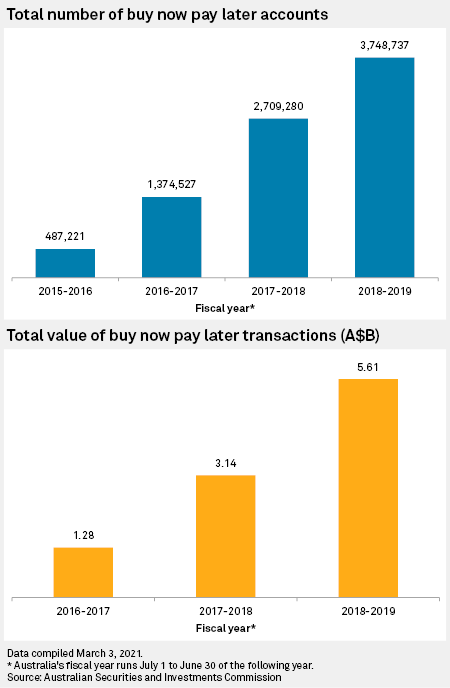

The number of open BNPL accounts had climbed to 6.1 million by June 2019, representing 30% of the nation's adult population, the Australian Securities and Investments Commission, or ASIC, said in a report released in November 2020.

ASIC said in its report that 21% of BNPL users missed a payment in the last 12 months. In fiscal 2018-2019, missed payment fee revenue for all BPNL providers totaled over A$43 million, up 38% from the previous year. The regulator "also found that some consumers who use buy now pay later arrangements are experiencing financial hardship, such as cutting back on or going without essentials (e.g. meals) or taking out additional loans, in order to make their buy now pay later payments on time."

The total size of BNPL transactions at A$5.6 billion in the fiscal year that ended June 2019 was tiny, compared with A$274.50 billion of credit card transactions in the same year, according to ASIC data. Numbers from the Reserve Bank of Australia showed that the total number of credit cards on issue fell to 16.96 million in December 2020 from 18.78 million in the prior-year period.

"BNPL services are vacuuming up young consumers in Australia before they have ever filled out a credit card application, and no-fee debit cards from nonbanks are allowing those same young consumers to purchase global goods online with none of the traditional fees," Graham Cooke, head of consumer research at Finder, a comparison firm for financial products. The number of credit card accounts in Australia has declined by 3 million since 2017, he said.

Banks react

"The rise of BNPL and the decline in credit card balances is definitely having an impact on [banks'] interest margins and non-interest income, and we are seeing banks respond by removing fees on low balance cards and even introducing their own interest-free card," Nathan Zaia, equity analyst at Morningstar, told Market Intelligence in an email.

Two of the big four Australian banks have launched cards that have cost structures that are closer to a BNPL service than a traditional credit card as they seek to protect their market share.

National Australia Bank Ltd. launched the NAB StraightUp card in September last year, claiming to be the country's first no-interest credit card. Customers can gain access to credit of up to A$3,000 for a flat monthly charge, or pay nothing if the card is not used. Commonwealth Bank of Australia followed with a similar product. CBA and Westpac Banking Corp. have signed partnership deals with some BNPL providers. Australia and New Zealand Banking Group Ltd., however, said it is not interested in getting into the BNPL business.

"There is still a market for the traditional credit card, but yes, I think the success of BNPL is forcing the banks to make changes to their credit card offerings," Zaia said. More than the lost credit card business, the concern for banks is the lost potential for cross-selling other products. "Once a customer has a home loan, credit card, transaction account with linked payments all with the one institution, history has shown they more often than not don't bother switching," he said.

Shifting consumer preferences

BNPL players, which typically earn their revenue from merchant fees and late charges from customers who miss their payments, are growing rapidly as part of a shift in consumer expectations where short-term credit need not carry a cost and should be available on the spot.

"Younger people don't want a product that attracts interest, even though many credit cards already come with an interest-free period that is longer than those available with a BNPL service," said Peter Marshall, research and compliance manager at Mozo, a financial comparison service.

Afterpay, one of the biggest players in the sector, reported A$9.8 billion in underlying sales in the fiscal half ended Dec. 31, 2020, up 106% from A$4.8 billion in the prior-year period. The company said its active customers grew by 80% in the period to 13.1 million from 7.3 million.