S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Mar, 2021

By Zia Khan, Rebecca Isjwara, and Rehan Ahmad

The Asia-Pacific will likely remain an active place for mergers and acquisitions in the financial sector in 2021, thanks to its stronger post-pandemic recovery, opening markets and a growing pool of fintech startups hungry for funding, experts say.

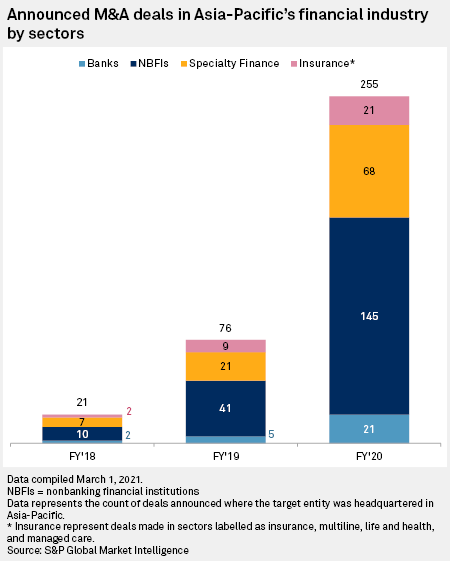

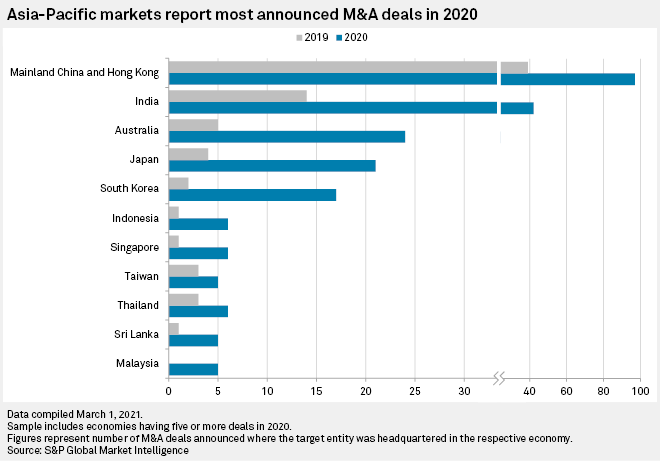

The number of financial sector M&A deals announced in Asia-Pacific more than tripled to 255 in 2020, S&P Global Market Intelligence data show. Greater China, which includes Hong Kong, Taiwan and Macao, accounted for more than a third of the total deal count and remained as the top destination for M&A deals in the region.

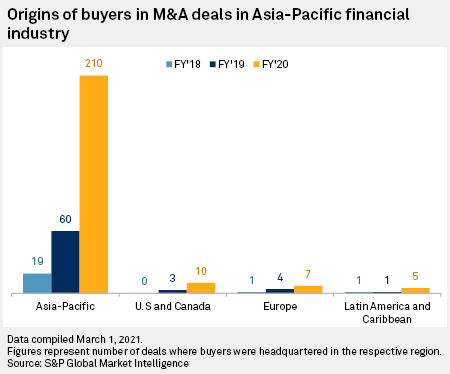

While most of the buyers were based in the Asia-Pacific, investors from the U.S. and Europe announced 17 deals in 2020, more than double the seven in 2019, the data showed.

"With Asia-Pacific expected to rebound from the effects of the pandemic sooner than the rest of the world, deal momentum is likely to continue well into 2021, given the region's inherent advantages — positive valuations, lower acquisition premiums and a growing mid-market," said Yash Chanana, director, investment banking at Acuity Knowledge Partners.

M&A activity broadly picked up across the globe in the second half of 2020 as market confidence started improving with progress in developing COVID-19 vaccines. But global investors are increasingly looking at China, South and Southeast Asia for superior returns and better growth opportunities. China was the first major global economy to recover from the pandemic and many other countries in the region are expected to bounce back this year. India's economy is expected to strongly rebound from its first recorded recession and data from Southeast Asia point to a recovery taking hold.

Key trends

The key trends in the Asian market would include mergers of weaker lenders, takeovers of small finance institutions by universal banks, and the sale of noncore assets, Chanana said. In addition, he expects China and developed countries to invest in emerging economies in South and Southeast Asia and overall market consolidation in India.

Global investors may be unable to ignore the strong lure of China's insurance, securities and asset management sectors despite the ongoing geo-political and trade tensions. China started allowing more foreign access to its financial industry since 2018, gradually lifting ownership caps in segments that were previously considered to be strategic, including securities, fund management, futures and life insurance.

"We expect U.S. firms' appetite for Chinese assets to remain strong despite the tense geopolitical environment, driven by their desire to tap into China's consumer demand and establish a long-term competitive position in the world's fastest-growing market," Chanana said. "The opening up of China's economy, particularly its financial sector, is a move long demanded by the U.S., and may actually ease some of the pressure from the ongoing trade tensions," he said.

China attracted investments from global institutions such as Goldman Sachs Group Inc. and JPMorgan Chase & Co., primarily in the securities sector in 2020. In December 2020, Goldman Sachs struck a deal to acquire the remaining 49% stake in its securities joint venture, while JPMorgan acquired an additional 20% stake in its Chinese securities joint venture to increase its stake to 71% in October of the same year.

Collectively, U.S. and European firms participated in 12 financial M&A deals in China during 2018-2020, compared with 11 deals in the rest of the Asia-Pacific region, Market Intelligence data shows. In total, mainland China and Hong Kong accounted for 97 announced deals in 2020, up 148% year over year.

Ben Balzer, partner and head of corporate finance and restructuring for Asia-Pacific at management consulting firm Oliver Wyman, expects more global investors to follow the footsteps of their peers. Credit Suisse Group AG and UBS Group AG, for instance, could further increase their stakes in local joint ventures after getting regulatory approvals.

"We expect others to consider their options as well and watch closely how some of the players who have recently taken control of their JVs will fare," Balzer said, adding, the moves show their commitment and confidence in the long-term potential of the Chinese market.

The post-COVID recovery in the global M&A market will likely see the Asia-Pacific playing an increasingly important role, due to its attractive markets, growth opportunities and opening up policies, Miranda Zhao, Natixis' head of M&A for Asia-Pacific, said in a recent post.

"Private equity firms continue to raise record funding and grow rapidly in the region, with [special purpose acquisition companies] potentially adding to the momentum...All these factors should position Asia-Pacific as a fast-growing M&A market in the coming years," Zhao said.

Red-hot fintechs

Another key driver for M&A in the Asia-Pacific in 2021 and beyond is expected to be the thriving fintech sector, especially in Southeast Asia, India and China.

The region's vibrant fintech space has been creating a lot of interest among investors and banks looking to satisfy their tech needs build and accelerate their digital capabilities.

Data recently compiled by Market Intelligence shows that Asia-Pacific fintech firms scooped up $3.14 billion across 113 deals in the 2020 fourth quarter, which marks the highest quarterly funding activity for the year. Indian fintech companies raised $2 billion in 121 deals in 2020, while Southeast Asian fintech firms netted 28% of Asia-Pacific deal activity and 17% of the region's funding value in 2020, according to the data.

Higher tech adoption rates and promising growth prospects will likely make China and Southeast Asia hot destinations for fintech investments in 2021, Acuity's Chanana said. He expects strong interest in blockchain, regulatory technology and wealth management services in these markets.

The unprecedented online traffic driven by social distancing measures is forcing banks of all sizes to scout for technology and realign their business models, which would lead to technology-driven acquisitions. In addition, banks may seek bolt-on acquisitions or joint ventures with fintech companies to bolster their digital capabilities, Chanana said.

Meanwhile, a surge in newly listed special purpose acquisition companies could also support M&A in the region, particularly in Southeast Asia where startups generally have fewer fundraising options. SPACs are skeleton organizations that list with the intention of buying and reverse merging with a private company. A surge of newly listed SPACs in 2020 suggests that more companies are on the hunt for deals before their two-year deadline is up, analysts previously told Market Intelligence.