S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Jul, 2021

By Camilla Naschert

|

|

An Air Liquide truck in Canada. The company is one of the world's top suppliers of fossil-based hydrogen for industrial uses and green hydrogen opportunities are building momentum. |

Having churned out hydrogen supplies for decades, the big three industrial gas giants now find themselves center stage in the emerging low-carbon hydrogen economy.

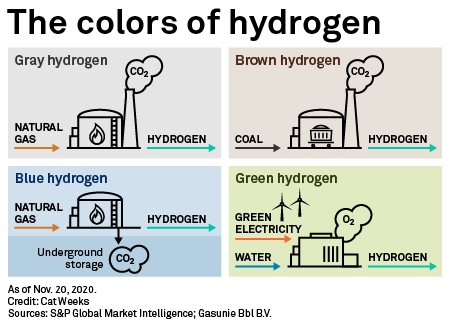

Linde PLC, Air Liquide SA and Air Products & Chemicals Inc., which derive between about 10% and 25% of their total revenue from producing gray hydrogen, made with fossil fuels, are set to be key players as momentum builds globally around the production of low-carbon hydrogen. That includes green hydrogen, made with renewable electricity, and blue hydrogen, produced with natural gas and carbon capture technology.

The companies believe the widespread rollout of low-carbon hydrogen plays to their strengths. But it is also forcing them to reimagine themselves, with investors keeping enthusiasm in check for now.

"It has been really transformational," David Edwards, director and advocate for hydrogen energy at Air Liquide in the U.S., said about the recent market enthusiasm for hydrogen. "Hydrogen itself is not a new topic, but now we're talking about using it as an energy vector."

After decades in the hydrogen business, the industrial gas players are on home turf when it comes to handling and transporting hydrogen at scale, Edwards said. At the same time, producing and selling green or blue hydrogen also brings challenges, not least the fact that the customer base is broadening beyond just existing users and that electricity now plays a key role in production.

|

Air Liquide is planning to invest about €8 billion in low-carbon hydrogen infrastructure by 2035 and wants to develop 3 GW of electrolyzer capacity by 2030, in part by riding a wave of public-sector support for the technology. "We do have some experience, but there's also a lot of new territory," Edwards said in an interview.

Linde, meanwhile, already generates about $2 billion in annual sales from hydrogen, and plans to grow its hydrogen business as the use of low-carbon fuels increases.

ESG pressure

While policy drivers in the form of capital expenditure support, off-take guarantees and loans are helping incentivize the rollout of clean hydrogen production, investor pressure around decarbonization is also mounting.

"[Environmental, social and governance] is enormous, and has accelerated in the past year," Peter Clark, head of global chemicals equity research at Société Générale, said in an interview. "The gas majors are uniquely placed to facilitate the transition. Investors are becoming increasingly aware of this."

The industrial gas giants already have their own decarbonization goals. Linde wants to curb its emissions intensity by 35% by 2028, and Air Products is aiming to reduce its emissions intensity by a third by 2030. Air Liquide wants to cut its direct emissions, known as Scope 1 and 2, by a third between 2020 and 2035.

"They need to diversify their strategy, in terms of becoming low-carbon investments. Hydrogen is a key enabler for carbon neutrality," Mona Dajani, who leads law firm Pillsbury's energy and infrastructure division, said in an interview.

The decarbonization push is also set to bring new users to the hydrogen arena, even if that is logistically challenging for the industrial gas companies. The transportation and mobility sector will be a top adopter, along with companies in regulation-driven fields like refining, power storage solutions, chemical processes and steelmaking, Linde Vice President David Burns said in a July 1 white paper on hydrogen.

Taking a partnerships-based approach, Linde has a stake in British electrolyzer-maker ITM Power PLC, eyeing the fueling station segment in particular, and also teamed up with Italian gas utility Snam SpA for the joint development of clean hydrogen production and processing projects.

Air Liquide, meanwhile, has partnered with electrolyzer-maker Siemens Energy AG, and the companies have applied for EU project funding for French and German ventures. In the U.S., the company is working with manufacturer Cummins Inc.

"There's such a large market that we can't do it alone. We need new technologies, whether that's electrolyzers, storage or the distribution side," Edwards said.

Different approaches

There are differences in the approach to clean hydrogen among the three giants, Clark noted. While Air Liquide and Linde are currently pursuing a more regional model with polymer electrolyte membrane electrolysis and mobility, Air Products is a first mover in mega-scale exports, using alkaline electrolyzers.

The companies "are not swimming tightly in their lane," said Dajani, who has worked with industrial gas players on hydrogen solutions and advised the Biden administration on hydrogen policy.

"The opportunity is huge," Seifi Ghasemi, CEO of Air Products, said at the Reuters Global Energy Transition conference on June 24. Capitalizing on this momentum will allow the business to grow significantly faster than GDP, which has been the traditional growth driver for industrial gases, Ghasemi said.

"It's very natural for us to go from gray to blue [hydrogen]. The next step would be to go to green hydrogen," he said. The company has entered that segment by developing the $5 billion NEOM solar and wind-powered electrolysis project in northern Saudi Arabia with local utility ACWA Power International, which will see green hydrogen exported as ammonia for the international market. The 4-GW plant is set to start producing in 2025.

Demand for green hydrogen will come from industrial users like the steel sector, which is under pressure from a growing social and political consensus over climate change, Ghasemi said. Financial incentives could be sped up by a global tax on carbon, the CEO said.

Playing the long game

But alongside opportunity, there is also still caution. The industrial gas companies will only commit to multibillion-dollar investments in the clean hydrogen space if the returns are in line with their traditional business model, analysts at S&P Global Ratings said in an April 23 note.

Société Générale's Clark does not see that traditional business at risk. "Their green hydrogen business will be growing much faster than gray, but cannibalization is going to be gradual. It's going to be a premium product for a long time," Clark said.

Given its fivefold cost premium over gray hydrogen, the economics for green hydrogen are challenging at this point. But rising carbon prices and scaling effects could change this picture over the course of the decade, with Europe set to lead the way in green hydrogen adoption, Linde said in its white paper.

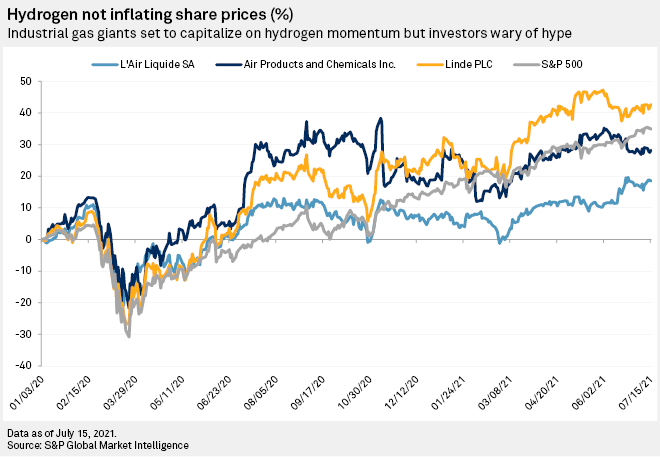

Compared to pure-play hydrogen businesses like ITM Power or Plug Power Inc., investors in industrial gas giants have not yet fully bought into the excitement, and there is still wariness of hype.

Share price growth can also be attributed to other factors, including gas prices. "I would argue the hydrogen story is not significantly showing in the share prices," Clark said.

So while companies are gearing up now, scale will only become significant towards the end of this decade and beyond, and Clark sees companies playing a long game. "This is a growth driver for decades," he said.