Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2021

By Tom Jacobs and Kris Elaine Figuracion

Excessive heat and drought conditions, combined with other adverse weather conditions, spawned a damaging series of wildfires in the western U.S., a trend that could have a significant impact on the property and casualty insurance market.

|

The National Interagency Fire Center, or NIFC, in its outlook for July through October said fire activity had increased across the West during June.

Through July 19, the NIFC has recorded 35,086 fires nationwide this year, which have burned a total of about 2.5 million acres. Almost half of the acreage burned thus far in 2021 has been in the southwestern and northwestern parts of the country.

The two largest active fires are the Bootleg Fire in Oregon's Fremont-Winema National Forest, which has burned more than 293,000 acres, and the Beckwourth Complex Fire in the Plumas National Forest in Northern California, which has wiped out more than 105,000 acres.

NIFC spokesperson Stanton Florea said the center's National Wildland Fire Preparedness Levels stands at its highest level, which indicates that multiple areas are dealing with large and complex fires that areas that "have the potential to exhaust national wildland firefighting resources."

Prolonged drought conditions are driving a lot of fire conditions across the West, according to Florea.

Shrinking insurance market

The prospect of another severe fire season continues to impact the homeowners insurance market. Aon PLC in a recent white paper said the market continues to restrict capacity to cover wildfires as the events become larger and more frequent.

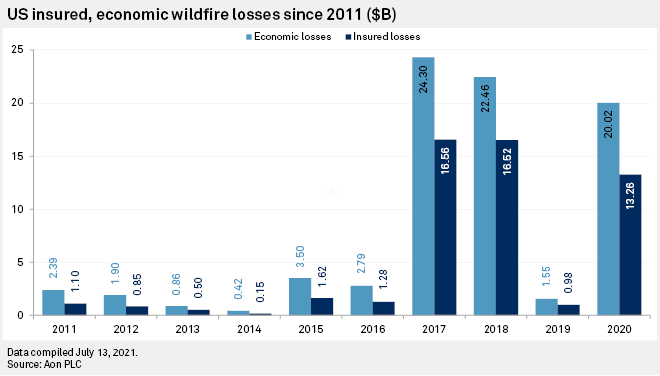

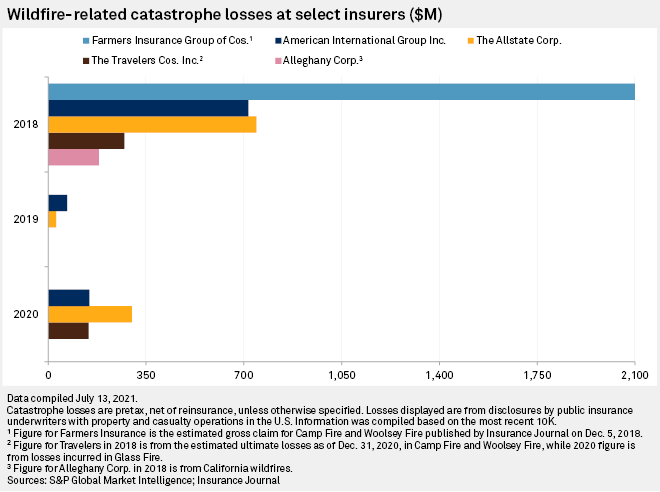

Insured losses from wildfires in the U.S. have exceeded $13 billion and economic losses have topped $20 billion in three of the last four years, according to Aon. Catastrophe losses related to wildfires at Farmers Insurance Group of Cos. touched $2.1 billion in 2018 alone.

Most wildfire losses that have hit the insurance market originated from California utility companies due to inverse condemnation, which states that private property owners are entitled to compensation if their property is damaged by the government or utilities. While all U.S. states have such doctrines in place, California has been the only one to apply it for utility-related fires. Aon's report stated that there have been "significant" price spikes in excess casualty risks associated with wildfires, "especially when no exclusionary language is in place."

Speaking during The Travelers Cos. Inc.'s second-quarter earnings call, Michael Klein, president of personal insurance and executive vice president, said the company is managing its wildfire exposure across all lines. Travelers continues to work its way through nonrenewal activity subject to the lifting of moratoriums as they expire, he said. The company last month was granted an additional 6.9% rate increase on its property product in the Golden State, Klein added.

"We've got that sort of risk prevention partnership extending across an additional state in the West, which we think, on the margin, is helpful," Klein said.

The Travelers executive also noted that the company's Wildfire Defense Services endorsement, which was added to California homeowners policies in 2020, has been extended to policies in Colorado.

Wildfire Defense Services combines forecasting and threat analysis to identify Travelers customers who could be impacted by wildfires and then utilizes other resources to help them take preventive measures, if possible.

California losses low in 2021, for now

Property damage in California year-to-date has been relatively light compared to recent years. According to Cal Fire, there have been 4,991 incidents that have destroyed or damaged 135 structures and caused no fatalities.

California in 2020 totaled 10,431 fires that torched more than 4 million acres. Paul Pastelok, long-range meteorologist for AccuWeather, said the potential is there for those numbers to be matched this year. Very low mountain snowpack melt-off, coupled with a moderate La Niña that lasted from the end of last summer through the winter worsened the drought in the western U.S. and produced extremely dry conditions.

"We're in a dangerous situation right now, and it could get possibly worse, depending on the upper-level [weather] pattern going into September, October and November," Pastelok said in an interview.

Adding to the danger is the imminent arrival of the monsoon season. Unlike such seasons in the tropics, there is little precipitation produced by a monsoon in California.

"They're dry thunderstorms with lightning and they can ignite more fires and bigger fires, especially if there's localized wind," Pastelok said. "All those fires that are burning right now are going to spread, and maybe if there are any pop-up dry thunderstorms, it's going to ignite more fires."

While homeowners multiperil and fire dwelling premiums at the largest insurers well outpaced incurred losses in the Golden State in 2020, that was not the case in neighboring Oregon. Incurred loss ratios exceeded 100% for all of the top 10 writers of those businesses last year. Given the rate and capacity adjustments being made in California in response to the rising threat of wildfires, it is possible that insurers could follow suit in Oregon as well.