S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Mar, 2021

By Ranina Sanglap

Major banks in Australia face rising mortgage risk as more homebuyers are borrowing over 95% of the value of their properties while some supportive government policies last, although analysts say there is little cause for alarm yet.

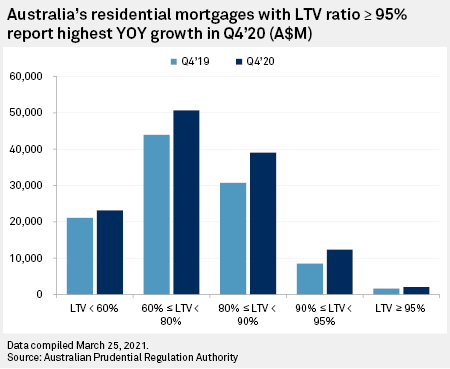

In the three months ended December 2020, residential mortgages with a loan-to-value ratio of at least 95% increased 27.4% from a year earlier, although this segment remained the smallest portion of the sector's mortgage book, according to the Australian Prudential Regulation Authority. The year-over-year increase was much higher than the 15.4% growth for mortgages with an LTV ratio of between 60% and 80%, as well as the 9.7% growth for home loans with an LTV ratio of below 60%, according to the regulator's quarterly report on bank statistics released March 16.

"Mortgage stress is always a potential risk for the banks given their large exposure to this segment, but it doesn't appear to be an imminent risk," Omkar Joshi, principal and portfolio manager at Opal Capital Management, told S&P Global Market Intelligence in an email.

"Obviously we still need to see how the economy progresses. Lending standards have generally been pretty good across the industry. The banks are also well provisioned for any potential issues," he said.

Home buyers have been rushing to the market, with new residential mortgage lending up 20.2% to A$128.1 billion in the December 2020 quarter from a year earlier, according to the Australian Prudential Regulation Authority. A record-low policy interest rate, the government's wage subsidy program JobKeeper as well as a policy of guaranteeing home loans for eligible first home buyers with a minimum deposit of 5% of the property value are believed to have encouraged home purchases, analysts said.

When supports wind down

Research from Roy Morgan earlier showed that when JobKeeper ends March 28, around 20% of mortgage borrowers as of November 2020 could be "at risk."

The end of the wage subsidy program could mean up to 150,000 jobs lost, Australia's Treasury Secretary Steven Kennedy said in a March 24 statement to Parliament. However, Kennedy added that part of the impact could be cushioned by the recovery of the labor market, which saw the jobless rate falling to 5.8% in February from a recent peak of 7.5% during the pandemic.

"Households are under pressure with mortgage stress, flat incomes and rising costs," said Martin North, founding principal and banking sector analyst at Australia-based Digital Finance Analytics. North added that lending standards might be deteriorating despite the country's lending laws still being in place, as Australia is considering relaxing its responsible lending rules for banks.

Grant Halverson, CEO of McLean Roche, a retail banking and payments consulting firm, added: "NPLs are very low, and show no signs of moving higher — by June it will be clearer how this issue will track — right now it's just opinion and guesswork."

"There is no evidence of any declines in lending standards or banks and other lenders chasing market share — if that happens it will emerge later this year," Halverson said.

The Australian Prudential Regulation Authority said in the quarterly report that "overall, residential mortgage asset quality could deteriorate over coming quarters as repayment deferrals expire and government stimulus changes, however, some of these impacts may be offset by continued improvement in the economy and low interest rates."

The regulator added that majority of outstanding residential mortgage loans remain well covered by collateral despite the increase in loans with higher LTV ratios. The asset quality of housing loans is also stable, with residential mortgage nonperforming loan ratio falling to 1% in December 2020, from 1.1% in September that year, the regulator said.

Mortgage rush

While risk may not be alarming for now, the mortgage-focused Australian banks are enjoying a boost of their bottom line amid the housing boom.

Commonwealth Bank of Australia, the country's largest bank by assets, reported "above system" growth in its home lending business for the fiscal first half ended Dec. 31, 2020. The bank said in February that its approvals for home loans reached 179,000, up 32% from 136,000 in the prior-year period. CBA said it had a 25.2% share of Australia's home lending market, compared with its next rival Westpac Banking Corp. with a 21.6% market share.

"The strength in the housing market is positive for bank earnings and it doesn't appear that banks have reduced their lending standards and increased their risk profiles," Joshi said.

Australia's banks are benefiting from a resurgent housing market "as their profit is still significantly driven by mortgage book growth, and if loan volumes net grow, they will benefit," North added.

Location

Segment