Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Feb, 2021

As investor demand continues to outpace the supply of U.S. leveraged loan debt this year, the share of riskier, B-minus rated loan borrowers tapping the new-issue loan market has climbed to a record high, while the borrowing cost on these loans has fallen to the lowest level since the Great Financial Crisis.

|

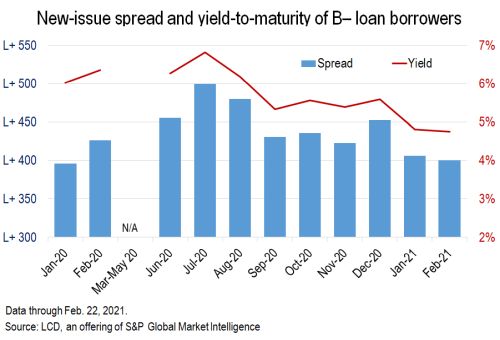

The new-issue yield to maturity on term loans — which takes into account the spread over Libor, 3-month Libor (or in some instances the Libor floor) and original issue discount — to B-minus rated corporates has dipped to 4.76% so far in February, the lowest level since LCD began tracking this metric in 2010. In January, the average was 4.81%, the first time it had fallen below 5% in over 10 years. For reference, loans from B-minus borrowers that were launched to the syndications market last July cleared at 6.83%, although such activity remained light through the summer. The final four months of 2020 saw a pickup in B-minus borrowing, with new-issue yields averaging roughly 5.5%.

Looking at spread alone shows a similar pattern, with the average spread over Libor tightening to L+400 in February, just a few basis points above the January 2020 reading (L+396) and 100 bps lower than in July. In fact, going back to the start of 2017, the average B-minus spread fell below the L+400 mark in just seven out of 49 months.

|

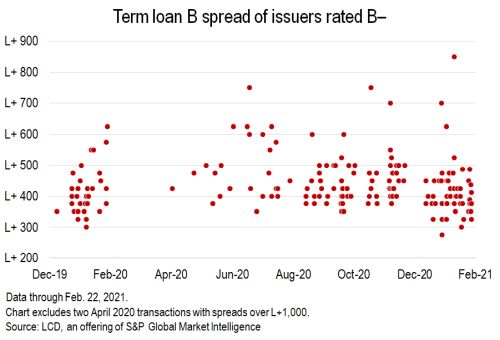

Although the range of spreads within the B-minus average remains wide, with a handful of outliers pricing atop L+600, the current distribution largely follows pre-COVID-19 patterns, with the bulk of loans falling into the L+300 to L+500 range so far this year. Following the onset of the pandemic, most deals for B-minus borrowers carried spreads of well over L+400, with very little investor appetite for these transactions. In fact, the liquidity-related $95 million incremental first-lien term loan for AGS (AP Gaming I) in April 2020 closed with a spread of L+1,300.

Although spreads began to tighten in the second half of 2020, as investor appetite increased, none of the loans to B-minus borrowers that launched between April and December fell below L+350. In contrast, so far in 2021, LCD has tracked eight transactions with spreads below L+350, including a $475 million fungible add-on term loan B for refinancing of Parexel International (B-/B2) debt at L+275, a $2.75 billion first-lien term loan to fund the buyout of RealPage Inc. (B-/B3) and a repricing for Precision Medicine Group LLC (B-/B2) to L+300.

Indeed, the current $121 billion repricing wave extended even to the riskiest leveraged loan borrowers. Some 36 corporates rated B- or B3 by at least one rating agency lowered the cost of their existing loans in the year to Feb. 22, accounting for $36.8 billion, or 30% of this year’s repricing volume. Post repricing, the average spread of these 36 transactions fell to L+395, versus L+464 originally, according to LCD.