Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Mar, 2021

With their ability to provide permanent capital, opportunity to deliver a steady stream of fees, as well as a tool to drive growth, insurance businesses have been hot targets for the alternative asset giants over the past few years.

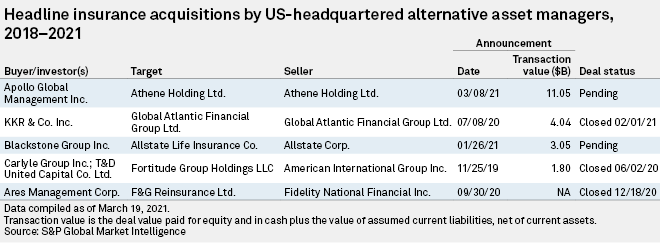

The Blackstone Group Inc., KKR & Co. Inc. and Carlyle Group Inc. are among those who have made acquisitions in the space over the past 12 months. Blackstone also brought in Gilles Dellaert, previously co-president and chief investment officer of retirement and life insurance company Global Atlantic (Fin) Co., to head up Blackstone Insurance Solutions, a part of the business that has the potential to be the firm's single largest business group by AUM, according to a number of the firm's executives.

|

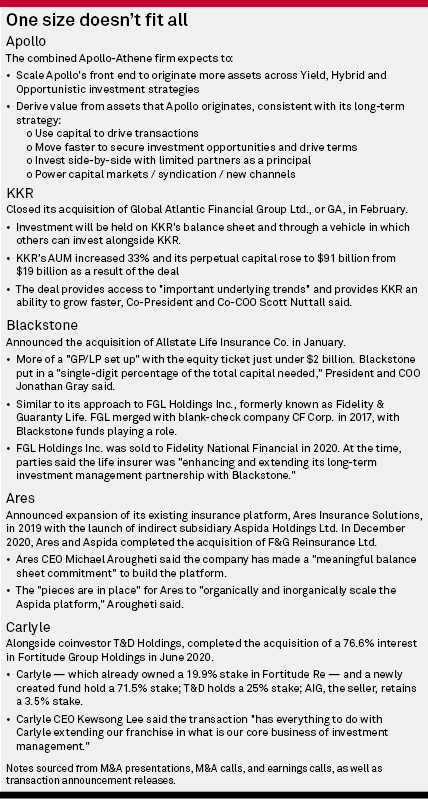

But while most firms focus on ramping up their exposure to insurance, trend leader Apollo Global Management Inc. is metamorphizing its business due to its early entry into the market. It announced March 8 that it would merge with Athene Holding Ltd., the life insurance business it helped create in 2009 and for which it manages the majority of its asset base, bringing in fees for doing so. Athene accounts for about 40% of Apollo's AUM and generates 30% of its fee-related earnings revenue, Apollo CEO Marc Rowan told analysts on the day the merger was announced.

Athene sits on Apollo's balance sheet as a $2.5 billion asset that generates no earnings, as a result of "accounting history and an accounting nuance," Rowan said during the analyst call. "So we are buying the other approximately 70% of Athene that we don't own through merger, yet we get 100% of the benefit of consolidation."

The all-stock transaction implies a total equity value of roughly $11 billion for Athene. Apollo, together with certain of its related parties and employees, owns approximately 35% of the outstanding Athene class A common shares. The merged entity would create a $29 billion pro forma market cap company, based on the March 5 close, that is expected to be eligible for S&P 500 inclusion. The success of this partnership could be playing a role in Apollo's peers' desire to crack the insurance market.

"What's attractive about this fixed annuity insurance business is there's an enormous addressable market, global addressable market," Jefferies analyst Gerald O'Hara said in an interview. There is a "long-tailed opportunity to acquire fixed annuity blocks at attractive pricing and to infuse better asset management into the equation, modest leverage and achieve double-digit returns.

"Any time you have a double-digit return, like [a] mid-teens return structure, I think you're going to get a fair amount of investors interested," O'Hara added.

|

Alternative asset managers "thrive off the illiquidity premium and ability to add value over long periods of time," O'Hara said, adding that the insurance theme is likely to remain a focal point for several or more years to come.

For the insurance firms themselves, there has been a "particularly acute" need to pursue differentiated asset management strategies over the past year "either as part of, [or in] direct affiliation with" an alternative asset manager or through third-party asset management "in light of ultra-low interest rates," Tim Zawacki, S&P Global Market Intelligence principal research analyst covering the U.S. insurance industry, said in an emailed response.

For spread businesses like Athene, the benefit is having "access to the sort of differentiated asset management strategy that Apollo (or its peers) can provide," he said.

But each firm has its own spin on how to execute on the strategy, with some investing heavily off their own balance sheet, while others opt for a general partner/limited partner style relationship or have co-invested alongside another investor.

"Different companies have different appetites for how much capital they do or don't want to commit to it ... and they have to [also] go with whatever they think their area of expertise is," KBW analyst Robert Lee said in the days following the announcement.

In the case of Carlyle and Fortitude Reinsurance Company Ltd., which is a more diversified insurance company with a broader range of products, not just annuities or life insurance, Lee said: "They may think, well, there's other things out there, and we're not interested in building an origination capability, but we think we can manage a broader array of insurance blocks more effectively."

"I think a lot of it comes down to where companies think of their expertise may be. It could be resources, it could be some companies want to do it, but they just want to build it maybe in a more organic way. So it's a lot of similarities in strategies but companies adopted to their resources," Lee added.

Zawacki expects these firms "will remain very active in the pursuit of inorganic growth both in the form of traditional M&A and reinsurance solutions," but he added that in the longer term, the outlook "comes down to whether Apollo's thesis about the implications of marrying two undervalued franchises in an undervalued sector is proven correct."