S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Oct, 2022

By Darren Sweeney and Anna Duquiatan

While the average age of the overall U.S. power generation fleet holds steady, nuclear plant operators continue to look at extending the lives of their efficient and carbon emissions-free reactors.

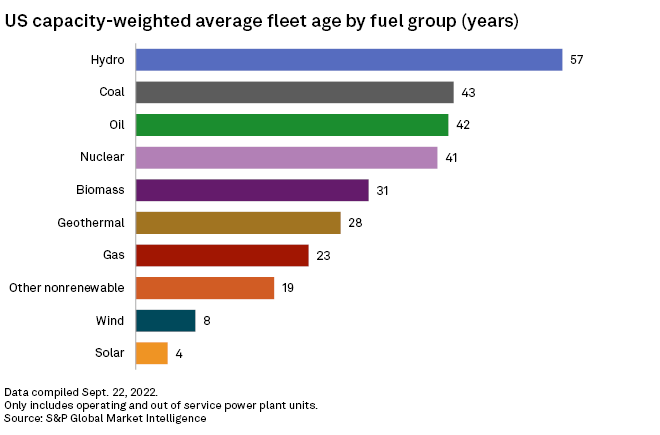

An S&P Global Market Intelligence analysis shows the capacity-weighted average age of the overall U.S. generation fleet remains relatively young, at 28 years, in line with 2021.

The oldest plants in service, as of Sept. 22, were hydroelectric facilities, with an average fleet age of 57 years, and coal-fired plants, with an overall average age of 43 years. Oil-fired units were next, at 42 years, and the U.S. nuclear fleet came in at 41 years.

But as older and less-efficient plants are being retired, operators of nuclear plants are seeking to extend the lives of their units.

Texas-headquartered power provider Vistra Corp. is the latest operator to seek a license extension for its reactors. On Oct. 3 it applied to the U.S. Nuclear Regulatory Commission to continue the operation of both units at its 2,400-MW Comanche Peak nuclear plant for an additional 20 years. The current licenses for units 1 and 2 extend through 2030 and 2033, respectively.

The NRC licenses nuclear plants for an initial 40-year operating period, and operators can apply for a 20-year extension. Vistra is pursuing its first extension for the Comanche Peak units.

Many plant operators have already been granted a first extension. Southern Co., Dominion Energy Inc., Duke Energy Corp. and NextEra Energy Inc. are among the major U.S. utilities that have plans to pursue, or have already been already been granted, license renewals, second license renewals for their nuclear plants, which would allow the reactors to stay online for a total of 80 years.

The U.S. nuclear fleet's average age should see some revision relief soon, however, with the expected completion of two new units at the Alvin W. Vogtle Nuclear Plant in 2023.

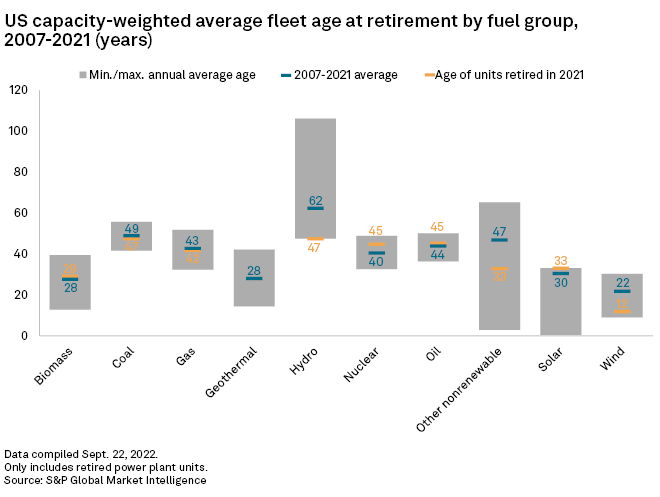

Average age at retirement

The oldest units that were retired in 2021 were younger than average annual retirement ages by fuel groups over the previous 15 years, the analysis shows. The average age of hydro-powered generation units at retirement in 2021 was 47 years, compared to the hydro fleet retirement average of 62 years for 2007-2021. Coal-fired units also averaged a retirement age of 47 years in 2021, below the fleet average of 49 years over the 2007-2021 period.

Both oil-fired units and nuclear reactors that were retired in 2021 had an average age of 45 years, slightly above their 15-year fleet average ages of 44 and 40, respectively.

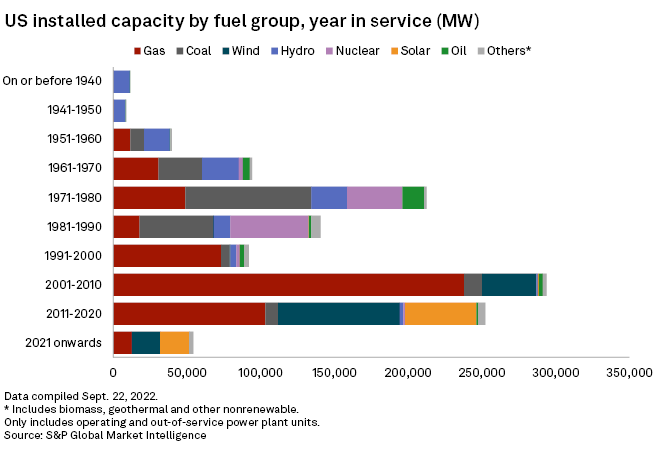

Installed capacity

The U.S. installed the most generation capacity in 2001-2010, at nearly 294 GW, the analysis shows. The bulk of that, about 238 GW, was natural gas-fired generation, followed by nearly 37 GW of wind resources.

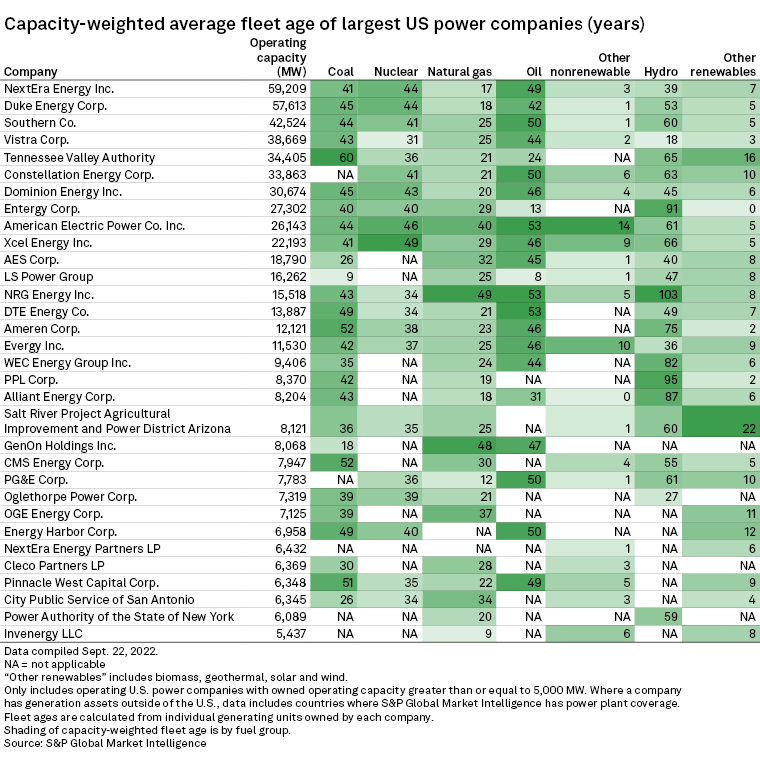

Fleet age of largest US power companies

The New York Power Authority, which operates natural gas and hydro facilities in New York state, has the oldest fleet among operating U.S. power companies with owned operating capacity of at least 5,000 MW. The average age of its fleet is 51 years, the analysis shows.

NextEra, the nation's largest investor-owned utility by market cap, has the youngest fleet at a capacity-weighted average age of 17 years. NextEra limited partnership NextEra Energy Partners has an average fleet age of six years, almost entirely consisting of wind and solar assets.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.