S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Mar, 2023

By Zia Khan and Marissa Ramos

Australian banks may raise more capital to repay COVID-19-era loans from the government after they helped drive a nearly three-fold month-over-month jump in aggregate debt raised by lenders Asia-Pacific in January.

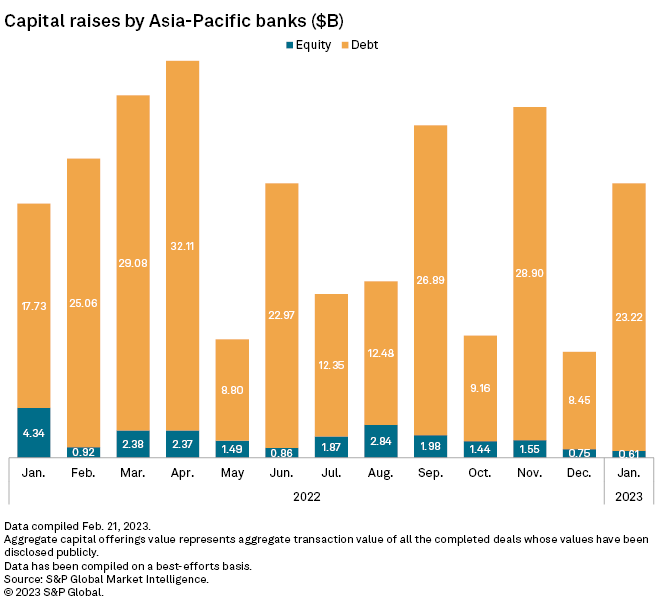

Aggregate debt raised by banks in the region rose to US$23.22 billion in January from US$8.45 billion in December 2022 and US$17.73 billion in January 2022, according to data compiled by S&P Global Market Intelligence. Multiple billion-dollar debt sales by Australian banks and Sumitomo Mitsui Financial Group Inc.'s US$5.80 billion total loss-absorbing capacity note issuance drove the total. The aggregate figures include bonds, senior debt and preferred securities.

Banks' equity raising activities were subdued in January, as rate hikes and geopolitical tensions continue to cloud the growth outlook. In total, just four Southeast Asian banks tapped equity capital markets in January, raising about US$606.7 million.

Australian banks raised more than US$7.5 billion via debt security sales in January as they prepared to repay cheap pandemic loans provided by the country's central bank, the data shows. National Australia Bank Ltd., Westpac Banking Corp., ANZ Group Holdings Ltd. and Commonwealth Bank of Australia are expected to raise more than A$120 billion in 2023 as they need to repay their share of about A$200 billion of three-year loans extended to lenders by the Australian central bank via the pandemic-related Term Funding Facility, The Australian Financial Review reported Jan. 5. The four banks received a total of A$132.88 billion of loans via the facility, according to central bank data.

"We expect the Australian banks to continue to issue capital securities in 2023," said Marvin Kwong, director and portfolio manager of fixed income for Asia at M&G Investments. "Supply is expected to remain manageable, given that the banks have already built up capital buffers continually over the past few years."

The Term Funding Facility was set up by the Reserve Bank of Australia to offer low-cost three-year funding to banks as part of a policy response to the COVID-19 pandemic. The facility closed to new drawdowns June 30, 2021, at which time A$188 billion of funding was outstanding, according to the central bank. The facility will continue to support low borrowing costs until mid-2024.

Billion-dollar issuances

In January, Asia-Pacific lenders completed more than half a dozen billion-dollar debt issuances, all denominated in foreign currencies. Sumitomo Mitsui Financial's US$5.80 billion U.S.-dollar-denominated nonconvertible issue was the largest offering in January, followed by Japan Bank for International Cooperation's US$2.50 billion and Asian Infrastructure Investment Bank's US$2 billion issuance.

Three euro-denominated offerings were completed by National Australia Bank, Westpac and ANZ Group, while Export-Import Bank of India and Macquarie Bank Ltd. also joined the pack with U.S. dollar issuances.

The increase in Asian banks' issuance of foreign-currency bonds "could be due to several factors, such as the volatility of rates within some of the banks' home markets, front-loading of issuances in order to step up lending in other markets, as well as some stability as observed in the U.S. rates market in January," M&G's Kwong said.