S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Nov, 2022

| Dominion Energy has invested in renewable natural gas projects at dairy and swine farms and sees the opportunity to add to its project pipeline, executives said. Source: Align RNG |

Utility executives said they have plenty of opportunity to invest in renewable natural gas, or RNG, supply projects, even as major energy and investment companies continue to acquire RNG developers.

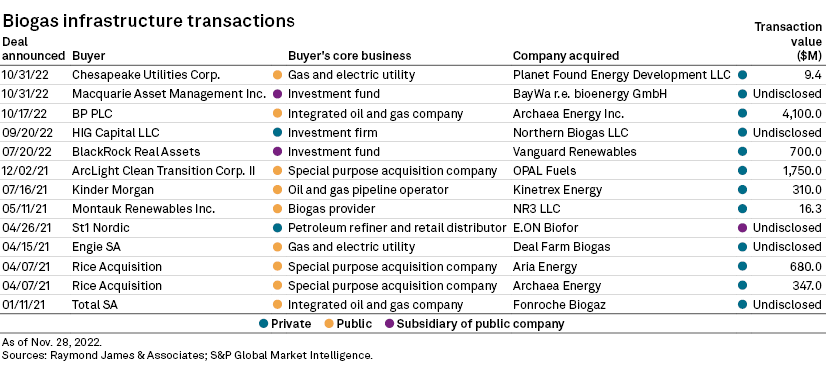

Earlier this year, utility executives faced questions about their role in the space after BlackRock Real Assets acquired RNG project developer Vanguard Renewables LLC in a deal valued at $700 million. Inquiries from Wall Street analysts only multiplied after oil major BP PLC agreed to purchase Archaea Energy Inc. for $4.1 billion.

The concern is that deep-pocketed buyers will squeeze utilities out of the space. Analysts worry that competition for RNG assets will drive up the cost of acquiring supply projects, leading to lower rates of return on the investments. But utility executives tried to alleviate those worries during quarterly earnings calls.

"I think [the BP-Archaea deal] really highlights the value that others see for RNG and, really, the growth potential for RNG. And so first, it gives us confidence that we're going to find more high-growth potential projects," DTE Energy Co. CFO David Ruud said during an Oct. 27 conference call. "Right now, we're just really confident in our business development pipeline."

'Ample opportunities' for utilities

Some utility operators, such as DTE, have invested in RNG supply projects through unregulated subsidiaries, though state legislation is opening pathways to investing through regulated gas distribution companies as well. The investments present higher growth prospects than stable utility operations, providing cash flow that can fund the equity portion of a utility's capital structure.

But the investments are also strategic: Gas utilities operate the infrastructure to transport RNG from supply points and face a growing imperative to decarbonize their distribution systems. RNG, a pipeline-quality alternative to gas, is processed from waste methane at farms, landfills and other facilities. Producing the fuel can be considered carbon-negative because RNG projects use methane that would otherwise escape into the atmosphere.

DTE's business development pipeline is stocked with years of high-return RNG projects, Chairman and CEO Jerry Norcia told analysts. A new federal investment tax credit for RNG has made those projects more economic, meaning DTE can invest less capital while getting the same earnings contributions from them, Norcia said.

Dominion Energy Inc. has "ample opportunities" for investments in RNG projects in 2023, CFO Jim Chapman told analysts during a Nov. 4 call. The company has focused on developing supply projects in partnership with dairy and swine farm operators.

Dominion has four facilities in operation, with 11 under construction and five more set to start construction by year-end, according to COO Diane Leopold. The company still intends to invest $2 billion in the space by 2035, according to Dominion Chairman, President and CEO Robert Blue.

Size is an advantage

Dominion's targeted RNG spending over more than 15 years is about half what BP paid for Archaea Energy. But some executives said gas utilities' size can be an advantage in the RNG marketplace.

Northwest Natural Holding Co. President and CEO David Anderson believes that companies of BP's scale will be looking for large transactions, leaving smaller projects on the table. Companies like Northwest Natural, which is pursuing regulated and nonregulated RNG investments, can be nimble and tailor their approach for each project, Anderson told analysts on a Nov. 8 conference call.

"We're not going to try to compete against these bigger guys," Anderson said. "If these bigger companies are spending a lot of time on the smaller projects, I'm not sure the returns are going to be what they want them to be."

Chesapeake Utilities Corp. President and CEO Jeff Householder echoed those comments during a Nov. 3 conference call. A day prior, the diversified energy distributor announced the acquisition of a company that specializes in processing RNG from chicken litter. Several companies have developed the niche process to deal with poultry industry waste on the Delmarva Peninsula, where Chesapeake distributes gas.

"There are some competitive barriers that exist that we like and that gives us, I think, a leg up," Householder told analysts. "And so we don't see the BPs and the Shells and the other folks that are actively engaging in biogas projects as a significant source of competition at this point."

Utilities take diverse approaches

UGI Corp. President and CEO Roger Perreault on Nov. 18 told analysts that the company intends to progress its plans to invest $1.25 billion in renewable gas by 2025. RNG supply project investments accounted for much of the $300 million invested since 2021, Perreault said.

As part of its 2023 and 2024 capital plans, New Jersey Resources Corp. is pursuing opportunities to off-take RNG supplies for blending and delivery to its utility customers, as well as to build, own and operate RNG infrastructure, said Patrick Migliaccio, COO of subsidiary New Jersey Natural Gas Co., during a Nov. 17 conference call.

Other utilities plan to focus on procuring RNG to meet climate goals and provide customers with lower-carbon options. WEC Energy Group Inc. signed its fourth contract to off-take RNG in October, President and CEO Scott Lauber said Nov. 1.

NiSource Inc. has established common RNG gas quality standards and streamlined its process for connecting to RNG supply across its six-state gas utility footprint, NiSource Chief Risk Officer and Senior Vice President for Strategy Shawn Anderson told analysts on Nov. 7. RNG producers are injecting nearly 2 Bcf per year into NiSource's system, Anderson said.

One Gas Inc. expects to file a voluntary RNG tariff in Oklahoma by year-end, and it is exploring similar options in its other territories, COO Curtis Dinan said Nov. 1. Asked if the company is interested in unregulated RNG investments, One Gas President and CEO Sid McAnnally said the company remained focused on serving as a transporter.

"We continue to be encouraged by the growth and investment we are seeing in this space," McAnnally said. "Recent acquisitions of RNG-related companies demonstrate the market value of RNG and further validates our strategy to utilize our assets to connect RNG supply with demand for the product."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.