S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Nov, 2021

By David Feliba

Growing imbalances in Argentina's economy will likely propel the country's inflation rate above 60% in 2022, local economists said at a Nov. 3 event hosted by liberal think tank FIEL in Buenos Aires.

As the country heads into midterm legislative elections on Nov. 14, the Frente de Todos party, led by President Alberto Fernández and Vice President Cristina Fernández, is expected to lose to the center-right coalition of Juntos por el Cambio. Regardless of the results, the ruling Peronists will remain in office for at least another two years until the 2023 presidential elections.

At a panel focused on the post-election scenario following next Sunday's legislative vote, economists warned about the risks of inflation spiraling out of control should the government fail to tame pricing pressures as it attempts to tackle distortions in the economy. Those distortions include subsidies, an artificially propped exchange rate, price caps and a growing fiscal deficit.

"We are heading into a scenario in which inflation rises above 60%," Sebastian Galiani, an economics professor at the University of Maryland, said. Galiani, a former economic policy state secretary under the previous government, warned that the financial deficit would likely reach 7.9% of GDP by the end of the year. He argued that a fiscally strained budget would call for a "strong correction" in relative prices in 2022.

The fiscal deficit has risen in Argentina during 2020 as welfare expenditures grew together with mounting subsidies to energy and transportation. Galiani qualified the outlook for next year as "explosive" and warned that inflation could spike further once the government attempts to balance the budget.

Since 2018, the country has lost the capacity to finance itself through international debt markets. It has yet to strike a deal with the International Monetary Fund, a net creditor to Argentina on $44 billion in loans.

Unable to place international debt, the South American country has been left to rely on local markets and monetary expansion as a source of funding. But that formula, the economists warned, is having a damaging effect on inflation trends.

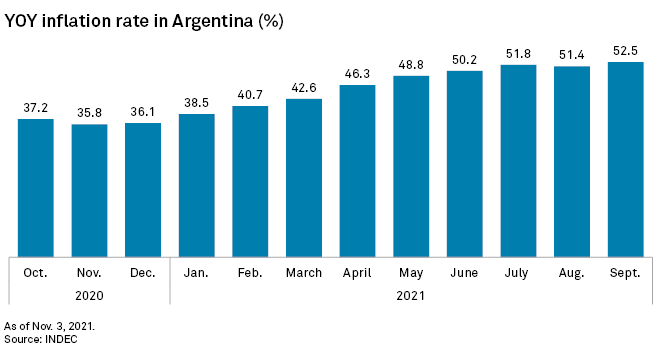

Argentina's inflation reached 52.5% in September year over year, driven mostly by an increase in clothing, healthcare and alcoholic beverage prices. The 3.5% monthly price increase reported in September was a turning point from previous months, when inflation had been slightly more moderate. It prompted the government to establish price caps on more than 1,400 goods in the economy, a decision that has been widely criticized by many in the private sector.

The government's aggressive monetary expansion and increased spending have been highly contentious, amid a growing fiscal deficit and rising inflation.

"If the government pretends to continue its spending spree, consequences on the inflation rate will be even more severe," Daniel Artana, chief economist with FIEL, said. "The macroeconomic variables are not sustainable, and some kind of adjustment will have to be done at some point."

The Argentine economy is expected to partially recover from a nearly double-digit GDP contraction in 2020. But Artana argued that the "very favorable external conditions" that propelled the economy this year will likely fade in 2022. "The external scenario is much less convenient right now, with soybean prices receding and the Brazilian economy slowing down."