Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Feb, 2021

| Arch Resources Inc. operates Black Thunder, the second-largest coal mine in the U.S. by production volume. The company recently announced plans to begin winding down production at the Powder River Basin operation. Source: Alan J. Nash |

The owner of the second-largest coal mine in the U.S. by production volume is planning for the asset's closure as retirement dates approach for several plants that burn much of the mine's fuel.

Coal demand in the U.S. has been declining for years, and Arch Resources Inc. announced Feb. 9 that it would be winding down its thermal coal operations, including those at Black Thunder, a Wyoming mine that produced 12.7 million tons of coal in the fourth quarter of 2020. Black Thunder production represented about 9.7% of the coal mined in the country in that period, according to an S&P Global Market Intelligence analysis.

|

Coal-fired power plants often utilize a specific coal quality that generators cannot easily replace with coal from other regions. While Powder River Basin coal operators have reported some success in managing costs as production footprints shrink, large-scale operations have long been one of the region's primary advantages.

"I do kind of wonder when the point comes where some of the Powder River Basin mines just aren't big enough to keep operating," said Emily Grubert, an assistant professor with Georgia Tech's School of Civil and Environmental Engineering who researches coal retirements. "So by closing, they actually kind of force some of the plants to close down as opposed to the other way around."

Pressure rising to retire coal earlier

A substantial amount of Black Thunder's 2020 deliveries went to plants that do not yet have public plans to retire, while several of the plants with plans to retire have closure dates set beyond 2030. However, pressure continues to mount for utilities to achieve net-zero emissions in alignment with international climate goals.

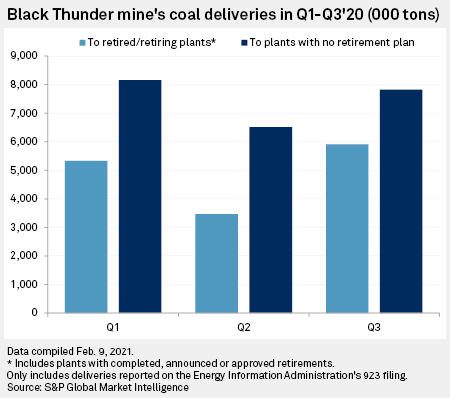

In the third quarter of 2020, about 43.0% of the coal from the Black Thunder mine was delivered to U.S. power plants that have retired or have scheduled a retirement date, based on available fuel contract data from the U.S. Energy Information Administration. More than a quarter of the coal delivered from Black Thunder to plants with a set retirement date during the first three quarters of 2020 went to power operations facing closure by the end of 2025.

Some of the buyers of Black Thunder's coal have set net-zero emissions targets, including DTE Electric Co., Ameren Corp. and Xcel Energy Inc. As pressure builds to meet those targets, some companies could move coal plant retirements forward.

For example, DTE had already announced plans to retire its 1,270-MW Belle River power plant and its 3,086-MW Monroe power plant in 2030 and 2040, respectively. However, DTE President and CEO Jerry Norcia said on a Feb. 19 earnings call that the company is looking to accelerate both closures.

Change of outlook

While it has since ceded the title to Peabody Energy Corp.'s North Antelope Rochelle mine, Black Thunder was once the largest coal mine in the U.S. Arch Resources, known as Arch Coal Inc. at the time, grew the mine by acquiring the Jacobs Ranch mine in 2009.

|

|

Domestic demand has been weaker than producers expected several years ago, but opposition to crucial coal export projects also dashed producers' hopes of exporting more of the fuel from the U.S. West Coast.

Steven Leer, then Arch's CEO, said on an earnings call in October 2009 that the capability to move Powder River Basin coal to the Asia-Pacific region would be a "game-changer." Leer had previously suggested Powder River Basin market demand could rise by 300 million tons. In 2020, producers in the region produced just 230.1 million tons of coal, down 49.5% from the 455.5 million tons produced in 2009.

In 2009, new coal plants were still being built in the U.S., and the natural gas sector had yet to demonstrate the threat that the shale gas boom would ultimately pose to domestic coal demand. Since then, coal plant retirements have picked up at a rapid clip while plans to build new coal plants in the U.S. are nearly nonexistent.

The stark reversal in trends has Arch talking about its thermal coal assets in the Powder River Basin differently in 2021. During a recent earnings call, executives laid out plans for a near-term closure of the company's Coal Creek mine in the basin and an "accelerated" closure of the much larger Black Thunder mine.

"Our focus is on reducing the footprint while simultaneously producing that coal, generating cash and using that cash generated to shrink the footprint," Arch President and CEO Paul Lang said of the Black Thunder mine.

In 2020, the company tried to advance a joint venture of Western U.S. coal operations with Peabody's western operations to compete against natural gas and renewable energy. However, the Federal Trade Commission objected based on potential anti-competitive effects the partnership might create, and the deal was abandoned.

Arch did not respond to a request for details about its plans for closing the Black Thunder mine.