Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Sep, 2022

By Michael O'Connor and Chris Hudgins

U.S. retail sales in August rose beyond expectations as shoppers showed resilience in the face of high inflation.

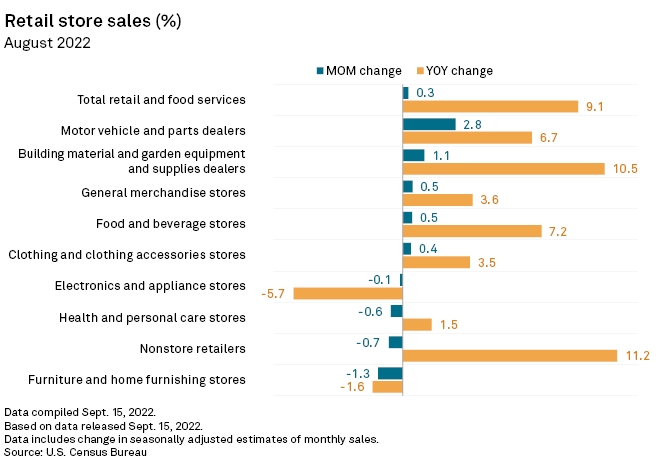

Retail and food services rose 0.3% month over month in August, according to U.S. Census Bureau data released Sept. 15. Economists expected the figure to be flat, according to the consensus estimate compiled by Econoday.

Motor vehicle and parts dealers and building material and garden equipment and supplies dealers saw the highest increases in sales.

Confident consumers have shown a willingness to keep on spending in the face of the worst inflation in four decades, with online retailers continuing to benefit from shopping habits adopted when pandemic lockdowns were in effect.

Retail sales

U.S. retail and food services sales reached $683.3 billion in August, according to the seasonally adjusted Census Bureau preliminary estimate, up from $681.3 billion in July.

Motor vehicle and parts dealers posted a 2.8% month-over-month increase in August, while sales at building material and garden equipment and supplies dealers rose 1.1%. The largest declines in August came at furniture and home furnishing stores, which fell 1.3%. Electronics and appliance stores had the biggest annual decline: sales were down 5.7% in August from the same time a year ago.

Default signals

The median probability of default score for all publicly traded U.S. retailers as of Sept. 13 was 4.3%, up sharply from 1.6% a year ago.

Internet and direct marketing retailers again had the highest median market signal one-year probability of default of any sector, at 8.1%, according to S&P Global Market Intelligence data. The score, which represents the odds of default within a year, is based mainly on the volatility of share prices for public companies and accounts for country- and industry-related risks.

Bankruptcies

There have been 12 retail bankruptcy filings in 2022 as of Sept. 14, according to Market Intelligence data, the fewest number of filings in comparable periods since at least 2010.