S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Mar, 2021

By Rebecca Isjwara

Asian cities continue to dominate a list of most competitive financial centers in the world and the confidence in the global financial systems is stabilizing as vaccines raise hopes that the COVID-19 pandemic will likely abate this year, a survey found.

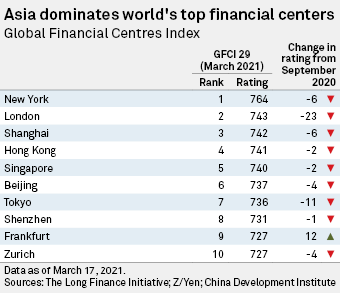

Six of the top 10 cities in the biannual Global Financial Centres Index compiled by the Z/Yen Group in cooperation with the China Development Institute are Asian hubs.

New York, London and Shanghai maintained their top three ranks in the 29th iteration of the index. They were followed by Hong Kong, Singapore, Beijing, Tokyo, and Shenzhen among other Asian cities. Hong Kong, Singapore and Beijing each climbed one rank to supersede Tokyo in the order, which slipped to the seventh position from fourth, according to the survey that features 114 major global financial centers.

The latest index showed that cities' rating scores are still lower than 2019 levels, reflecting the uncertain nature of the global economic environment. However, average scores only declined by 0.55%, or 3.5 points, from the previous survey in September, indicating greater confidence in the financial system than during the early months of the pandemic last year. By comparison, the average rating scores of financial centers had crashed by 41 points in the September survey over that in March 2020.

Welter of instability

The ratings reflect "a welter of instability in international trade, politics and economics, not least large-scale interventions by central banks and questions about the future treatment of commercial banks, insurers and payment providers," said Michael Mainelli, the executive chairman of Z/Yen in a March 17 press release.

The survey combines assessments from financial professionals with quantitative data which form instrumental factors. The GFCI 29 survey used more than 65,000 assessments from 10,774 financial services professionals, according to the press release.

Yu Lingqu, vice director of center for financial studies at China Development Institute, said that the rise of Chinese cities as a cluster is an important takeaway from the index.

"More international think tanks, financial institutions and the financial practitioners are paying attention to China's mainland financial center development and the corresponding opportunities that we can discover," he said in a press briefing following the report's release. "Compared with top financial centers New York and London, much more improvements need to be done in competitiveness with many China's mainland centers," he said.

Hong Kong expects to benefit as a gateway city between international investors and the mainland Chinese market in the Greater Bay Area, an upcoming area in South China that also includes Macau and several cities in the Pearl River Delta.

"The role Hong Kong can play [for the Greater Bay Area] is really the international aspect of it," said King-lun Au, executive director and board member, Financial Services Development Council of Hong Kong, citing the city's common law system, infrastructure, talent pool, as well as market capabilities such as liquidity and risk management tools. "This super connector role... we believe there are many, many opportunities ahead for everyone who are interested in the growth of China."

Fintech rankings

In the fintech rankings, published alongside the GFCI 29, Shanghai ranked second, just after New York, followed by Beijing and Shenzhen. London took fifth, while Hong Kong and Singapore ranked sixth and seventh.

"Shanghai, Beijing and Shenzhen in the top two, three and four in the international community [shows they are] performing well compared with all the international financial centers," China Development Institute's Lu said.

Mainland China is home to large tech companies with fintech operations, such as Ant Group Co. Ltd. and Tencent Holdings Ltd.. Hong Kong's virtual banks have commenced operations last year, while Singapore granted four digital bank licenses in December 2020.