Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Feb, 2022

|

| The Ellendale diamond operation in Western Australia once produced half the world's fancy yellow diamonds. Australia's geology has the potential for more discoveries, but exploration spending is coming off a very low base, experts say. |

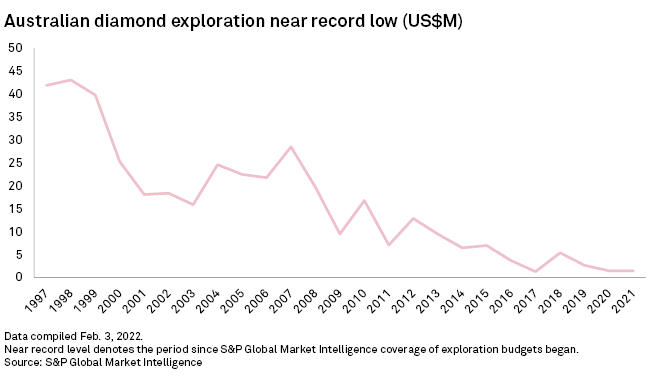

Spending on diamond exploration in Australia fell to a near-record low in 2021, but some new players are aiming to return the country's industry to its glory days when the Ellendale and Rio Tinto Group's Argyle mines in Western Australia dominated markets.

Diamond miners spent US$1.5 million on exploration in 2021, the second-lowest amount on record since S&P Global Market Intelligence started coverage of the data in 1997. Spending peaked in 1998 at US$43.1 million and hit an all-time low of US$1.3 million in 2017.

Globally, diamond exploration fell to US$202 million in 2021 from its 2008 peak of US$986 million, Market Intelligence research analyst Paul Manalo said in an interview.

"We haven't seen any reversal of trend in global diamonds exploration, just a continuation of the downward trend," which some attribute to the rise of synthetic diamonds that are cheaper and more customizable, Manalo said.

An increase in Australian diamond exploration spending in 2022 is "definitely warranted," as new companies try to fill in for the closure of Argyle and the "very low bar" set by recent exploration spending, Manalo said.

Reviving the industry

The latest entrant to the Australian diamond scene is Odessa Minerals Ltd., which has been reincarnated from its former life as software developer Fargo Enterprises Ltd. Odessa relisted on the ASX in January on the back of the Aries project that includes the Ellendale diamond field.

|

| Gem-quality diamonds of various shades, hues and colors from Odessa Minerals' Aries project, Western |

Odessa CEO Alistair Stephens expects a "significant kick" in equity markets' willingness to back diamond exploration in 2022, particularly given the vacuum left when Argyle closed in 2020 at the end of its 37-year life.

Odessa's investor presentation cited a strong increase in reported rough diamond prices over the past 18 months, the efforts of the ex-De Beers SA and Rio Tinto executives at Burgundy Diamond Mines Ltd. to resurrect Ellendale, and Lucapa Diamond Co. Ltd. acquiring the Merlin mine in the Northern Territory in 2021.

Ellendale previously produced over half the world's fancy yellow diamonds, while Argyle was the fourth-largest diamond-producing mine, averaging 8 million carats a year.

Meanwhile, private group India Bore Diamond Holdings Pty Ltd. obtained its first mining lease for its Ellendale L-Channel deposit in March 2021. The project covers a resource target area of at least four times the size of the initial lease.

Anglo American PLC unit De Beers reported in January that the consolidated average realized price for its diamonds was 10% higher in 2021 over 2020, and 19% higher in the second half of 2021 versus the first half.

"Demand for rough diamonds remained robust, with positive midstream sentiment and strong demand for diamond jewelry continuing over the holiday period, particularly in the key U.S. consumer market," Anglo American said in January.

Long road ahead

Odessa's A$6 million IPO was well-supported, Stephens said, having "hit the right spot in terms of the commodity and the timing, and we're not competing with a lot of other diamond companies for the same investment."

"Australia has been significantly underexplored," Stephens said. "The fact that you can access alluvial, as well as hard rock, gem qualities means there are still opportunities out there."

New discoveries are more likely to be found in greenfield areas, though "a whole field of pipes could have further potential with correct assessment" at Ellendale, according to F

The distribution of diamonds within an ore body is "somewhat random," Grigor said in an interview, and while alluvial diamonds are "almost always better grade than the original pipe," they are not a continuous, flat-lying ore body, but pockets of traps.

"Diamond operations are probably higher-risk than gold or anything else" due to their geological complexity, Grigor said.

Though there is a shortage of diamonds, particularly consumer-sized diamonds, "it's too simplistic to suggest a diamond project will be economic" simply on the back of strong current diamond prices, Grigor said.

Australia's potential lies mainly in Western Australia and the Northern Territory, Grigor said, though diamonds have been found in South Australia and New South Wales.

"What Lucapa has achieved over five to 10 years is typical of the time frame in the diamond industry," Grigor said, as the company is "now generating good profits and are well established, with their buyers sorted out for their diamonds."