S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jun, 2021

By Yuzo Yamaguchi

Japanese financial institutions that offer deal advisory services are set to enjoy a further boost to their fee income as mergers and acquisitions gather steam, helped by ultralow interest rates, experts say.

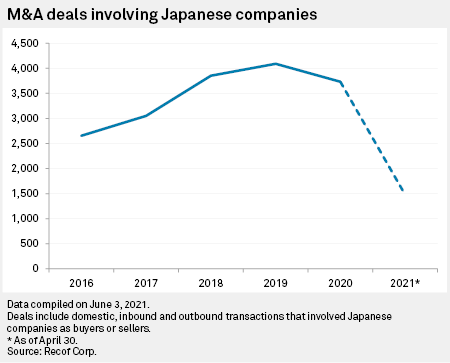

During the first four months this year, 1,480 deals involving Japanese companies were announced, according to M&A advisory firm Recof Corp. It was up from 1,288 in the same period of 2020, as well as 1,443 in the first four months of 2019. On an annual basis, 2019 was the strongest year on record in Japan when 4,088 deals were sealed, before falling to 3,730 in 2020.

As M&A transactions picked up in recent months after a lull in 2020 due to the pandemic, major Japanese financial institutions reported strong performance in fees from deal advisory for the fiscal year ended March 31. Nomura Holdings Inc., the nation's largest brokerage, said its revenue from deal advisory in the last fiscal year climbed 27% from a year earlier to ¥115.9 billion, the highest in 10 years, mainly driven by domestic transactions and outbound investments to Europe. Daiwa Securities Group Inc., Japan's second-largest brokerage, said its advisory revenue in the fiscal year ended March 31 was the second-highest in the company's history.

"There is no question that deals for this year will surpass last year's levels," said Shingo Ide, chief equity strategist at NLI Research Institute. "Momentum of deals will remain strong for the rest of the year."

Japanese banks and brokerages have been seeking growth outside their lending and other interest rate-tied businesses, as the nation's yearslong ultralow interest rates and sluggish loan demand amid an aging population pressured their growth prospects. Financial institutions in Japan, once reliant on lending, have been shifting toward dealmaking, according to Hajime Takata, executive economist at Okasan Securities Co.

High hopes

As the world's third-largest economy is gradually emerging from the pandemic, cash-rich Japanese companies are again on the lookout for domestic and overseas targets that need to restructure or divest assets due to the slowdown caused by the COVID-19 crisis, or ones that offer new growth prospects. The M&A momentum has also been aided by low-cost funding in Japan, where interest rates have been chronically low for decades.

Nomura is aiming for a further 50% increase in advisory revenue over the next three fiscal years, compared with the fiscal year ended March 31. The company was ranked third in Japan-involved deals for the January-to-March period, according to Maxus Corporate Advisory, which cited data from Refinitiv.

"We are committed to continuing this growth trajectory over the next few years," Steven Ashley, head of Nomura's wholesale business, said at an investor briefing May 12. He added that target growth sectors include healthcare, technology, media and telecom, clean energy and infrastructure.

Daiwa Securities, ranked sixth among the top 21 global deal-making institutions in the first quarter through March according to Maxus, is aiming at growing the volume of relatively smaller deals.

"We're aiming to become a top player in the mid-cap market," Seiji Nakata, CEO of Daiwa Securities Group, said at an investor briefing May 20 about business plans for the next three years starting April 2021. Nakata was referring to deals of less than $1.0 billion each.

While Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. did not disclose their advisory fees from deals, the two megabanks handled 41 and 37 deals and ranked first and second in the market, respectively, for the January-to-March quarter, according to Maxus.

Deal momentum

Some notable deals this year include Japanese semiconductor maker Renesas Electronics Corp. acquiring Dialog Semiconductor PLC of the U.K. for €4.9 billion in February. Meanwhile, two major loss-making Japanese airlines, Japan Airlines Co. Ltd. and ANA Holdings Inc., are reportedly considering merging their international operations as COVID-19 grounded most flights. More unprofitable regional banks in the nation could also consolidate to cut costs as Prime Minister Yoshihide Suga publicly urged the lenders to do so.

Okasan Securities' Takata expects ailing businesses in sectors like transportation, retail, hotel, restaurant, leisure and medical — all suffering from the pandemic — to be acquisition targets as well. Their debt-to-net worth ratio ranged roughly from 200% to 800% in the October-to-December quarter 2020, according to his analysis.

Owner-operator companies that are having hard time finding successors could be another target, he added. Of about 3.8 million small business operators in Japan, nearly 2.5 million will be aged 70 years and above in 2025 and about half of them have not found successors yet, Takata pointed out, referring to a government report.

The robust stock market this year would also support M&A, increasing assets of an acquirer and making it easier for them to take over a target possibly through a share-swap deal, Takata added.

The Nikkei Stock Average, which has risen nearly 6% since the start of the year to 28,963 on June 8, is expected by some analysts to top 30,000 by the summer on the bullish outlook for corporate earnings for the fiscal year that started in April.

As of June 8, US$1 was equivalent to ¥109.45.