S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Aug, 2021

By Lauren Seay

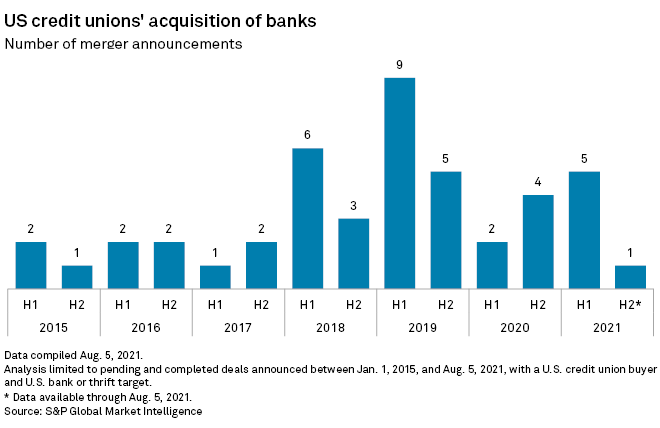

Credit unions remain on the hunt for bank acquisitions, and a bank with $500 million to $1 billion in total assets could trade as early as this week, one deal adviser said.

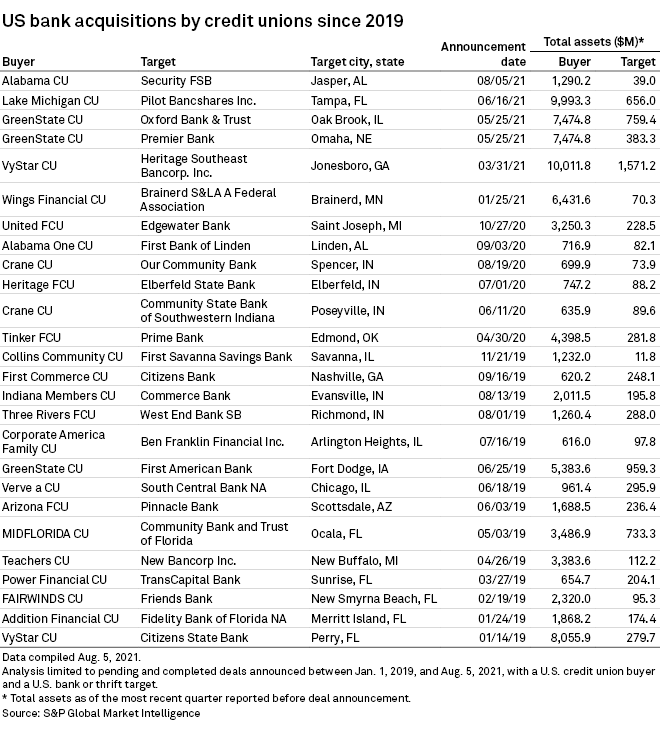

A growing number of credit unions are using secondary capital to expand their deal capacity. One such institution, Tuscaloosa, Ala.-based Alabama CU, said Aug. 5 that it plans to acquire Jasper, Ala.-based Security Federal Savings Bank in an all-cash deal. The tie-up marks the sixth credit union acquisition of a bank announced this year.

The acquisition is the first of four credit union acquisitions of banks that will be announced "very soon," Michael Bell, partner and co-leader of the financial institutions practice group at Honigman LLP, said in an interview.

"There's tons more in process right now," Bell added.

Alabama CU recently funded $30 million in secondary capital with an eye toward growth, and believes it will find multiple potential targets, its CEO said.

Secondary capital is an uninsured loan that issuing credit unions can assume and classify as net worth on their balance sheets upon regulatory approval. Alabama CU President and CEO Steve Swofford said in an interview that the funding bolstered the credit union's capital ratio to 10.5% from 8.5%, which will enable it to consider acquisitions the same size as the Security Federal deal and larger.

"We anticipate that there will be a lot of smaller institutions that find the current environment very difficult," Swofford said. "This is our first bank purchase, but we anticipate that this won't be our last."

Secondary capital bolsters buyers

Like Alabama CU, more credit unions are taking advantage of secondary capital to bolster their growth, Bell said.

"Secondary capital today is much different than secondary capital five years ago. It's becoming more mainstream and more credit unions in the industry are looking at it in a positive or affirmative way," he said. "They see it as a tool or a way to add strength to the credit union, whether that's organic or nonorganic growth."

Even more credit unions could take advantage of secondary capital following a recent final rule from the National Credit Union Administration. On Jan. 1, 2022, the number of credit unions eligible to issue subordinated debt will expand by including "complex" credit unions, defined as those with more than $500 million in assets.

Expanding the pool of credit unions eligible to access secondary capital could support more credit union acquisitions of banks, Bell said.

The number of credit unions using secondary capital, and the size of those transactions, has been increasing over the past two to three years, said Michael Macchiarola, CEO of Olden Lane, an advisory firm for credit unions. The firm has assisted credit unions in more than 25 secondary capital approvals from the NCUA since 2018.

Cash is the only currency credit unions have to offer when acquiring banks, and secondary capital can offset the capital dilution from the all-cash transactions. Likewise, it can offset the dilution that comes from merging with a less well-capitalized credit union, Macchiarola said.

"It is a form of capital rehabilitation. It can replace the capital that you spend on the transaction," he said. "I do think you're going to see credit unions avail themselves of the tools in the toolbox, one of which is secondary capital."

Banking industry groups have long opposed credit union acquisitions of banks, pointing to credit unions' tax exempt status creating unlevel playing field. The Independent Community Bankers of America, a trade organization, proposed a 10% exit fee be imposed on banks that sell to credit unions.

Roll Tide

Security Federal had $39.0 million in total assets at June 30, representing only about 3% of Alabama CU's $1.29 billion in total assets as of the time period.

Once the acquisition of Security Federal closes, the credit union will have a branch presence in Walker County, a goal it began targeting two years ago. Alabama CU now has roughly 1,200 customers and $11 million in loans in the market, Swofford said.

"When we got the announcement that the bank was for sale, we were immediately interested," he said. "It just fit our footprint really well."

While Swofford said Alabama CU is focused on finding more M&A opportunities in its home state, he did not shut the door on opportunities in Florida, where the credit union has one branch, in Pensacola.

"Our name restricts us a little bit there, and since we're the University of Alabama's credit union, we're probably not going to change that," he said. "If the right thing came along, ... we might consider it. But that's not really a priority right now."