Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Apr, 2022

|

Chinese lenders continued to dominate S&P Global Market Intelligence's ranking of the Asia-Pacific's largest banks by total assets in 2021, helped by strong growth in lending after a pandemic-induced slowdown.

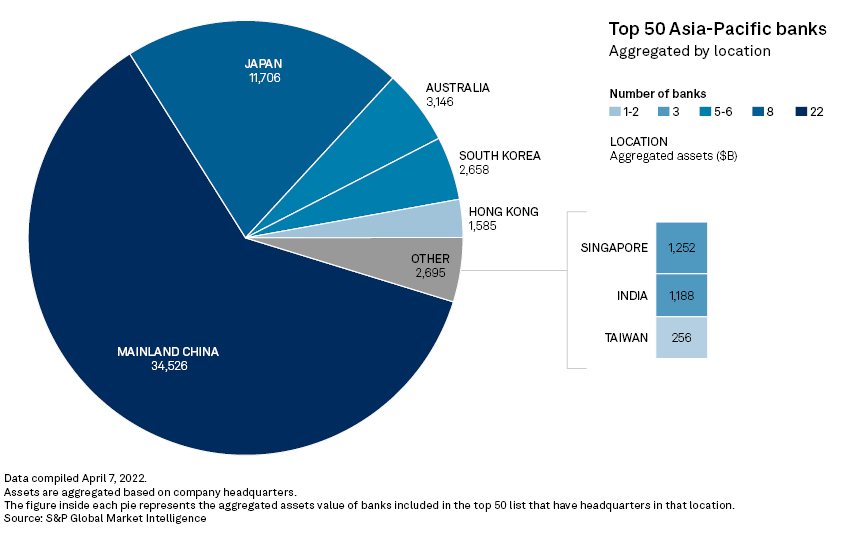

Twenty-two mainland Chinese banks featured in the list of the 50 largest banks in the region, holding combined assets of $34.526 trillion at end-2021, up more than 10% from a year ago. Industrial & Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd. kept their positions as the region's largest banks, with their total assets growing 10.16% year over year to $19.081 trillion in 2021, Market Intelligence data shows.

Eight Japanese banks, with combined assets of $11.706 trillion, made it to the list, compared with nine lenders with combined assets of $12.748 trillion in the previous-year ranking. Mitsubishi UFJ Financial Group Inc. retained its fifth position on the list with $3.177 trillion in assets, while Mizuho Financial Group Inc. and Postal Savings Bank of China Co. Ltd. switched their places on the list.

China's economy registered 8.1% growth in 2021 even though the pace slowed during the second half of the year. Banks in the world's second-largest economy benefited from solid growth in new bank lending, which hit a record 19.95 trillion yuan in 2021, an increase of 1.6% over 2020, the People's Bank of China said.

Loan growth, however, has been losing steam this year as the economy slows on the back of a resurgence in COVID-19 infections and debt problems at China's property developers. Outstanding yuan loans grew by 11.4% year over year to 201.01 trillion yuan in the quarter ended March 31, a rate unchanged from a month earlier, but down 1.2 percentage points from a year earlier, the People's Bank of China said.

China Guangfa Bank Co. Ltd. saw the biggest jump in ranking, climbing to No. 31 from No. 35 in the previous ranking, after its total assets swelled more than 30% year over year to $493.36 billion as of June 30, 2021. On the other hand, Japan's Fukuoka Financial Group Inc. slipped to No. 48 from No. 43. Malaysia's Malayan Banking Bhd. and Japan's Mebuki Financial Group Inc. dropped off the list.

In addition to China and Japan, South Korea has more than five lenders featured on the ranking list of 50 largest banks in Asia-Pacific. KB Financial Group Inc. moved up one place on the list to No. 26 in 2021, while Shinhan Financial Group Co. Ltd. fell one notch to No. 29. The remaining four South Korean banks — NongHyup Financial Group Inc., Hana Financial Group Inc., Woori Financial Group Inc. and Industrial Bank of Korea — each fell two notches from their positions in the prior-year ranking.

Australia's four largest banks, along with Macquarie Group Ltd., reported combined assets of $3.146 trillion at the end of 2021. Commonwealth Bank of Australia and Westpac Banking Corp. retained their rankings at No. 19 and No. 23, respectively, while National Australia Bank Ltd. climbed one notch to No. 24. Australia and New Zealand Banking Group Ltd., occupied the 21st slot in the latest ranking, one notch down from the previous year.

Macquarie and India's ICICI Bank Ltd. were the newest additions to the Top 50 largest Asia-Pacific banks, coming in at No. 47 and No. 50, respectively.

As of April 18, US$1 was equivalent to 6.37 Chinese yuan.