S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Jan, 2024

| Atmos Energy Corp. and Black Hills Corp. submitted plans to reduce greenhouse gas emissions from their Colorado gas distribution systems. Source: georgeclerk/iStock/Getty Images Plus via Getty Images. |

Utilities Atmos Energy Corp. and Black Hills Corp. plan to rely heavily on energy efficiency and demand response, with contributions from renewable fuels, as they target state-mandated greenhouse gas emissions reductions in their Colorado natural gas operations.

The investor-owned gas utility operators outlined their decarbonization strategies in a pair of clean heat plans. The filings fulfilled the Colorado Public Utilities Commission's mandate for the companies to chart a path toward reducing emissions 22% from 2015 levels by 2030.

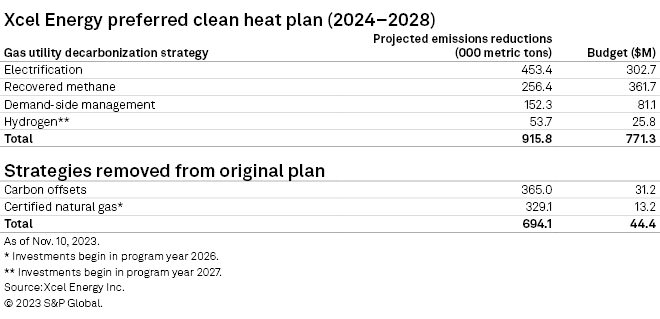

In assessing different clean heat portfolios, the companies ran into a dilemma similar to the one their larger peer, Xcel Energy Inc., encountered when it filed the state's first clean heat plan in August 2023. Achieving the full 22% reduction by 2030 would require far outspending the cost cap imposed on clean heat plans by legislators, or 2.5% of annual retail sales. Xcel Energy subsidiary Public Service Co. of Colorado sought to lower its plan cost and achieve deeper emissions reductions by procuring certified natural gas and carbon offsets. However, the company dropped those plans after stakeholders challenged the strategies' qualifications as clean heat resources.

Subsequently, Atmos and Black Hills did not include certified gas or carbon offsets in their clean heat plans. However, both plans included novel proposals that could attract scrutiny during the stakeholder process because enabling legislation does not clearly define them as clean heat resources.

The companies also faced an additional challenge: Unlike Xcel, Atmos does not operate an electric utility, and there is limited overlap between Black Hills' electric and gas territories, making electrification in buildings more difficult.

Black Hills

Black Hills Colorado Gas Inc.'s preferred plan would fit within its five-year $35 million cost cap, but it would only achieve 11% of the utility's 2030 emissions reduction target when factoring in customer growth, according to a report prepared by ScottMadden Inc. and Applied Energy Group Inc. Excluding customer growth, the plan would achieve 28% of the 2030 target (Docket No. 23A-0633G).

In the preferred plan, energy efficiency and demand-side management (DSM) programs would account for more than 90% of the emissions reduction. The strategy typically involves offering incentives to customers who elect to have their gas use suspended or limited during peak demand days.

The plan included emissions savings from a separately proposed and funded 2024-2025 DSM plan pending PUC approval. Black Hills would use its clean heat plan budget to expand programs included in the DSM plan and to launch additional measures.

Black Hills would also rely on a strategy not specifically identified as a clean heat resource in enabling legislation: advanced monitoring and leak detection. The company would deploy two advanced monitoring and leak detection units across its full system every three years, focusing first on large leaks and then targeting smaller leaks that require repair in order to comply with regulations. This would be similar to a strategy that Xcel has used.

In 2027, Black Hills would begin procuring renewable natural gas (RNG), or waste methane captured and processed into pipeline-quality gas. Responses to a joint request for information by Colorado gas distributors showed that RNG project developers lacked confidence that their supplies would qualify under the PUC's strict criteria, Black Hills said.

The PUC did not allow out-of-state RNG to count toward emissions reductions, a decision that gas utilities unsuccessfully challenged. Another decarbonization scenario that Black Hills considered achieved a lower cost by following less stringent RNG guidelines. Black Hills once again urged commissioners to reconsider their criteria.

The gas utility would also partner with Black Hills Colorado Electric to shoulder some of the costs of a building electrification pilot in southwest Colorado, one of the few places where the parent company's electric and gas territories overlap. Black Hills also proposed a green hydrogen pilot project in 2030.

Atmos Energy

Existing demand-response programs and expanded energy efficiency measures would also account for the lion's share of emissions reductions under Atmos's preferred plan. Like Black Hills, Atmos would count emissions reductions funded through a separate DSM plan toward its clean heat target (Docket No. 23A-0632G).

The company also intended to procure RNG and credits tied to the fuel's environmental benefits. This pathway would cost nearly $17.5 million over five years, keeping it within the annual cost cap of $3.4 million, according to a report prepared by Apex Analytics LLC. The company projected that this strategy would reduce emissions by 31,081 metric tons of CO2 equivalent in 2030, short of the 146,388-ton decline needed to achieve a 22% end-of-decade reduction.

Under the umbrella of energy efficiency, Atmos would pilot gas heat pumps, which are available for commercial and industrial applications and becoming available for residential buildings. Atmos would demonstrate the high-efficiency heating and cooling technology — an alternative to electric heat pumps — for three years beginning in 2025.

In another pilot, Atmos proposed subsidizing the cost of replacing energy-inefficient manufactured homes for low-income households in Weld County, Colo. The company said retrofitting these homes would be less effective and efficient. The pilot would provide up to $30,000 toward buying a new manufactured home that meets the requirements of the US Department of Energy and the US Environmental Protection Agency's Energy Star program, with a focus on replacing homes built before 1995.