S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Aug, 2021

By Charlsy Panzino and Chris Hudgins

U.S. retail sales fell in July, missing economists' expectations as supply chain issues plagued retailers and consumers increasingly switched to spending on services instead of physical goods.

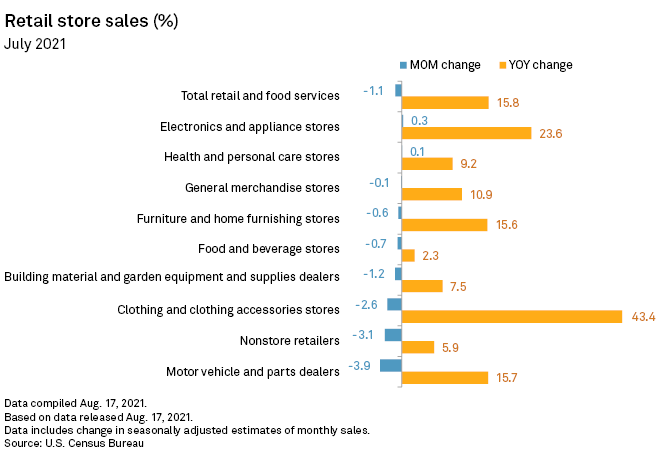

Retail and food services decreased 1.1% month over month in July, following a revised 0.7% rise in June, according to U.S. Census Bureau data released Aug. 17. Economists polled by data firm Econoday expected a 0.2% monthly decline in July.

Households spent less on a wide variety of goods from vehicles to clothing in favor of spending at bars, restaurants and gas stations, Lydia Boussour, Oxford's lead U.S. economist, said in an Aug. 17 note. Increased consumer caution as the coronavirus delta variant spreads is a key risk to the outlook in the second half of the year, but consumers are expected to stay confident enough to continue spending.

"Strong fundamentals, including a pile of accumulated savings, continue to underpin consumer spending," Boussour said.

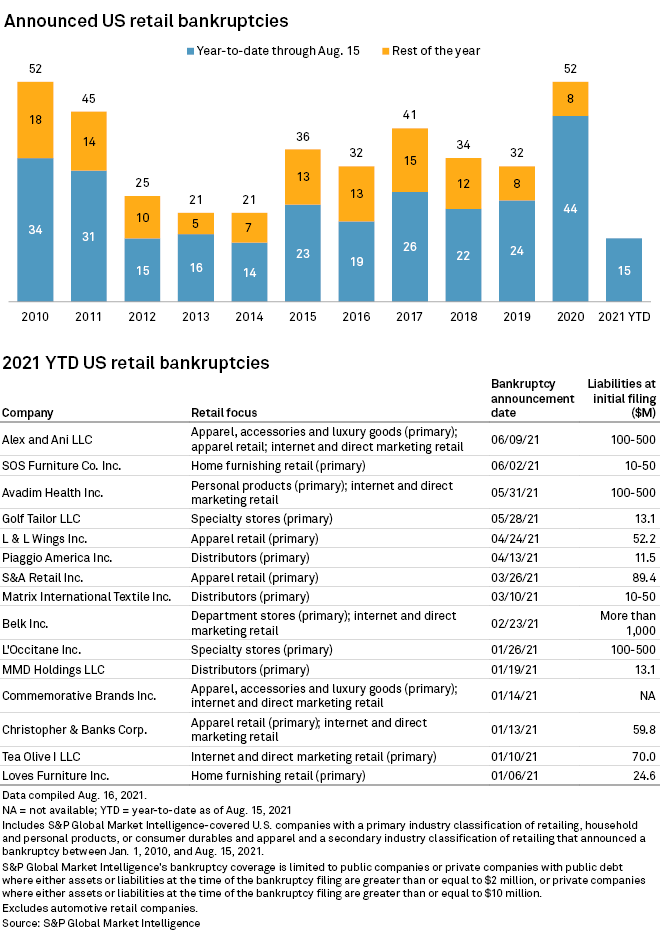

Meanwhile, struggling U.S. retailers continued to steer clear of bankruptcy court. No companies in the sector filed for bankruptcy in the month through early August, marking the second straight month without a new retail filing.

Retail sales

U.S. retail and food services sales decreased to $617.72 billion in July, according to advance estimates by the Census Bureau. This is down from a revised $624.73 billion in June.

Sales in the retail trade, which excludes food service, fell 1.5% from June. Sales at auto and other motor vehicle dealers were down 4.3% month over month. The auto industry has been hit by production issues and a shortage of semiconductors.

Retail sales surged in the spring after consumers received federal stimulus checks, and now those numbers are returning to normal, according to Rajeev Dhawan, director of the Economic Forecasting Center at Georgia State University.

Consumers are also beginning to see the effects of supply constraints, Dhawan said in an interview

"People are telling me that if they ordered a washing machine, it's taking three to six months for it to come," Dhawan said. "These things are all manufactured abroad so supply chain disruptions that happen in Asia show up over here."

On a year-over-year basis, retail trade sales were up 13.3% in July. Clothing and clothing accessories stores were up 43.4% year over year, and food services and drinking places were up 38.4%.

Retail sales were up in such categories as home improvement, sporting goods and e-commerce in 2020 because of coronavirus lockdowns, but now that spending is going into clothing and apparel categories, according to Mickey Chadha, vice president and senior credit officer at Moody’s Investors Service.

"As people go out and travel and take vacations and go to concerts or go to restaurants, they're finding that they need to update their wardrobe since they haven't done that in a while," Chadha said in an interview.

Moody's forecasts a 6% to 8% increase in retail sales for 2021 over 2020, according to Chadha. Although the delta variant might have impacted July's retail sales as consumers grow cautious again, he does not expect the rising cases to impact the rest of the year, unless there are more shutdowns.

"There is definitely a risk of the consumer being a little shy going into stores," Chadha said. "On the flip side, I know that consumers have been fairly comfortable now buying online, and a lot of retailers have done a really good job pivoting into their e-commerce capabilities."

Back-to-school spending will also help the second half of 2021, unlike 2020 when many schools switched to online learning, Chadha said.

Consumer prices

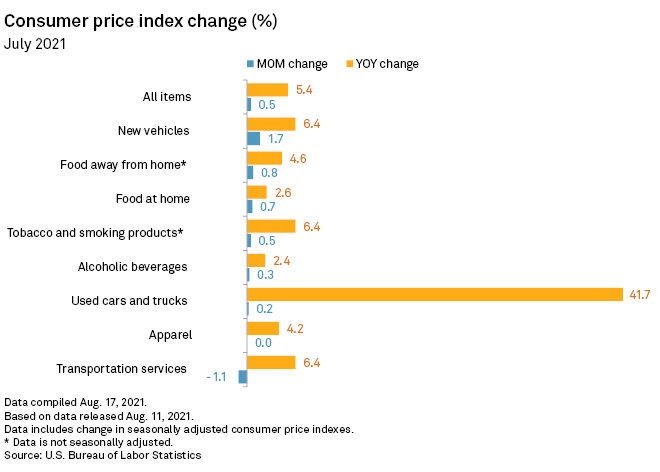

Consumer prices rose 0.5% in July compared to the previous month, according to data from the U.S. Bureau of Labor Statistics. On a year-on-year basis, prices jumped 5.4% before seasonal adjustment.

Prices for new vehicles rose 1.7% month over month in July and 6.4% on an annual basis.

Bankruptcy

No S&P Global Market Intelligence-covered U.S. retail companies went bankrupt between late July and early August. So far in 2021, 15 retail companies have filed for bankruptcy.

Bankruptcy filings have fallen across business sectors in 2021 so far as government stimulus measures and companies are being kept afloat by easy access to credit.

Employment

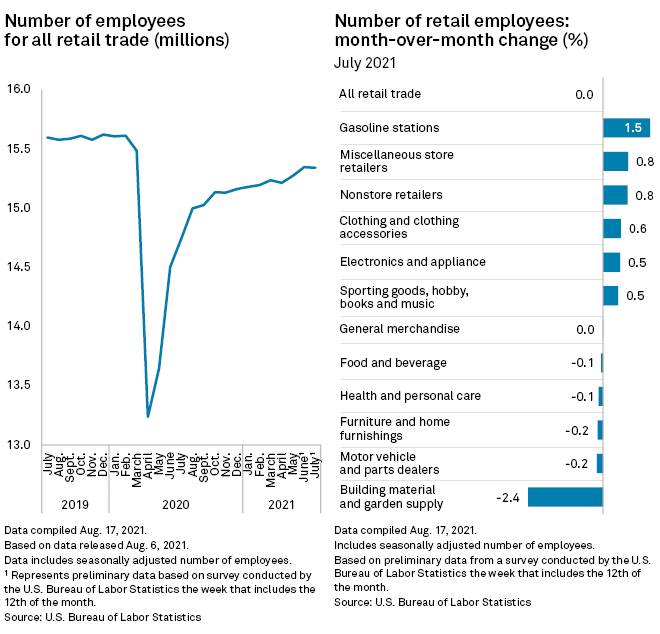

Employment in the retail sector was 15.3 million jobs in July, down by 5,500 jobs from June, according to Bureau of Labor Statistics data.

Jobs at clothing stores were up 0.57% in July from June, while jobs at gas stations were up 1.52%. Employment at motor vehicle and parts dealers were down 0.20% and building material and garden supply stores registered a 2.42% drop in jobs.

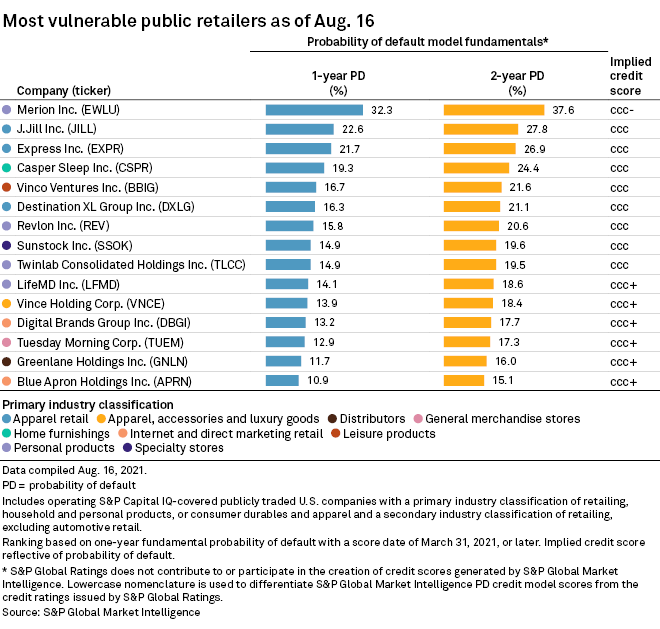

Vulnerability

An analysis of the one-year probability of default scores identified 15 public retailers with scores ranging from 32.3% to 10.9% and corresponding implied credit scores of "ccc-" to "ccc+." The probability of default scores represent the odds that each company will default on its debt in a year, based on financial reports and accounting for different macroeconomic factors.

Health supplements retailer Merion Inc. topped the list with a probability of default score of 32.3%. The company did not respond to a request for comment.