In this edition of Insight Weekly

The global insurance industry disclosed roughly $1.3 billion in collective losses and reserve charges related to the Russia-Ukraine war in the first quarter, according to an S&P Global Market Intelligence analysis. Insurers and reinsurers in Europe were hit particularly hard, with some signaling that losses may impact future earnings as the situation escalates.

After soaring in 2021, the market for special purpose acquisition companies is falling back to Earth in 2022. SPAC mergers, which bring private companies into public markets without a traditional IPO, have declined in value from a record 2021, and fewer new SPACs are coming to market, according to Market Intelligence data. Some investment banks have pulled back on their SPAC businesses, and private investment in public equity financing for SPACs has slowed, experts say.

Asian banks' bond issuance in focus

Asia bank bond issuance stays tepid in April amid rate hikes, China lockdowns

Mitsubishi UFJ Financial and Japan Bank for International Cooperation were the only bond issuers among Asia-Pacific banks in April, raising an aggregate $3.50 billion, according to Market Intelligence.

Indian banks to raise bond funds to lock in low rates before window closes

Indian banks are looking to raise funds through the bond market in the next few months to capitalize on low interest rates, even as most banks meet capital requirements.

Deep dives

In-depth features looking at the impact of major news developments in key industries.

Financials

US banks pull back on bond purchases as funding outlook shifts

Interest rates have continued to rise in the second quarter, but banks appear to have held off on securities deployment as loans have continued to grow and deposits have leveled off.

US bank margins fall in Q1 despite increase in rates

The Fed kicked off highly anticipated rate hikes in mid-March and long-term rates rose notably ahead of the move, but the banking industry's aggregate, taxable equivalent net interest margin dipped in the first quarter.

European i-banks edge out US peers as volatile markets boost Q1 trading revenues

Market volatility fueled double-digit income growth in fixed income, currency and commodities for global investment banks in the first quarter of 2022.

Combined Q1 profit of 3 biggest Mexican banks jumps 40.8% YOY

Combined net profit for Grupo Financiero BBVA México, Grupo Financiero Banorte and Grupo Financiero Inbursa increased 40.8% year over year to 34.24 billion pesos.

Insurance

Global insurers take $1.3B in losses from Russia-Ukraine war in Q1

Swiss Re experienced the largest war-related impact with a $283 million reserve hit for potential claims. Hannover Re established a "precautionary reserve" of more than $160 million for claims related to the Ukraine-Russia war.

Private Equity

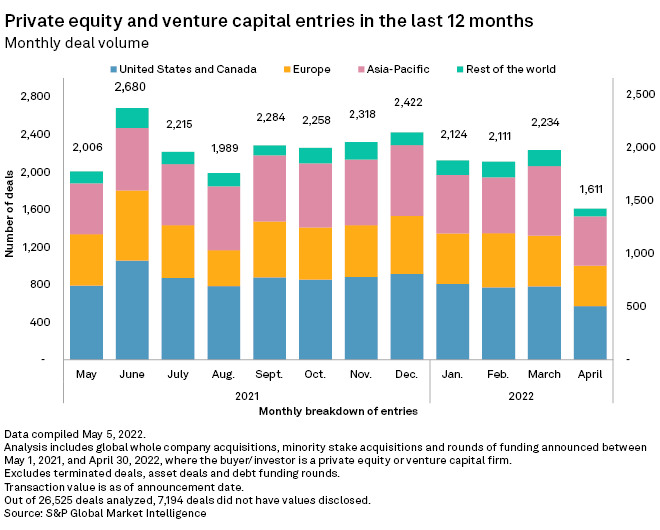

Global private equity deal value inches up in April

A total of 1,611 private equity deals were announced globally in April, down 22.2% from the same month in 2021, according to Market Intelligence data.

Fintech

Venture capitalists shift to funding APAC digital lending companies in Q1

Funding for firms in the digital lending space, which was negatively affected by the pandemic, increased to 52 deals in the first quarter, up from 38 in the first quarter of last year, Market Intelligence data shows.

Financials Research: Q1 US fintech funding remains elevated but investors are tapping the brakes

U.S. financial technology companies raised $9.3 billion in the first quarter of 2022, exceeding last year's average quarterly funding levels.

Credit and markets

SPAC boom fizzles as market retreats, threat of new regulation looms

A previously euphoric corner of the financial world has turned more humdrum as investors lose their appetite for risk and eye potentially stricter rules for SPACs.

Technology, media and telecommunications

Meta, Snap look to lead Big Tech into metaverse

Making the metaverse work will require more widespread adoption of augmented and virtual reality, and Meta, along with Snap, is positioned to lead the way, analysts said. Other Big Tech companies are likely to follow.

451 Research: Cloud permeates nearly every facet of data platforms technology

Cloud adoption and cloud migrations remain strong among enterprises, particularly for operational and analytic databases, according to the latest survey data from 451 Research.

ESG

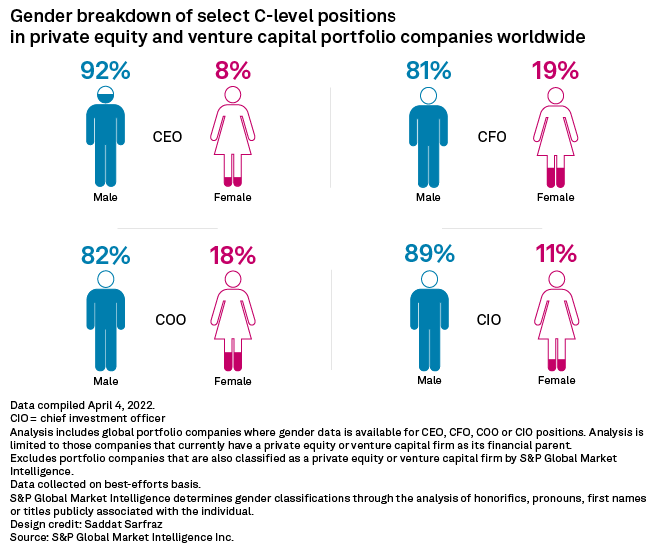

No guaranteed fix for woeful C-suite diversity stats at PE portfolio companies

The issue is front and center for firms and their investors, but it is unclear whether efforts to redress the balance will be effective.

Energy and utilities

A decade into tariffs, US solar manufacturing is still deep in Asia's shadow

Washington has been unwilling to provide targeted incentives for solar manufacturing, relying instead on import tariffs that have raised panel prices while leaving the country dependent on factories in Southeast Asia.

Australia power plant pipeline includes 50 GW of wind, solar resources

Australia's power generation mix, now nearly two-thirds coal and natural gas, is undergoing a dramatic transformation, with nearly 50 GW of wind and solar resources under development.

RRA Research: Western US wind pipeline buoyed by favorable financials in Wyoming, New Mexico

While solar and energy storage dominate the project pipelines in California, Nevada and Arizona, wind reigns supreme from New Mexico to Montana as robust wind resources and low-cost land lead to very favorable financial outlooks in these states.

Metals and mining

Ukraine war intensifies shipping challenges amid looming graphite supply crunch

Shipping constraints, first triggered by the COVID-19 pandemic and now exacerbated by the war in Ukraine, have stymied developers and suppliers aiming to feed the world's growing hunger for graphite.

Metals and Mining Research: Copper discoveries – Declining trend continues

Elevated copper exploration budgets over the past several years have not led to a meaningful increase in the number of major discoveries.

The week in M&A

Siemens Energy launches €4B takeover bid for wind unit Siemens Gamesa

Deal Profile: Boston-based Brookline Bancorp to acquire NY-based PCSB Financial in $313M deal

Deal Profile: Massachusetts-based Cambridge Trust, Northmark Bank to merge in all-stock deal

Deal Tracker: Europe's media, telecom M&A falls 18.2% YOY in April

The Big Number

Read more here.

Trending

Read more here and follow @karinrives

Insight Weekly is a newsletter published every Monday that highlights exclusive industry-focused reporting, market news and economic insights from the global newsroom here at S&P Global Market Intelligence.

Sign up here to receive Insight Weekly via email every Monday.

S&P Global Mobility and S&P Global Market Intelligence are owned by S&P Global Inc.