Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Apr, 2021

By Yannic Rack

| A coal-fired power plant in Germany. Utilities across Europe are racing to reduce their emissions amid rising carbon prices and stricter environmental policies. Source: Sean Gallup/Getty Images News via Getty Images |

.

|

Most of Europe's major utilities have joined the race to net-zero, shedding their most polluting power plants and setting targets to reduce their carbon footprints.

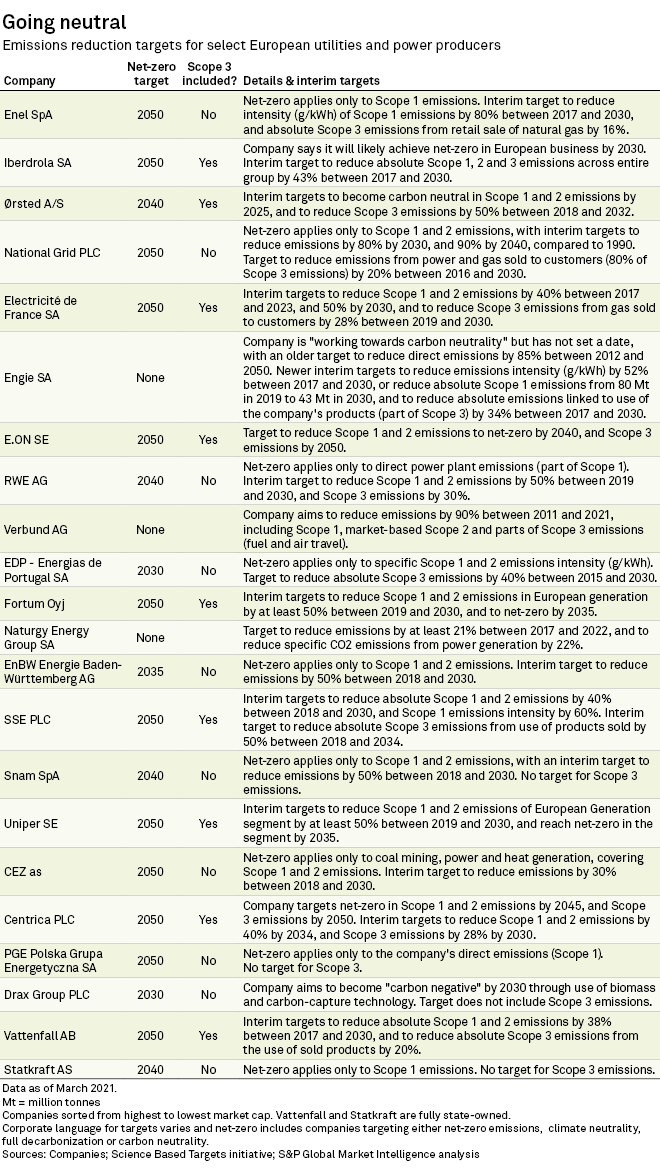

An S&P Global Market Intelligence analysis shows that all but three of the 22 largest power and gas utilities on the continent have now set net-zero emissions targets, and many have already made significant strides toward achieving them.

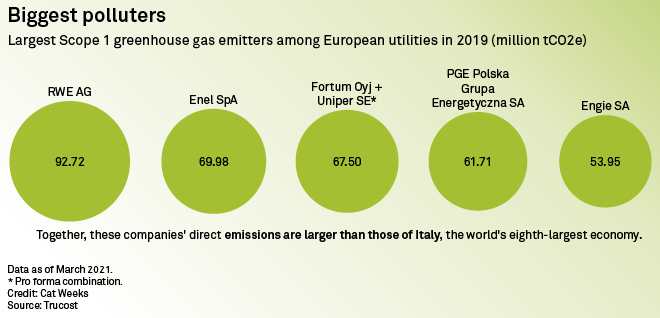

But despite this progress, many of the companies still carry carbon-intensive business profiles. Direct emissions from the five biggest polluters in the sector are larger than those of Italy, the world's eighth-largest economy.

That is starting to become a liability as investors and other stakeholders increasingly focus on environmental, social and governance issues.

"Over the last six to 12 months, there has been an exponential increase in ESG money — funds and clients who are interested in the energy transition story," said Dominic Nash, head of European utilities research at Barclays. "I don't believe there is a single European utility with a management team today with their head in the sand ... they are all very aware of it."

This growing awareness has resulted in a spate of newly set or strengthened net-zero targets in the sector, including from major companies such as Enel SpA and EDP - Energias de Portugal SA. Others such as Fortum Oyj and Vattenfall AB expect to announce higher targets for at least part of their activities during 2021.

"To be completely aligned with the energy transition, we need to make sure that we are CO2 free," EDP's CEO, Miguel Stilwell de Andrade, said after outlining the company's five-year strategy in February.

Although companies' long-term climate targets are difficult to compare and often do not include all of their greenhouse gas emissions, most have also set interim goals approved by the Science Based Targets initiative, which assesses companies' emissions-reduction targets against the goals of the Paris Agreement on climate change.

'A big head start'

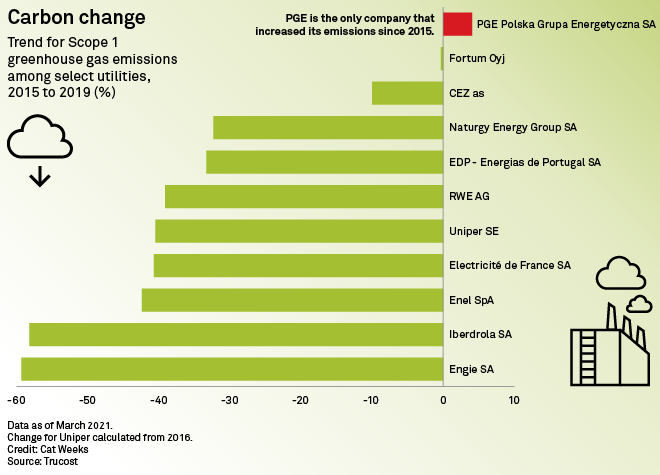

Ten of the largest publicly traded power producers in Europe already cut their direct emissions by more than a third on average between 2015 and 2019, according to the most recent data available from Trucost.

But emissions cuts within the peer group vary widely, partly demonstrating which utilities started to divest or wind down their fossil-fuel holdings early on to focus on building wind and solar parks and growing their regulated energy networks — a strategy now broadly adopted across the sector.

Companies such as Enel and Iberdrola SA have already shut down most of their coal-fired power plants, both in Europe and elsewhere, and become the first of a few clean energy supermajors that loom large over the renewables industry.

"There are companies which started this path 15 years ago — the Iberdrolas, EDPs, Enels of this world. So they have a big head start," said Alberto Gandolfi, head of European utilities research at Goldman Sachs.

Other power producers have driven down their carbon footprint even more dramatically by simply ditching their emissions-intensive businesses. Ørsted A/S sold its upstream oil and LNG units to refashion itself into the world's largest offshore wind developer and now plans to reduce its direct emissions to net-zero by 2025, ahead of any of its competitors.

There is one outlier: PGE Polska Grupa Energetyczna SA, the largest state-controlled power company in Poland, saw its emissions grow over the five-year period. And Finland's Fortum vaulted to No. 3 on the list of the largest outright emitters with the acquisition of Uniper SE, although the new subsidiary has made more progress than its owner in reducing emissions.

Market Intelligence's analysis of Trucost data focuses only on direct emissions, known as Scope 1, which for utilities mainly comprises the CO2 created by burning coal, gas and other fuels in their power stations. Many of the companies, for example those that trade and sell large amounts of natural gas or other fuels, also have large so-called Scope 3 emissions created by their customers, which sometimes exceed those from their own operations.

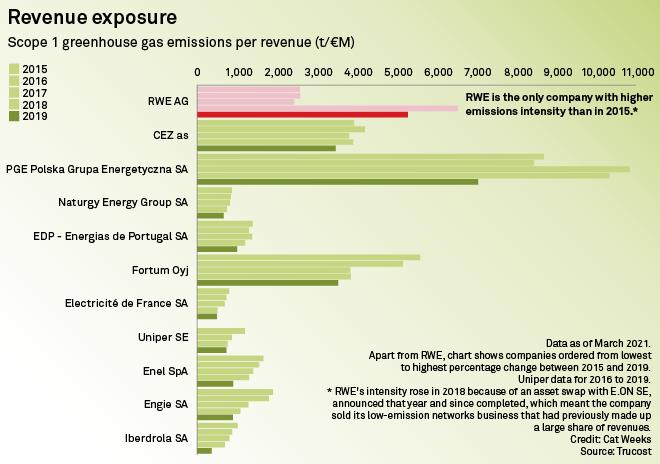

More than half of the companies have been less successful in reducing the carbon intensity of their overall portfolio, measured by direct emissions as a share of revenue, than they have in reducing their absolute emissions, Trucost data shows.

Utilities prefer to report their progress in cutting emissions in grams per kilowatt-hour, but that measure shows only the carbon intensity of their power production without taking into account the rest of their businesses, such as grid networks and retail. Several companies included in this analysis reported significant declines in their emissions intensity per kilowatt-hour in 2020, compared to 2019.

Out of three companies without formal net-zero targets only Naturgy Energy Group SA responded to a request for comment. A spokesperson said the company is "committed to the goal of achieving net-zero emissions by 2050" and is reviewing its environmental targets. The company already achieved its goal for 2022 by cutting direct emissions by 30% over the last three years.

Engie SA, the fifth-largest absolute emitter in the analysis, did not respond to a request for comment. Neither did Verbund AG, which does not have a net-zero target despite mostly owning hydropower plants.

'Everyone is getting there'

Even among the companies that have set out ambitious decarbonization pathways, the goalposts are likely to keep moving as countries tighten environmental policies.

"The targets companies have set are not permanent — they are going to change, usually for the better," said Kyle Harrison, a senior associate for corporate sustainability at BloombergNEF.

Gandolfi said investors should look at the rate of improvement, rather than absolute emissions today, to determine the best actors. Even more important is where companies are investing in the coming years, he said. And while companies that are only starting their transformation now, such as RWE AG, Naturgy and Engie, still carry higher business risk, they also offer potential opportunities for investors.

"Those companies, from a decarbonization perspective, have more road to go," Gandolfi said. "But everyone is getting there."

Some of the laggards in the sector have lately started getting a helping hand from the state.

In Germany, RWE is shutting its vast coal mines and power plants by 2038 under a timetable set by the government, which is paying the company billions to finance the closures. That model is being adapted in Poland, where utilities have asked the government to let them dump their coal assets into a state-owned entity that will manage their phaseout.

PGE, the largest of the Polish companies, argues this is the only way it will be able to attract financing in the future. Some banks have implemented policies against financing coal projects and the EU's green taxonomy is expected to further limit the amount of money flowing into polluting activities.

Meanwhile, Norway's sovereign wealth fund has sold its holdings in RWE because it ran afoul of the fund's new restrictions on thermal coal. And France's largest insurer has reportedly severed ties with RWE because it is moving too slowly to shrink its carbon footprint.

RWE is the only company analyzed that increased its emissions intensity by revenue over recent years due to an asset swap that saw the company shed its lucrative and low-emitting grids business. For now, that has left investors with a company even more exposed to coal and the CO2 produced in its massive power plants, despite RWE's pivot to renewables.

A spokesperson for RWE questioned whether intensity by revenue is an appropriate metric for assessing utilities and pointed to the low contribution of the coal business to the company's revenue.

Other utilities that have moved faster to align themselves with a low-carbon future say they are already reaping the rewards, for example through access to cheaper financing.

"We do see a small premium beginning to creep in, in terms of the green bonds," EDP's Stilwell de Andrade told Market Intelligence after the company's strategic update in February.

EDP used the occasion to update its climate targets, pledging to reduce its direct emissions to net-zero by 2030. The company also plans to strengthen its Scope 3 target in the coming months.

While many companies still have a challenging path to get to carbon neutrality, Goldman Sachs' Gandolfi said they will be forced to go all the way, propelled by economics, environmental policies and the push from green investors.

"The transition is going to happen, period," he said.

Trucost is part of S&P Global Market Intelligence.