S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 May, 2021

By Calvin Trice and Jason Woleben

A hybrid minivan equipped with Waymo's driverless technology takes to the streets.

A hybrid minivan equipped with Waymo's driverless technology takes to the streets.

Source: Waymo LLC

With the prospect of car navigation shifting in the coming years from total driver control to full machine guidance, auto insurance underwriting looks likely to become more complex as well.

The liability portion of most auto insurance policies today focus on the driver who is found to be at fault for an accident. When autonomous vehicles join the traffic flow, however, ultimate responsibility for car accidents could fall on a number of different parties.

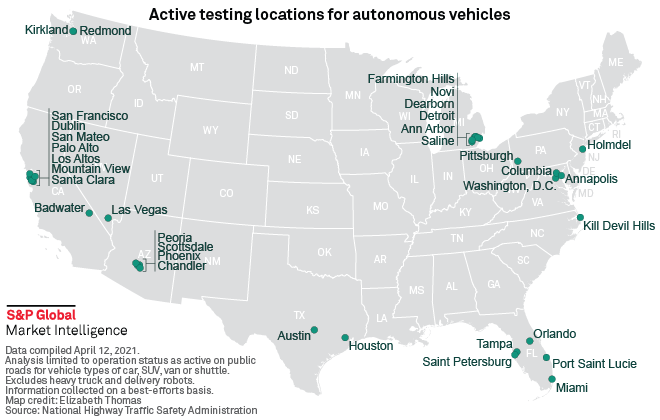

Driverless cars moved closer to everyday reality when Waymo LLC became the latest developer to ramp up testing of its autonomous taxi service in San Francisco — the first such expansion outside of the Alphabet Inc. subsidiary's original launch base in Phoenix. Waymo is one of seven companies that California has permitted to test fully autonomous driverless vehicles on public roads as of April 12.

Amazon.com Inc. subsidiary Zoox Inc. is also allowed to test its prototype on California roads. During a February webinar hosted by Travelers Institute, Mark Rosekind, the company's chief safety innovation officer, predicted that automated vehicles would be a more regular road presence in three to five years, and that widespread deployment at scale would follow in 20 to 30 years.

The technology promises to eliminate human error from driving, and with it the cause of more than 90% of serious accidents, but the development and eventual use of autonomous vehicles will require a different kind of coverage than most vehicles on the road today, Rosekind said.

Shifting fault lines

No technology is foolproof, and for vehicles that are likely to be built, programmed and maintained by multiple companies, sorting out where liability rests when accidents inevitably happen will be more complicated.

"It's one of the seminal questions in the space," said Michael Klein, executive vice president for The Travelers Cos. Inc., which insures Zoox's driverless testing and development. Clouding the answer in the coming years will be the various stages of driver assistance technology that precede fully driverless transport, he added.

Today, drivers have some or all navigational control, but many cars are equipped with sophisticated assistance technologies like emergency braking, adaptive cruise control, lane stabilization and blind spot monitoring. When accidents happen, the facts and circumstances of each event will determine fault, but claims can be handled to pay for replacement, repairs or injuries before fault is assigned, Klein said.

"Insurance does that today," Klein said. "Insurance pays the injuries, pays to get the car fixed and sorts out the fault on the backend."

With today's technology, accident fault has already entered a gray area — when a vehicle with emergency automatic braking rear ends another car, for instance. Nevertheless, removing driver liability from such a scenario is not likely in the near future, said Aite Group LLC insurance researcher Jay Sarzen.

"As long the operator can override any of those systems, responsibility still lies with the driver," Sarzen said.

In commercial applications of driverless vehicles, such as robotaxi services, liability will more clearly rest with the manufacturer, Sarzen said. Injuries or damage from malfunctions will eventually move under product liability, but that category could include multiple providers for any one vehicle, David Carlson, managing director of Marsh & McLennan Cos. Inc.'s domestic manufacturing and automotive practice, said in an interview.

A systems failure could point to a defect with the lidar detection system, electronic components, the design of the artificial intelligence programming, the 5G cellular network, the driver assist build or even a cybersecurity issue if navigation systems are hacked.

"There are many different layers in this ecosystem, and it has grown exponentially," Carlson said.

Even though the mainstreaming of fully autonomous vehicles is still years away, liability issues are being fought in court now. In April 2020, the family of a pedestrian killed by a Tesla vehicle that was on Autopilot filed a lawsuit to hold the manufacturer liable for "defective design" and "negligence," among other things. The complaint said failing to hold companies "at the helm of developing such cutting-edge technologies" responsible for their products makes it "inevitable" that the first pedestrian death related to Tesla's Autopilot would "certainly not be the last."

Future already here

Auto insurance agents should also stay in learning mode as driverless technology evolves, Klein said. Balancing the safety benefits of self-driving features against the steeper repair costs they incur when damaged should in the near term be integral to insurance sales, he said.

"Understanding these advanced safety features — where they are in which vehicles with which manufacturer — you can really be a good trusted advisor to your insured in helping them navigate this," he said.