S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 May, 2023

By Sean Longoria and Annie Sabater

US corporate bankruptcy filings slowed in April from a spike in March, though the tally of companies that have gone bankrupt so far in 2023 is higher than the first four months of any year since 2010.

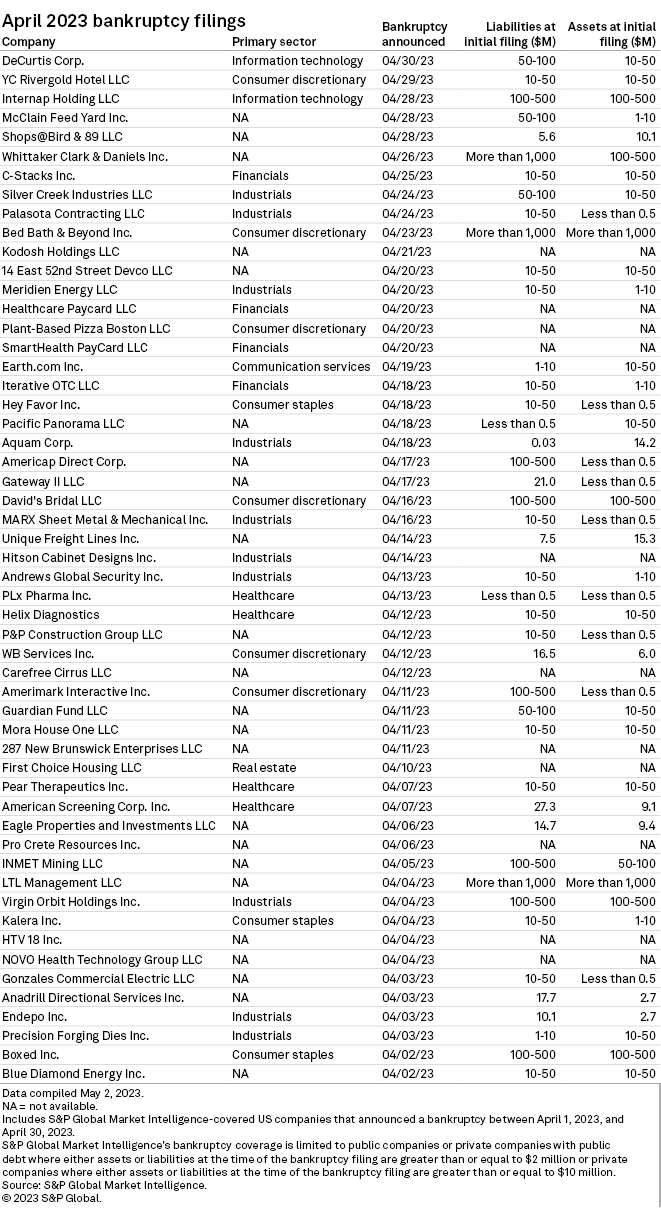

S&P Global Market Intelligence recorded 54 corporate bankruptcy petitions in April, a drop from 70 in March. Those fresh filings have pushed the year-to-date count to 236, more than double the comparable figure a year ago and higher than any of the prior 12 years.

Notable filings

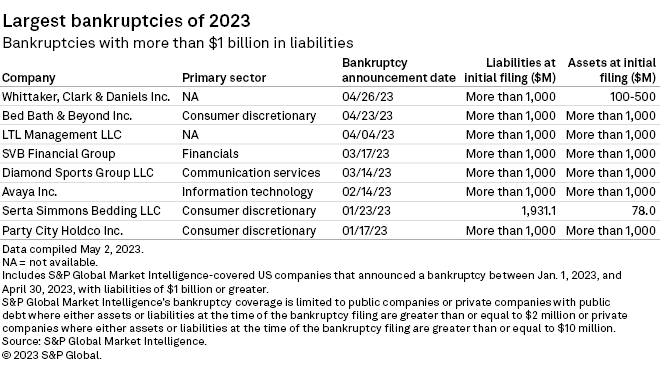

Bed Bath & Beyond Inc. filed for bankruptcy on April 23, with plans to sell its assets. The beleaguered retailer plans to eventually close its nearly 500 stores unless it closes a sale that would allow those stores to remain open, according to a company release.

– Download the charts in Excel format.

– Check out the monthly Retail Market series for retail-specific bankruptcy data.

Another prominent filing during the month was Virgin Orbit Holdings Inc. The company sought bankruptcy protection on April 4 to find a buyer, as it was unable to raise enough money outside of court to keep operating, according to a company release.

In the first four months of the year, a total of eight companies listing liabilities over $1 billion filed for bankruptcy. Larger bankruptcy cases are rising in 2023 alongside the broader increase in filings.

Sector breakdown

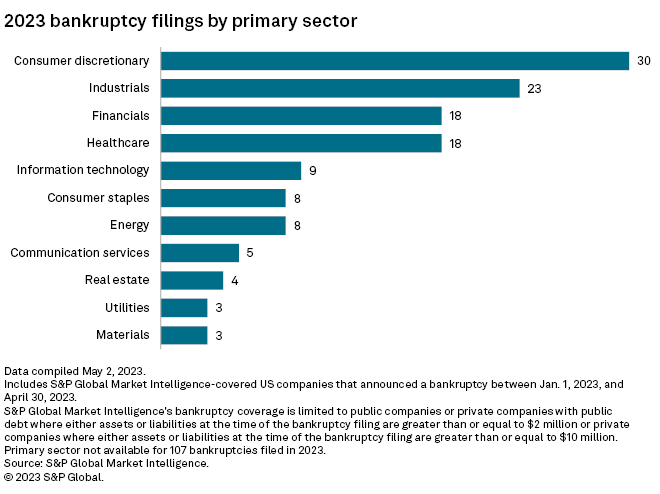

Consumer discretionary companies continued to record a higher number of bankruptcy filings than other sectors in 2023.

In addition to Bed Bath & Beyond, another notable filing from the consumer discretionary sector during the month was David's Bridal LLC's April 16 bankruptcy petition. That came just days after the wedding and special events clothing retailer disclosed plans to cut 9,236 workers nationwide.

This Data Dispatch is updated on a regular basis. The last edition was published April 5.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.